Release note 24.1

To search in the page use Ctrl+F on your keyboard

This document gives you a functional content preview of the Worldline Sips 24R1 release.

It is separated into two parts: :

- Acount to Acount

- User role in Merchant Extranet

If you would like to benefit from those new features, please get in touch with your usual Worldline Sips contact for our current customer else contact to sips@worldline.com. Deliveries in production: from January 15th to February 2nd 2024

New features of the Worldline Sips Solution

New Franfinance API

Franfinance provides a new API for the Franfinance 3X and Franfinance 4X payment methods. To benefit from these, two modifications must be made simultaneously:

- Implementation of a new AuthorizationRoute ( action to be carried out by Worldline)

- Evolution of the authenticationKey value by the merchant

To help you implement this payment method, visit our online documentation available here.</p>

Account to Account on the Sips Direct offer

The Account to Account payment method is now available on Sips Paypage. It allows customers to pay by SEPA transfer from their account to the merchant’s account.

This payment mean has advantages for the merchant :

- the payment is irrevocable

- the conversion rate is better because it is not impacted by card refusals

- the reconciliation is carried out automatically by Worldline

- the cost of the transaction is predictable, no commission fees from schemes

- most European countries are compatible, which makes it possible to address an international clientele

This payment method also has advantages for customers :

- the customer experience is more streamlined

- no registration necessary, just have a bank account

- higher spending limits than cards

- secure payment method based on strong authentication on Home Banking / Banking Apps

Other features will be added later such as instant payment if the customer’s bank has subscribed to this option. The logo below will be displayed on the payment pages, it will allow the customer to switch to their online banking in order to make the payment.

The new evolutions on Hosted Fields

1. Adding a field for the “invalid” event :

Worldline Sips allows you to better read the “invalid” event associated with the card number or CVV, thanks to the addition of the “complementaryInformation” field.This field will contain :

- For the card number : information on the minimum and maximum expected lengths

- For the CVV : a numerical indication as to the expected length of the field

To benefit from this development, you can refer to our online documentation available here.

2. Display of “scheme” logos :

When a single “scheme” logo is displayed, it is no longer clickable and the border surrounding has disappeared.

Before :

After :

Facilitate the reconciliation in Sips Office Extranet

New fields have been added in the tab “detail of a transaction”, to facilitate reconciliation.

Addition of the block “unpaid informations operation” :

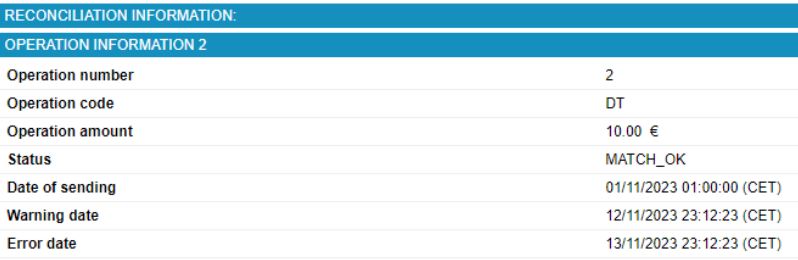

Addition of the block “reconciliation information” :

Change the user role in Merchant Extranet

Change role in the MEX is now possible without logging out using the button located to the right of the role you are currently using. You will then be redirected to the role selection page.

Regulatory changes

Implementation of the new CB2A protocol 1.6.1

Worldline Sips has implemented the elements relating to the implementation of Scheme Tokens of the new CB2A protocol 1.6.1 as well as the fields relating to the evolution.

The solution is to add fields 119 to the authorization request :

- 119-0001 Merchant tokenisation indicator

- 119-0015 Token authentication verification value

- 119-9F19 Token Requestor ID

For OEM Pay, payment methods integrated into the phone (GooglePay, SamsungPay, etc.), it will now be necessary to use the TAVV field in the authorization instead of CAVV.

Regarding the reporting, the value MERCHANT_TOKENIZATION(10) has been added for the field 59-0012 Mobile Payment Solution Identifier.

This development is part of the Scheme Token project currently underway at Worldline Sips.

Worldline Sips will contact the various acquirers in order to plan the deployment of this new protocol version.

Setting up OEM Pay

As part of the CB2A protocol, two already existing fields have been configured for OEM Pay.

The fields concerned are :

- 56_0028 : Payment pattern (example : ONE_SHOT, RECURRING_1, RECURRING_N)

- 56_0037 : Authentication Date

Application of 3-D Secure v2 on Bancontact

Already present on the CB, Visa, MasterCard and American Express networks. 3-D Secure v2 now also applies to Bancontact cards. Worldline Sips will gradually switch all Bancontact merchants to 3DSV2 during February 2024.

EMVCO recommandation

All “phone” fields to be filled in must comply with the international E164 format (example : +336 66 66 66 66) recommended by EMVCo. If the format provided is different, the fields may not be transmitted. If it is a mandatory field the transaction will be refused.

New version of Android SDK

Worldline Sips has updated the Android SDK for Sips InApp (new version 24.1.0). This update no longer depends on third-party libraries and strengthens compliance with the PCI-DSS standard. However, it requires updating the SDK in the application and removing the dependencies that Worldline Sips imposed.

Maintenance corrective

| Ref. | Appli. | Defect type | Solution summary | Priority |

|---|---|---|---|---|

| BFIRM-62915 | Web Paypage | Regression | Resizing the Apple Pay logo which was too small | Important |

| BFIRM-64519 | Extranet | Regression | Updated certificate that allows connection to SOE via SSO | Important |

| BFIRM-64561 | Batch | Bug | Updated response file format | Blocker |