Newsletter - March 2024

To search in the page use Ctrl+F on your keyboard

What's new at Worldline Sips?

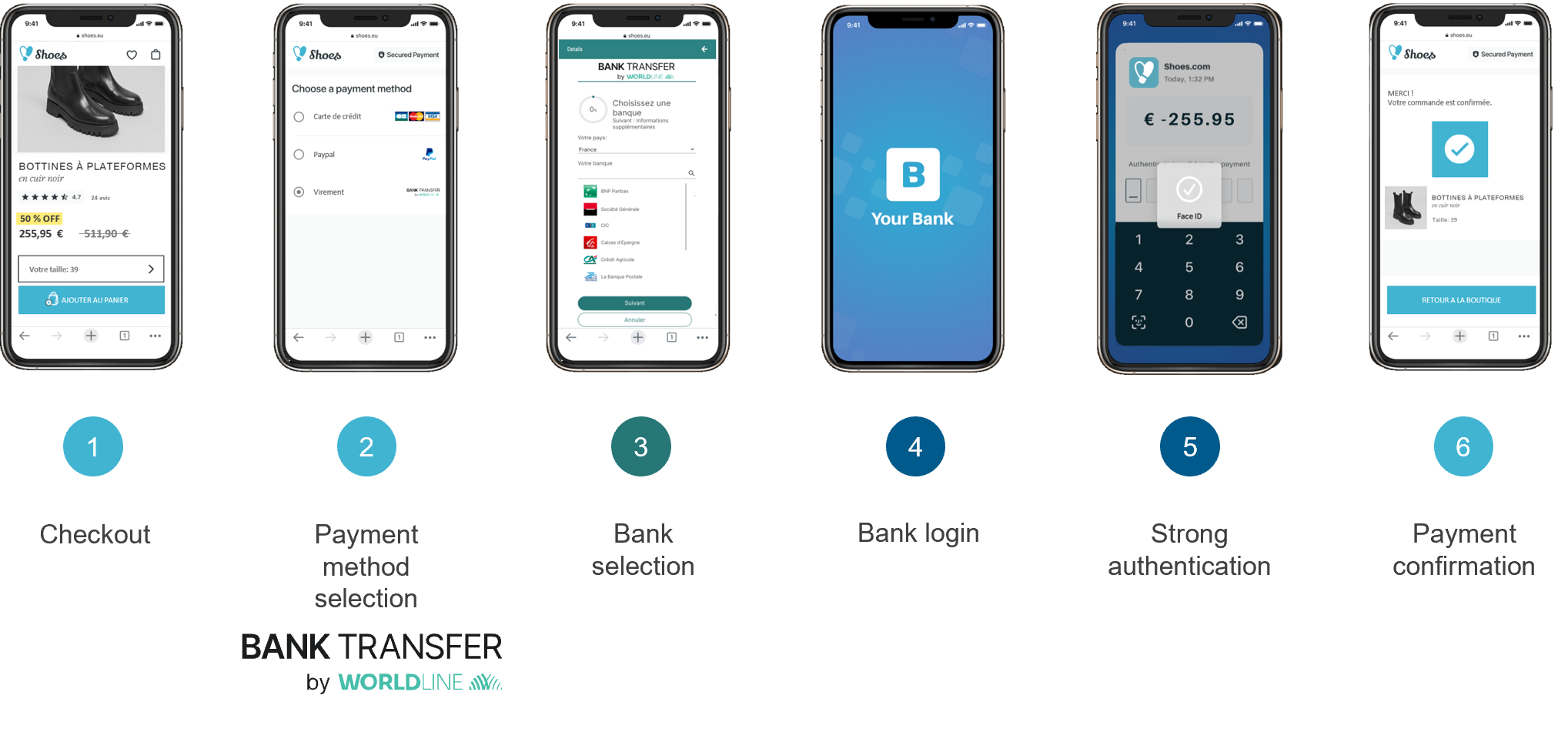

Account to account: A new high-performance payment method on a European scale

Discover Account to Account, the Worldline Sips transfer solution using the open banking technology.

This payment method allows your customers to make purchases by bank transfer, directly from their bank account to yours, via the SEPA transfer system. Irrevocable, it allows you a better conversion rate.

Account to Account is based on the Bank Transfer by Worldline solution, a continuously growing network that gives you access to more than 2,500 issuing banks spread over 14 European countries (109 banks in France).

The payment process is smooth and secure:

- shopping cart validation

- choosing payment method selection

- choosing bank

- bank app connexion

- string authentication

- payment confirmation

Are you interested in this payment method? Get in touch with your usual Worldline Sips contact.

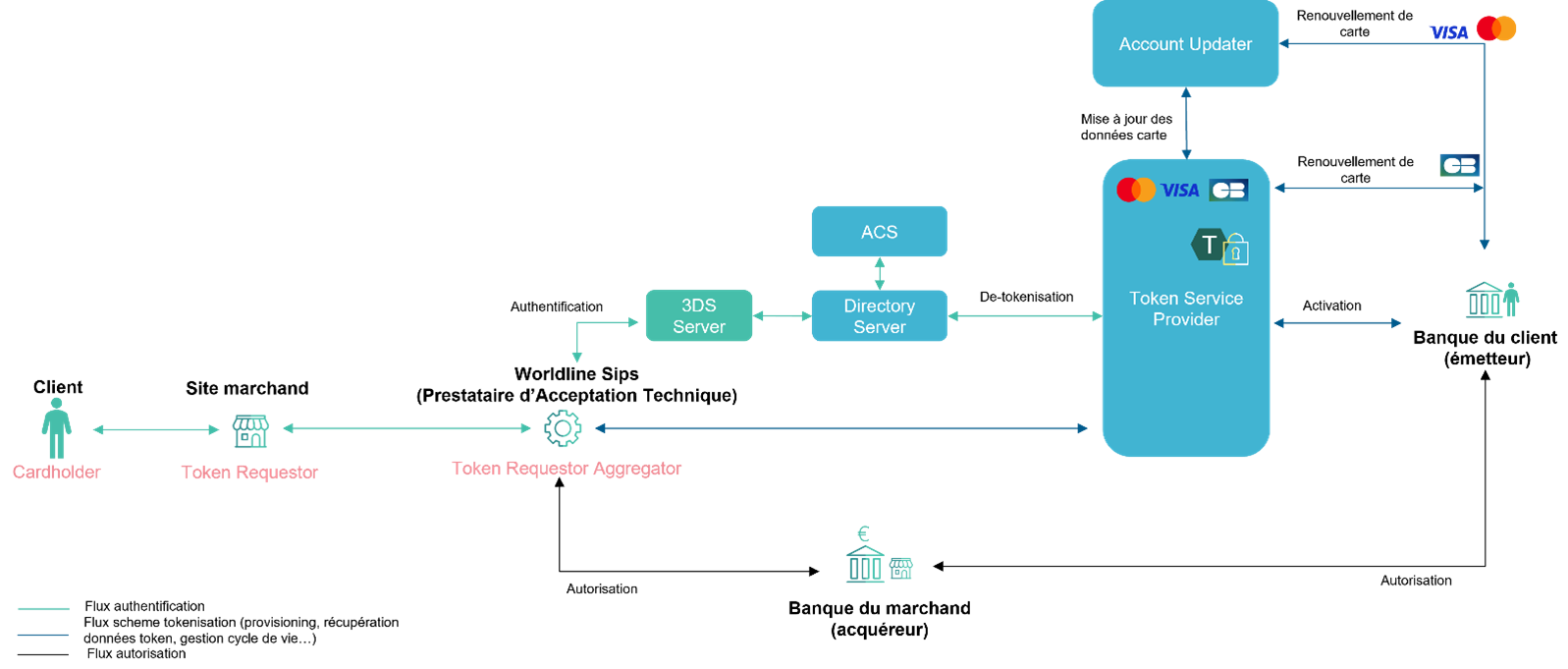

Deployment of Scheme Tokenisation : Boost your performance with enhanced security

What if there was a way to reduce the risk of a payment failing, while adding an extra layer of security? This is the goal of the Scheme Tokenisation.

Already deployed at Worldline Sips for merchants wishing to connect directly to Token Service Providers (TSPs), it will soon be deployed for merchants offering recurring payments (via duplication).

Before exploring its benefits, what is the principle of tokenisation?

Tokenisation (as it currently exists at Worldline Sips) is a process that consists of replacing the PAN*, considered as sensitive data, with another non-sensitive data: the token. Here, only the merchant and his Technical Acceptance Provider (PAT) are concerned. The token allows the merchant to be PCI-DSS compliant.

Speaking of the Scheme Tokenisation, it concerns the entire ecosystem (merchant, scheme, PAT, banks).

Each actor has a role to play:

- certification for the PAT;

- onboarding by the PAT on behalf of the merchant, with the schemes and more particularly with the TSP**. The latter transforms the PAN into a token;

- the provisioning and updating of the TSP vault by the issuing bank via the Account Updater;

- management of the token lifecycle by the merchant and the TSP;

- the management of authorisations by the PAT and the banks.

This feature not only offers a high level of security, it also ensures a better conversion rate. Through the Account Updater services, your customers’ card data will be updated, so no more blocking in case of expired or renewed cards.

You will soon find more information about the Scheme Token in our online documentation. In the meantime, don’t hesitate to reach your usual contact.

*Primary Account Number **There is one TSP per scheme (CB, Visa and Mastercard).

Regulatory info

Visa Business News : Modification of 3DS fields required this summer

In order to improve its scoring tool and optimise the obtaining of frictionless journeys, we remind you that Visa is planning an update of its ‘Secure Program Guide’. Initially scheduled for February 12, 2024, it has been postponed to August 12, 2024.

As of this date, Visa requires 7 fields in the authentication request (AReq); 5 others have changed their status (from mandatory to recommended).

Find here the complete list of fields concerned. If you don’t submit the additional data, you won’t be penalized, but you won’t get the benefit from this optimized Frictionless journey.

Merchant Extranet evolutions

Two-factor authentication: An extra layer of security

To ensure the best possible protection of your data, Worldline Sips is changing the access method to the Merchant Extranet (MEX)*.

After entering your username and password, a security code will be sent to the email address associated with your login. All you have to do is enter this code and you will be automatically redirected to the MEX homepage. This method adds an extra layer of security.

Convenient, all you need is access to your inbox.

Once you’ve logged in, you’ll find your interface as you know it.

To find out more, please contact your Account Support Manager.

*Deployment is scheduled for April 16, 2024 but remains subject to production requirements.

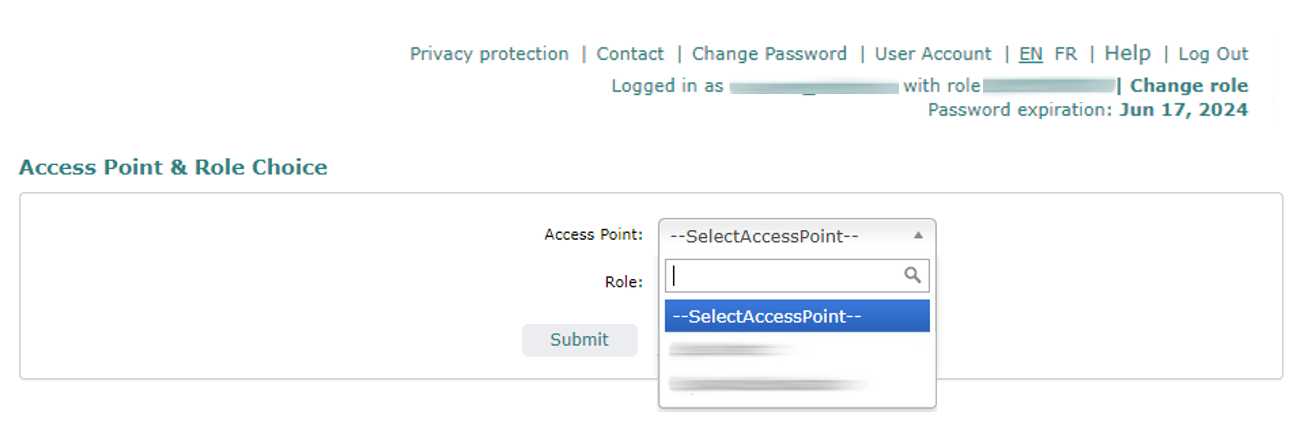

Easy access point selection: Improved user experience

As a MEX user, you potentially have multiple access points that determine which webshop(s) you can connect to*.

Recently, the page for selecting your access point and role has evolved. Choosing the access point is now easier. The drop-down list is replaced with a dynamic field that allows you to enter all or part of a webshop’s name or merchantId.

In addition, a link in the header at the top right now allows you to return to the selection page (no need to log out and log back in).

Enjoy a better user experience and easily manage your different access points!

*Find here the definitions of the terms “access point” and “role”.

Reminder

X-Pay

True rising stars of mobile payment, the use of X-Pay (Apple Pay, Google Pay, Samsung Pay) is becoming a real habit for consumers.

A confirmed success in Worldline Sips payments: we see a 17% increase in flows between the 1st and 2nd half of 2023.

Don’t hesitate any longer and offer these payment methods to your customers.

Get started in three clicks:

Fraud risk management

Security and fluidity of the payment process are the guarantee of a good conversion rate and it is not always easy to find the right balance.

Like our top merchants, you can rely on Worldline Sips’ fraud solutions:

- With our Go-No-Go offer, set the rules to accept or refuse transactions;

- With Business Score, a score is assigned based on whether or not you follow the rules you set. It allows you to automatically accept or refuse the transaction, or to put it on hold if the score is intermediary.

Click here to read more.

Reminder: network recommendations

To ensure service continuity during our next security maintenances scheduled for mid-April, we ask you to check and take into account the recommendations below:

- Address in priority the URLs present in the Worldline Sips documentation and not an only fixed IP

- Suppress/Modify the security controls on the certificate authority if present in your integration