Introduction

Worldline Sips is a secure multi-channel e-commerce payment solution that complies with the PCI DSS standard. It allows you to accept and manage payment transactions by taking into account business rules related to your activity (payment upon shipping, deferred payment, recurring payment, payment in instalments, etc.).

The purpose of this document is to explain the Samsung Pay means of payment integration into Worldline Sips.

Who does this document target?

This document is intended to help you implement the Samsung Pay means of payment on your e-commerce site.

It includes:

- functional information for you

- implementation instructions for your technical team

To get an overview of the Worldline Sips solution, we advise you to consult the following documents:

- Functional presentation

- Functionality set-up guide

Understanding Samsung pay payments with Worldline Sips

General principles

Samsung Pay is a means of payment offered by samsung to issue payments in a simple and secure way on compatible Samsung phone or watch.

The cardholder has previously added their card to the wallet available on the various Samsung devices. Afterwards, they can pay for purchases on a website or on a mobile application.

With this solution, customers pay for their purchases online without having to enter their card details all the time. In addition, with the wallet application they can view their transaction history.

Acceptance rules

Available functionalities

| Payment channels | ||

|---|---|---|

| Internet | V | Default payment channel |

| MAIL_ORDER, TELEPHONE_ORDER | X | |

| Fax | X | |

| IVS | X | |

| Sips In-App | X | |

| Means of payment | ||

|---|---|---|

| Immediate payment | X | |

| End-of-day payment | V | Default method |

| Deferred payment | V | Limited to 6 days. |

| Payment upon shipping | V | Limited to 6 days. |

| Payment in instalments | X | |

| Subscription payment | X | |

| Batch payment | X | |

| OneClick payment | X | |

| Currency management | ||

|---|---|---|

| Multicurrency acceptance | V | |

| Currency settlement | X | |

| Dynamic currency conversion | X | |

Samsung Pay means of payment characteristics

Here are the rules applied to Samsung Pay:

| Feature | Restriction | Restriction |

|---|---|---|

| Means of payment | MASTERCARD

MAESTRO VISA VPAY ELECTRON |

Worldline Sips |

| Browser/Device | Device Samsung | Samsung |

| IFrames | No | Samsung |

You have to make sure your acquirers support the Samsung Pay flow.

All anti-fraud checks are supported under Samsung Pay payments (fraud tool).

Samsung imposes a graphic charter for the payment page. Information related to this charter is available here: https://pay.samsung.com/developers/resource/brand

Authentication request

During the payment process, the cardholder authentication is done by Samsung Pay.

You have two options:

- Managing the cardholder authentication on your side. For this purpose, you will need to open an account with Samsung Pay and complete the implementation to manage the Samsung Pay authentication. Details about the implementation of authentication with Samsung Pay can be found here: https://pay.samsung.com/developers/You will need to use the Sips Office interface.

- Delegating the whole transactional process to the Worldline Sips platform and in particular the cardholder authentication

to the Samsung Pay server.In this case, you will need to use the Sips Paypage interface (available soon).

Authorisation request

The maximum capture delay allowed for an Samsung Pay payment is 6 days.

If you enter a longer capture delay, it will be automatically forced by the payment platform.

Payment remittance in the bank

Payments are remitted to a bank according to the payment terms you set. As standard, the remittance in bank is triggered at night as from 10 pm CET (Central European Time) via a file exchange with the acquirer.

Signing your Samsung Pay acceptance contract

You have two options to offer the Apple Pay means of payment on your website:

- You wish to manage the cardholder authentication on your side and use the Worldline Sips platform to make the authorisation request and the bank remittance. You will need to contact Samsung Pay.

- You wish to delegate the whole transactional process to the Worldline Sips platform and in particular the cardholder authentication

with Samsung Pay server, the authorisation request and the bank

remittance.In this case, you have no interaction with Samsung Pay. Worldline Sips is responsible for your enrollment/activation with Samsung Pay.

In order to activate the Samsung Pay acceptance, you will need to sign a credit card-type purchase contract with an acquirer accepting Samsung Pay payments. The means of payment is indeed associated with the cardholder's card brand (VISA, MASTERCARD, etc.), so you will need a purchase contract for this same brand.

Making an Samsung Pay payment

The remittance modes available for an Samsung Pay transaction are:

- Cancellation mode: default mode allowing transaction remittance on a predefined date, called capture delay. When this capture delay is reached, the remittance is sent automatically. This delay is set via the captureDay field with its 0 default value (end-of-day payment).

- Validation mode: you must validate the transaction to trigger the remittance. A capture delay must also be defined. When this capture delay is reached or exceeded, you will not be able to validate the transaction, which will therefore expire automatically.

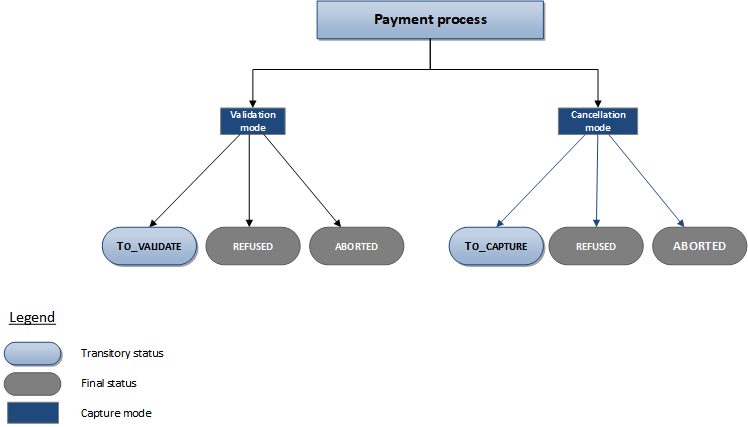

The diagram below explains the different transaction statuses according to the chosen capture mode:

Making an Samsung Pay payment with Sips Paypage

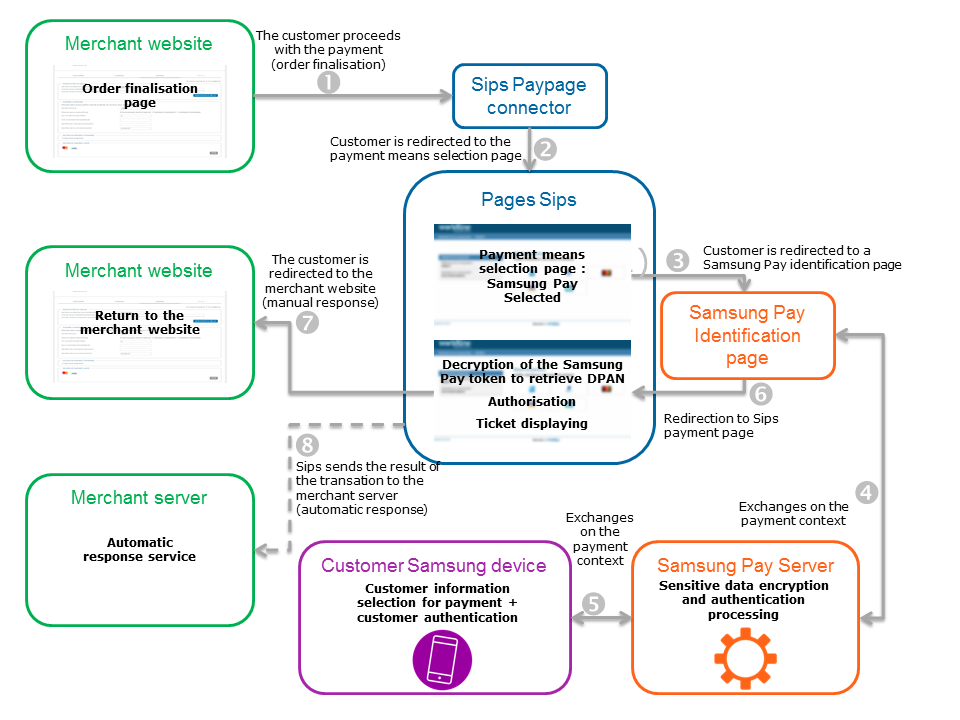

The payment process for Sips Paypage is described below:

Setting the payment request

The following field has a particular behaviour:

| Field name | Remarks/rules |

|---|---|

| captureDay | The value sent in the request must be 6 at a maximum. A

larger value will be forced to 6. |

Analysing the response

The following table summarises the different response cases to be processed:

| Status | Response fields | Action to take |

|---|---|---|

| Payment accepted | acquirerResponseCode = 00

authorisationId = (cf. the

Data Dictionary).paymentMeanBrand = card used

in the wallet (VISA, MASTERCARD or other).paymentMeanType =

CARDpaymentMeanDataProvider =

SAMSUNGPAYresponseCode =

00 |

You can deliver the order. |

| Acquirer refusal | acquirerResponseCode = (cf.

the Data Dictionary).responseCode =

05 |

The authorisation is refused for a reason unrelated to fraud, you can suggest that your customer pay with another means of payment by generating a new request. |

| Refusal due to a technical issue | acquirerResponseCode = 90-98

responseCode = 90,

99 |

Temporary technical issue when processing the transaction. Suggest that your customer redo a payment later. |

For the complete response codes (responseCode) and acquirer response

codes (acquirerResponseCode), please refer

to the Data dictionary.

Making an Samsung Pay payment with Sips Office

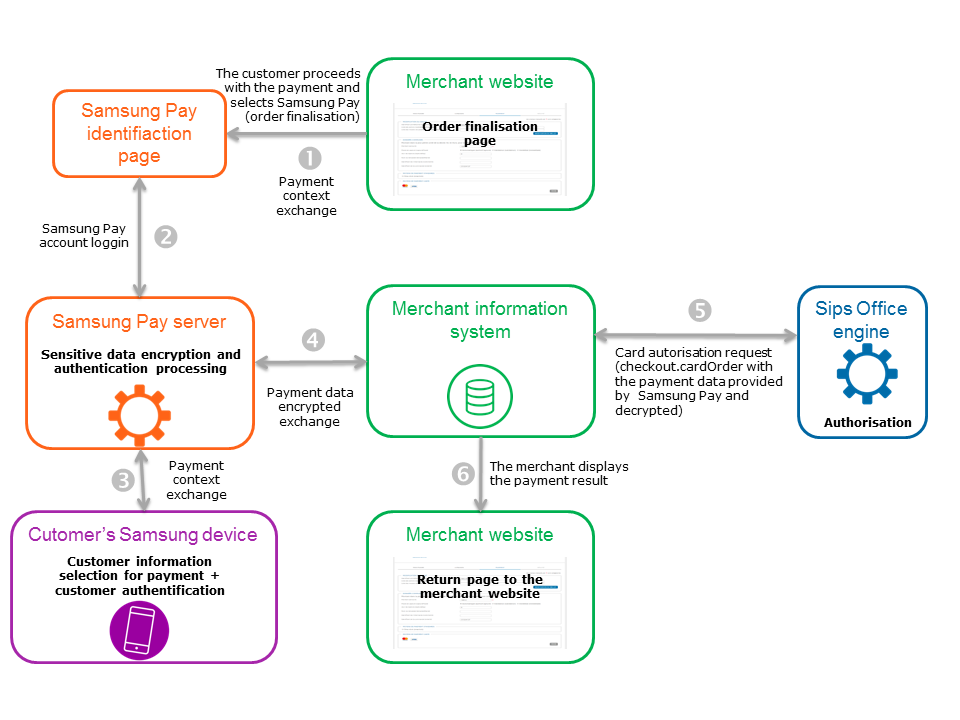

The payment process for Sips Office is described below:

Setting the payment request

To make a payment with Sips Office, you must use the cardOrder method.

The Samsung Pay payment request includes all mandatory fields of the connector you are using.

The following fields have a particular behaviour:

| Field name | Remarks/rules |

|---|---|

| panEntryMode | OEMPAY |

| paymentMeanDataProvider | SAMSUNGPAY |

| authenticationResult.samsungPay.cavv | The security code provided by Samsung Pay. |

| authenticationResult.samsungPay.eci | The ECI indicator provided by Samsung Pay. |

| paymentMeanBand | Must be populated with the card brand (CB, Visa, Mastercard, …). |

| cardNumber | Provide the DPAN (= Samsung Pay card number). |

| cardExpiryDate | Provide the DPAN expiry date. |

| orderChannel | INTERNET or INAPP |

| holderAuthentProgram | SAMSUNGPAY |

| walletType | Should not be populated. |

| schemeTokenData.tavv | The security code provided by Samsung Pay. Replace the usage of field authenticationResult.samsungPay.cavv (still usable) for CB2A 161 protocol |

Analysing the response

The following table summarises the different response cases to be processed:

| Status | Response fields | Action to take |

|---|---|---|

| Payment accepted | acquirerResponseCode = 00

authorisationId = (cf. the

Data Dictionary).paymentMeanBrand = card used

in the wallet (VISA, MASTERCARD or other).paymentMeanDataProvider =

SAMSUNGPAYresponseCode =

00 |

You can deliver the order. |

| Acquirer refusal | acquirerResponseCode = (cf.

the Data Dictionary).responseCode =

05 |

The authorisation is refused for a reason unrelated to fraud, you can suggest that your customer pay with another means of payment by generating a new request. |

| Refusal due to a technical issue | acquirerResponseCode = 90-98

responseCode = 90,

99 |

Temporary technical issue when processing the transaction. Suggest that your customer redo a payment later. |

For the complete response codes (responseCode) and acquirer response

codes (acquirerResponseCode), please refer

to the Data dictionary.

Managing your Samsung Pay transactions

Available cash operations

The following operations are available on Samsung Pay transactions:

| Cash management | ||

|---|---|---|

| Cancellation | V | Cancellation available on the partial amount of the transaction. |

| Validation | V | Validation available on the partial amount of the transaction. |

| Refund | V | Refund available on the partial amount of the transaction and for amounts greater than the initial amount (unlimited refund). |

| Duplication | X | |

| Credit | X | |

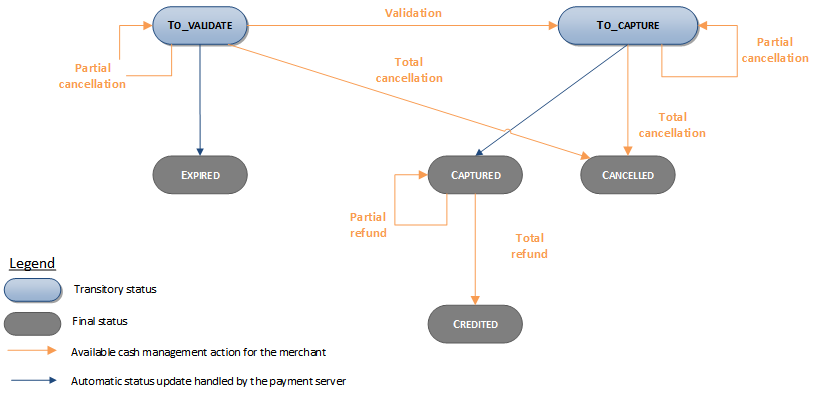

The diagram below allows you to know which cash management operation is available when a transaction is in a given state:

Viewing your Samsung Pay transactions

Reports

The reports provided by Worldline Sips allow you to have a comprehensive and consolidated view of your transactions, cash operations, accounts and chargebacks. You can use this information to improve your information system.

The availability of Samsung Pay transactions for each type of report is summarised in the table below:

| Reports availability | |

|---|---|

| Transactions report | V |

| Operations report | V |

| Operations report | V |

| Chargebacks report | V |

Sips Office Extranet

You can view your Samsung Pay transactions and perform various cash management operations with Sips Office Extranet.

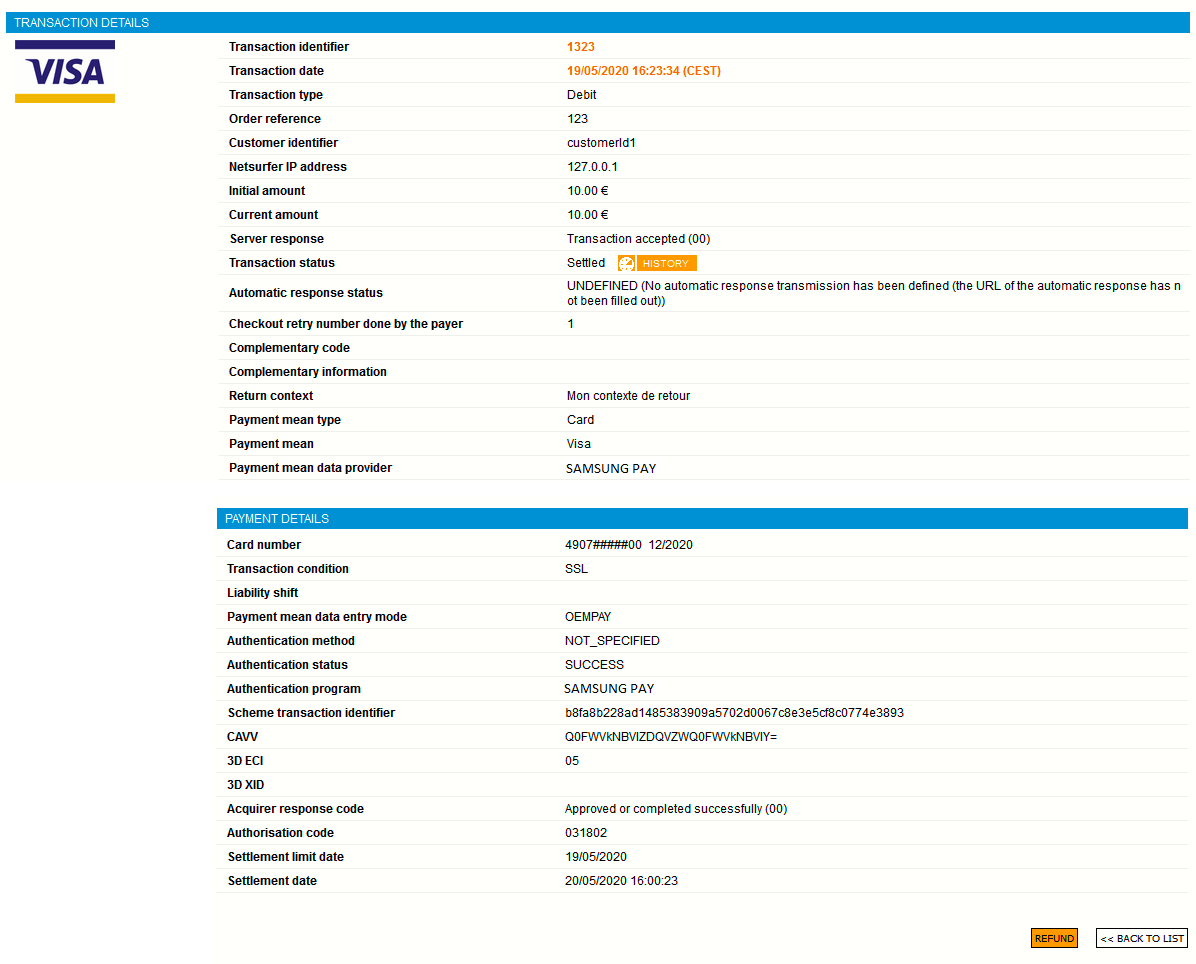

Here are the details of a Samsung Pay transaction made with a card enrolled for OEM payments:

Running your Samsung Pay tests

Contact your Samsung Pay representative or, failing that, contact your Worldline Sips representative.