Newsletter - March 2023

To search in the page use Ctrl+F on your keyboard

What's new at Worldline Sips?

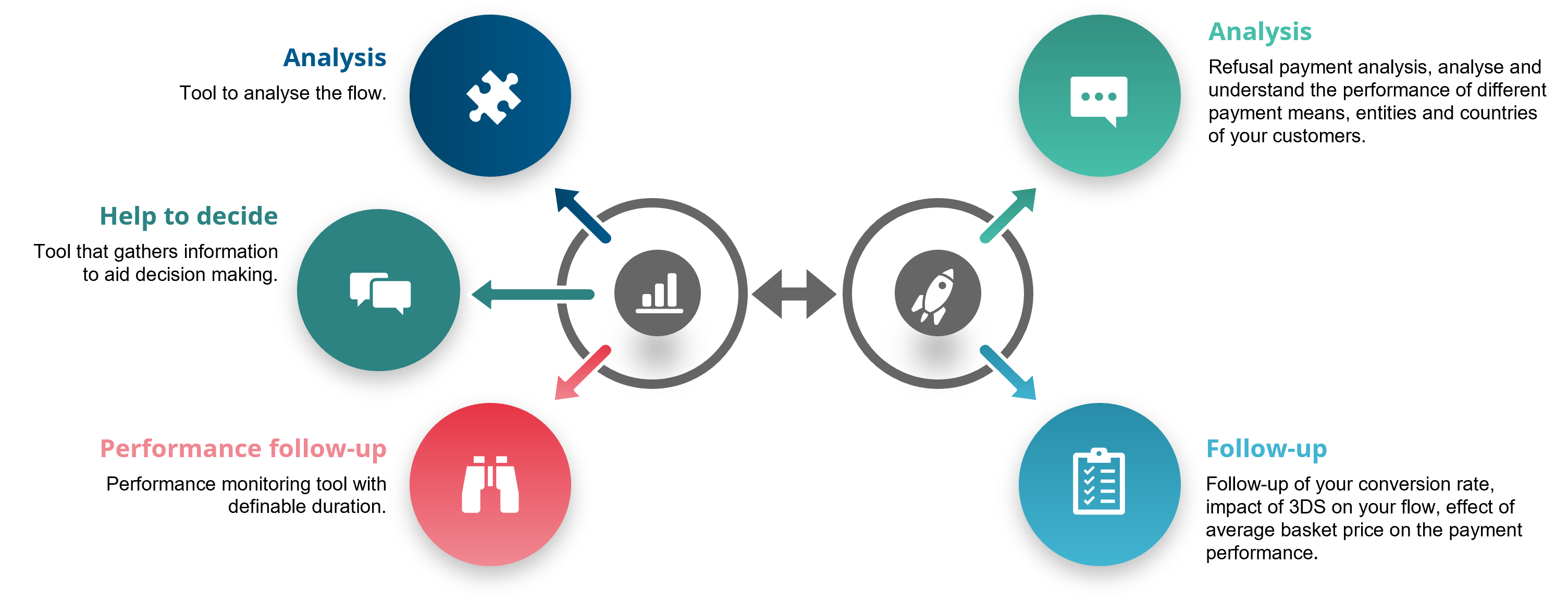

MyPerformance: A better follow-up of your KPI

Our teams continually improve the Worldline Sips solution and offer high quality tools. To follow and analyse your activity at a glimpse, we will soon put in place our MyPerformance tool.

Free and accessible through the merchant extranet, the tool will enable you to display your transactions over time. You can also extract key indicators and quickly analyse the performance of the payment workflow.

Direct To Authorization: A smoother payment experience

PSD2 offers alternative solutions to the cardholder’s strong authentication.

In this context, Worldline Sips allows you to benefit from the Direct To Authorization (DTA) option (Please, validate your eligibility with your bank), available for Sips Paypage, Sips Office and Sips In-App. So you can bypass the authentication and ask for a direct to authorization transaction.

Two exemption alternatives exist:

- Small amount (< 30€)

- Transaction Risk Analysis (TRA) Acquirer*

Meet the balance between regulatory rules, security and fluidity during your clients’ purchase journey!

In case of refusal, “Soft Decline”, the transaction can be replayed using a 3DS authentication.

For any questions, please reach your usual Worldline Sips contact.

Google Pay™: Now available via Worldline Sips

Worldline Sips expands its mobile payment offer with Google Pay™.

Secure, simple and quick, it allows the cardholder owning a Google account to pay online as in shops, without entering manually their card details. Easy to use, the application gives access to payment history and simplifies its management.

Google Pay™ is also secure for merchants as you do not need to handle sensitive payment data on your servers.

Reminder

Transactions chaining: Pay attention to financial penalties

Following PSD2, the cardholder needs to authenticate for each online purchase.

In recurring payment cases, all MITs (Merchant Initiated Transaction) need to be chained to a CIT (Customer Initiated Transaction) thanks to a chaining identification, the STI (Scheme Transaction Identifier). This STI needs to be sent in subsequent transactions, and becomes the iSTI (Initial Scheme Transaction Identifier.

We have noticed a few merchants perform MITs which have an iSTI with the value « Unknown » or « - » in place of the CIT’s STI.

To avoid any financial penalty:

- Make sure to use the STI of the CIT to chain your transactions.

- If you don’t have the STI of the CIT, you can use the STI of the last performed MIT.

Implementation of reconciliation reports in test environment

Do you want to follow the results of the reconciliation between the transactions carried out on your store and the return flows processed by your banks or financial institutions?

As you already know, Worldline Sips allows you to receive bank reconciliation and chargeback reports.

Test the integration of these files now on your test shops by a simple request to Worldline Sips support.

BIN8

We informed you of the implementation of a new standard involving the extension of the BIN (Bank Identification Number) from 6 to 8 digits.

As a result, a new format has been created in the merchant options in order to make BIN8 available in Worldline Sips responses.