Release note 22.4

To search in the page use Ctrl+F on your keyboard

This release note gives you an overview of the functional content of the WL Sips 22R4 release.

It is separated in two parts:

- new additions in the WL Sips Solution, where are listed the modifications of new functionalities added to our offer

- regulatory changes

If you want to benefit of those new functionalities, please get in touch with your usual Sips contact if you are one of our client. Or, send us a message at the following email address: sips@worldline.com.

Deliveries in production: from Monday, June 27th until Friday, July 15th 2022.

New features of the WL Sips Solution for merchants

Consideration of Code 60 refusals for SDD, Conecs, CVCO, CACF 3X and 4X and prepaid means of payment

On SDD, Conecs, CVCO, CACF 3X and 4X cash transactions or operations and on prepaid means of payment (except in the case of cancellation), it sometimes happens that requests fail because of a timeout (absence of response from the acquirer within a given time) with the sending of a response code 60. In this case, the transaction/operation was refused on the WL Sips side whereas it could still be accepted on the acquirer side.

In order to avoid these problematic cases, we have modified the behavior of the timeout cases of the flow of these means of payment. Thus, when SIPS receives a code 60 in response to a transaction/operation, the latter goes into a "to be confirmed" state (TO_CONFIRM_AUTHOR, TO_CONFIRM_CAPTURE, TO_CONFIRM_CREDIT).

Daily file-based processing is performed to check the status of these transactions/operations on the acquirer side and thus update these transactions to final states at 18:30 and during maximum 30 days.

Card information evolution

We enrich the online data (in automatic and/or manual response) returned to merchants for CB, VISA, MASTERCARD transactions with the addition of a new field: "issuingCountryCode" which is the country code of the card.

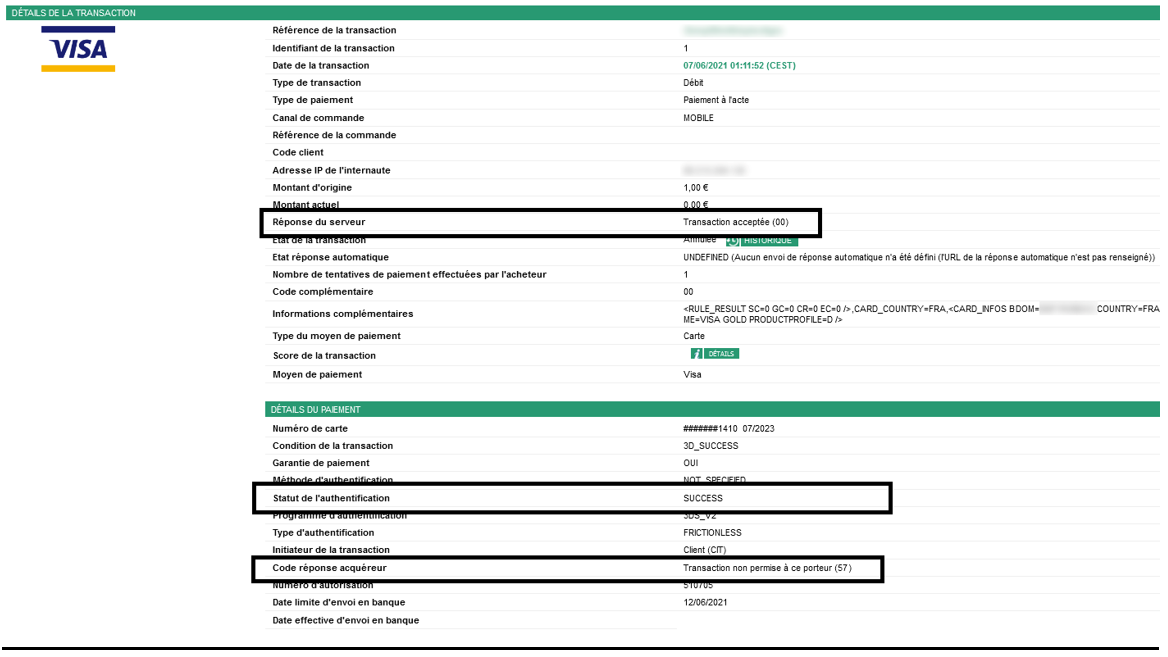

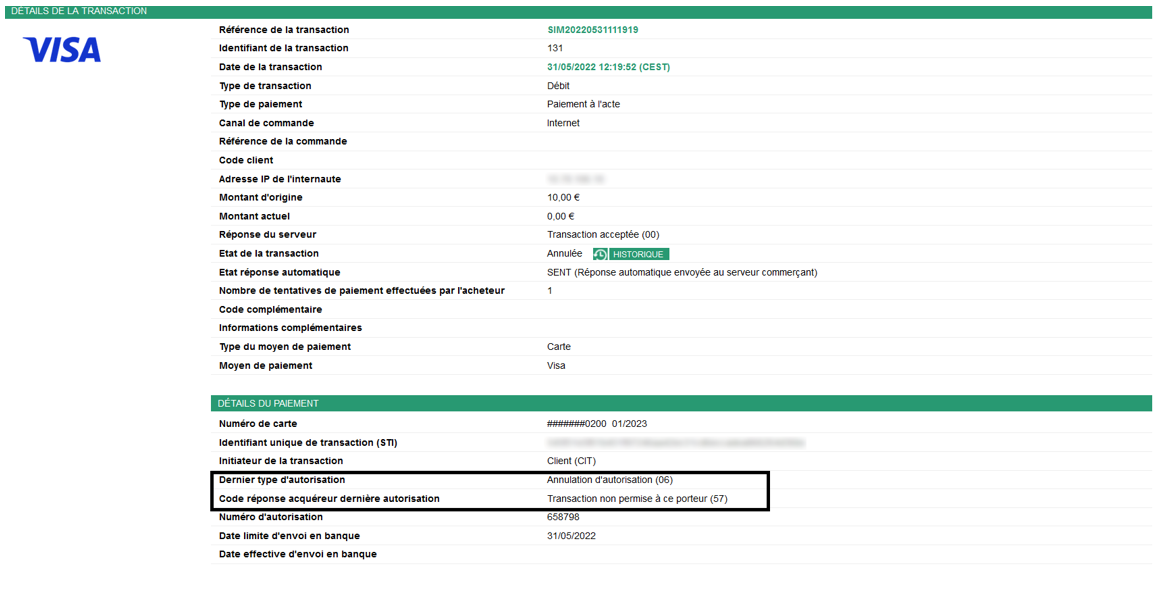

Detail transaction evolution in SOE

In order to improve clarity in Sips Office Extranet, a new field “last authorization type” has been added. It can contain the values "Account verification", "Authorization" or "Reversal". This makes it possible to distinguish specific authorizations. In addition, the field "Acquirer response code" has been renamed " Response code of last authorization acquirer ".

Before :

after :

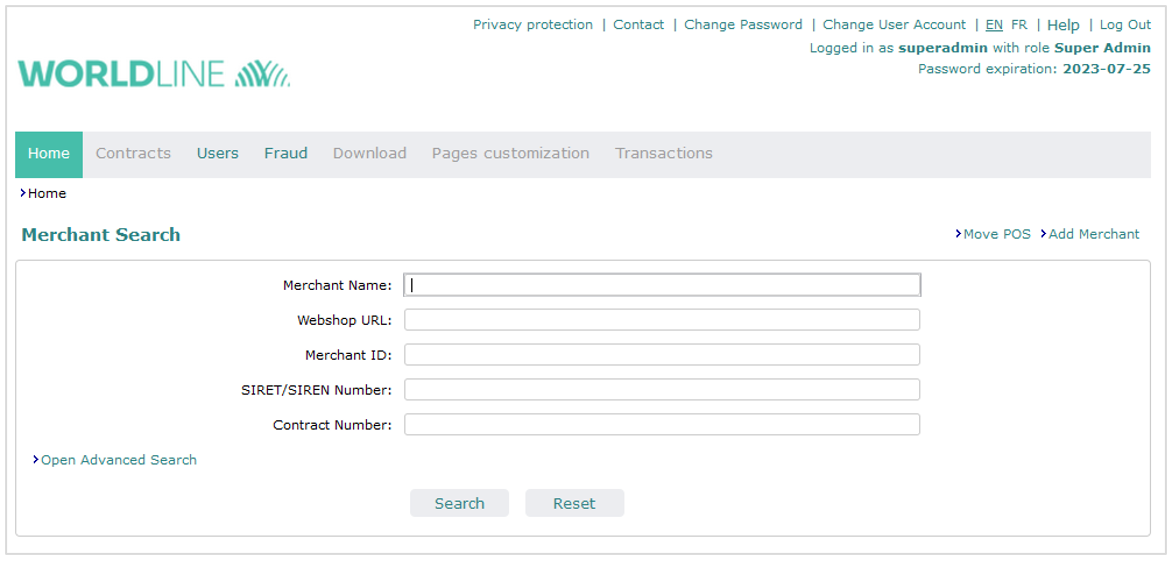

MEX evolutions

In this release, the Merchant Extranet portal has undergone changes to improve the user experience.

Update of the graphic chart

The Merchant Extranet is now in the new Worldline colors.

In addition, the "Dashboard" tab becomes "Home" and the "Transaction Management" tab becomes "Transactions".

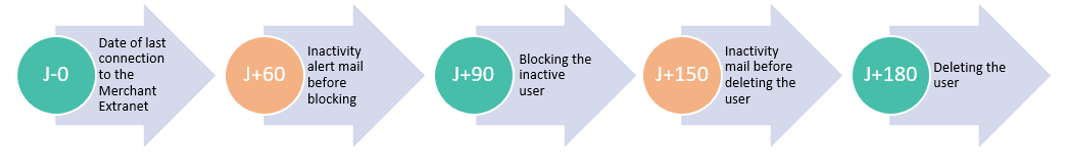

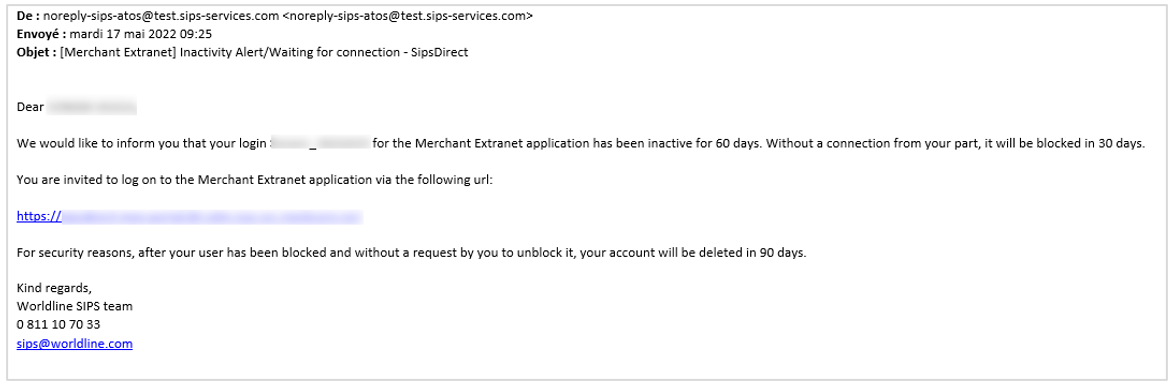

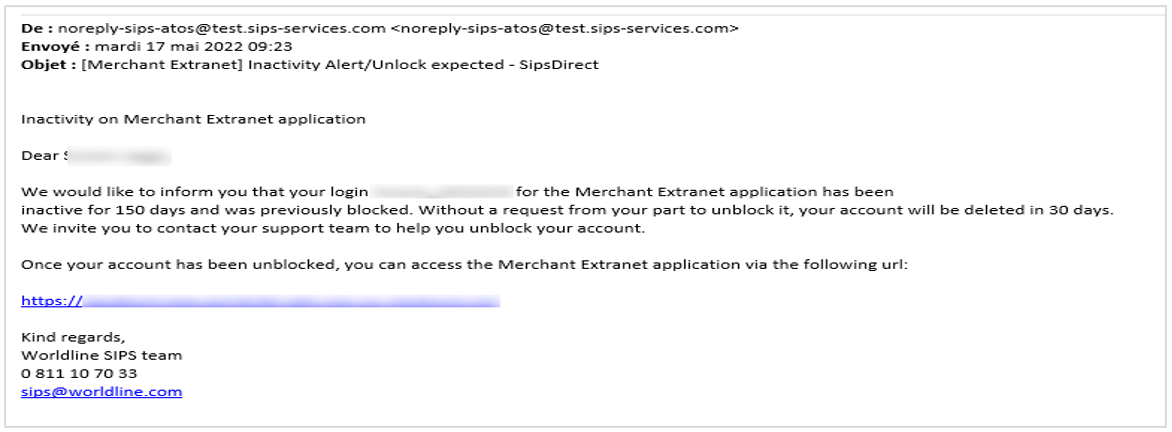

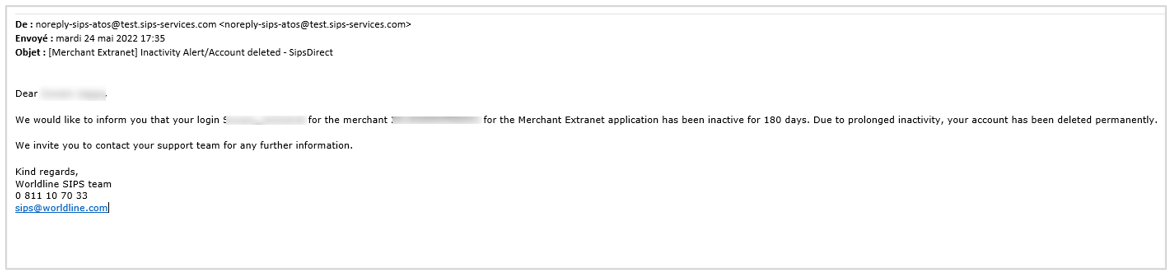

Mails alerting users MEX

In accordance with the WL Sips security policy and in the interests of communication with Merchant Extranet users, inactivity alerts have been set up.

- An email at 60 days to inform the user that their login will be blocked in 30 days without them logging in again.

- An email at 150 days to inform the user that their login will be deleted in 30 days without a request to unblock it.

- An email at 180 days to inform the user that his login has been deleted.

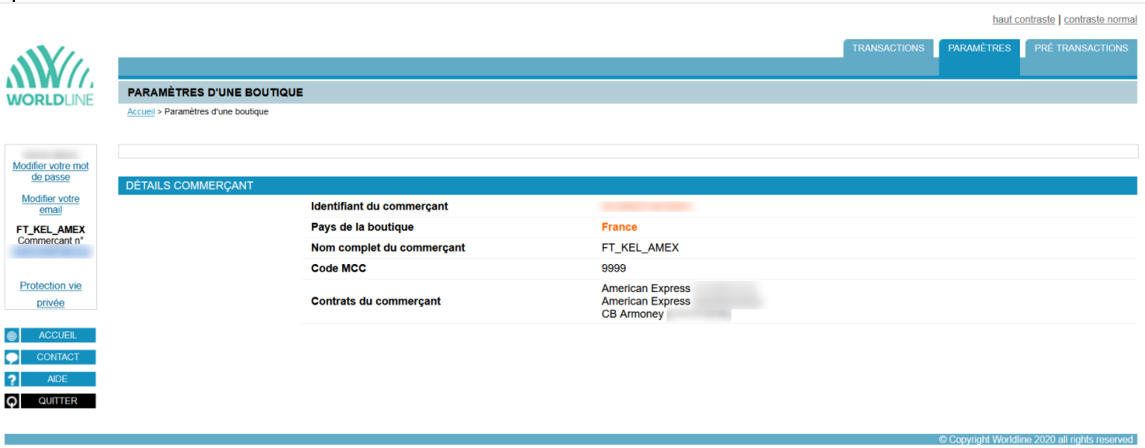

AMEX contracts displayed in SOE

Sips Office Extranet now lists all the Amex contracts of a store if the case occurs.

JRI in test environment

Chargeback reconciliation reports are now available on the 2.0 WL Sips test environment.

Merchants with a test environment will have the opportunity to test the integration of chargeback reports for all eligible payment means.

These files will be produced daily and automatically.

In order that not all transactions appear in the chargeback reports, only those over €100 will appear in the chargeback reports 5 days after they have been remitted.

The 5-day delay has been introduced to allow the merchant to perform cash management on these transactions before they eventually become chargeback. In effect, a chargeback is "blocked" and the merchant can no longer refund it.

To have this option, the merchant must send a request for activation of the "Chargeback reconciliation reports" option to Sips support or their preferred contact.

Regulatory changes

Different display on Sips Paypage depending on the payment case

In order to comply with MPADS regulation, the pages hosted on the WL Sips servers (Paypage) will display several different notions depending on the payment case :

- The authenticated amount ;

- The authorized amount ;

- The payment case.

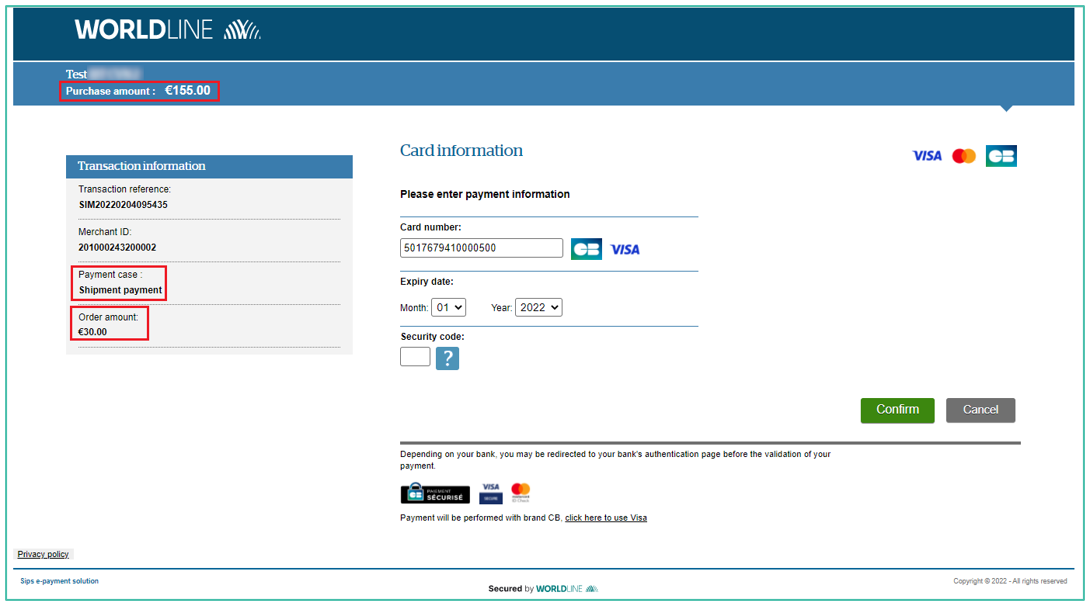

Below is the display in the case of a multi-payment shipment for a total purchase amount of €155.00 (authenticated amount) with the first shipment made within 6 days for an amount of €30.00 (authorized amount for this transaction).

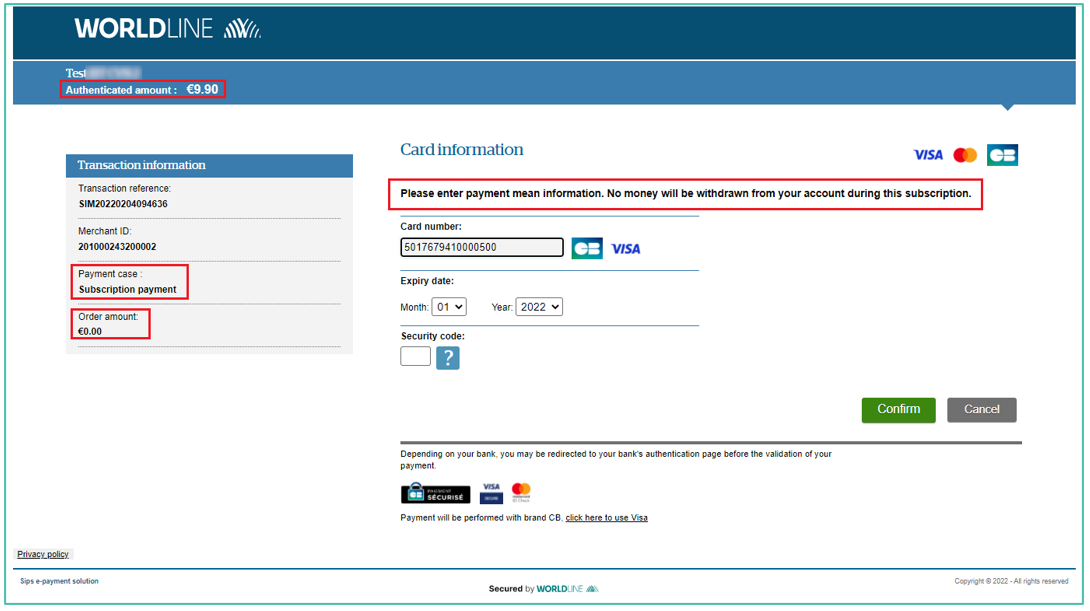

In case of a request for information (amount=0), a message informing the cardholder will be displayed to indicate that no amount will be debited from his account.

Below is the display in the case of a subscription-type payment, for a monthly direct debit of €9.90 (authenticated amount), the first month of which is free.

The different Paypage visuals will be available in the User Guides of each payment case once they are published in version 22.4 of the online documentation website.

Changes on Visa Secure and Mastercard Identity check logos

Visa Secure and Mastercard identity check logs has changed.

Former logos :

image

New logos :

image

The logos has been updated on all WL Sips pages (Paypage and Walletpage).

Corrective maintenance

| Ref. | Appli. | Defect category | Solution summary | Priority |

|---|---|---|---|---|

| 56534 | M2M | Functional | iSTI set to "UNKNOWN" when the merchant does not inform it about the BXAP protocol. | Minor |

| 57115 | SOE | Functional | TREF search available again for some merchants. | Critical |

| 57490 | Paypage | Functional | The order_id field has been transmitted to Paypal again. | Major |