Introduction

Worldline Sips is a secure multi-channel e-commerce payment solution that complies with the PCI DSS standard. It allows you to accept and manage payment transactions by taking into account business rules related to your activity (payment upon shipping, deferred payment, recurring payment, payment in instalments, etc.).

The purpose of this document is to explain the American Express Logee means of payment integration into Worldline Sips.

Who does this document target?

This document is intended to help you implement the American Express Logee means of payment on your e-commerce site.

It includes:

- functional information for you

- implementation instructions for your technical team

To get an overview of the Worldline Sips solution, we advise you to consult the following documents:

- Functional presentation

- Functionality set-up guide

Understanding American Express Logee payments with Worldline Sips

General principles

An American Express Logee card is a card stored in an electronic wallet of a tour operator or travel agency for the company account. It allows members of the company in question of carrying out transactions, for professional travel reservation for example, directly with the company account.

The end customer, namely the member of the company, therefore doesn't have to enter the number and expiry date of the card since this information is stored in the wallet of the merchant (tour operator or travel agency).

The American Express Logee card is an international payment card issued by and associated with the payment network American Express. A lodged card is a card that does not belong to an individual, but to a company. It is therefore not nominative and can't be subject to strong authentication. Understand here that, although it is an American Express card, it's not subject to the Safekey program.

To pay with an American Express Logee network card, merchant have to provide the card details, namely:

- Card number;

- Expiry date.

Acceptance rules

Available functionalities

| Payment channels | ||

|---|---|---|

| Internet | V | Default payment channel |

| MAIL_ORDER, TELEPHONE_ORDER | V | |

| Fax | X | |

| IVS | X | |

| Means of payment | ||

|---|---|---|

| Immediate payment | X | |

| End-of-day payment | V | Forced payment method |

| Deferred payment | X | |

| Payment upon shipping | X | |

| Payment in instalments | X | |

| Subscription payment | X | |

| Batch payment | V | |

| OneClick payment | X | |

| Currency management | ||

|---|---|---|

| Multi-currency acceptance | V | According to your contract |

| Currency settlement | V | According to your contract |

Authorisation request

Authorisation requests for American Express Logee cards are the same as for standard American Express cards.

The authorisation duration for American Express Logee cards is forced to 0 day (sent to American Express at next remittance).

Payments remittance

Payments are remitted to American Express overnight from 00:00, CET time zone (Central European Time), via a file exchange with American Express.

Signing a distance selling contract

In order to offer the American Express Logee mean of payment on your website, you have to sign a distance selling contract with American Express. Then, you transmit us the contract number for recording it in our information system. You will also be asked to provide us with the "Agency" code (of 4 characters) and the "Office" code (of 9 characters) provided by American Express, data which has to be transmitted in the American Express Logee remittance files.

Accepted currencies

All currencies may potentially be accepted on Worldline Sips (Please refer to the paragraph 'currencyCode' of Data dictionary) provided that they are specified in one of the contracts agreed upon with American Express Logee. Please note that American Express Logee contracts are single currency contracts. This means you should sign on one American Express Logee acceptance contract for each desired currency.

Making an American Express Logee payment

Worldline Sips offers you two solutions to integrate the American Express Logee means of payment:

- Sips Office which gives you the possibility to display your payment pages and works through a server-to-server dialog.

- Sips Office Batch which allows you to process batch payments.

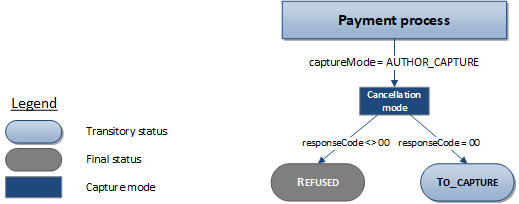

The remittance modes available for an American Express Logee transaction are:

- Cancellation mode: forced mode allowing transaction remittance on a predefined date, called capture delay. When this capture delay is reached, the remittance is sent automatically. This delay is set via the captureDay field. For an American Express Logee transaction, its value is forced to 0 (payment at the end of daytime).

The diagram below explains the different transaction statuses according to the chosen capture mode:

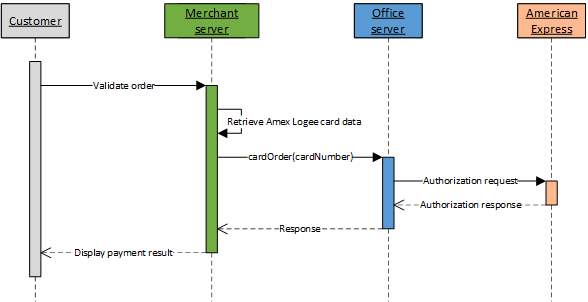

Making an American Express Logee payment with Sips Office

The payment process for Sips Office is described below:

Setting the payment request

American Express Logee payments can be initiated using the cardOrder function of the

CheckOut service. The following fields are used to send information

specific to this payment method:

| Field name | Remarks/rules | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

cardCSCValue |

Missing | ||||||||||||||||

cardNumber |

Mandatory | ||||||||||||||||

cardExpiryDate |

Mandatory | ||||||||||||||||

paymentMeanBrand |

Must be valued with AMEX_LOGEE. | ||||||||||||||||

invoiceReference |

Mandatory, must contain the invoice number associated with the transaction. | ||||||||||||||||

ShoppingCartDetail.ItemsList |

Must have an Item container. | ||||||||||||||||

Item.TravelData |

At least one TravelData must be in an Item container. | ||||||||||||||||

JourneyData.JourneyMode |

Optional. It is forbidden to provide a JourneyMode and a StayCategory in the same request. All JourneyMode in the request must be the same. | ||||||||||||||||

StayData.StayCategory |

Optional. It is forbidden to provide a JourneyMode and a StayCategory in the same request. All StayCategory in the request must be the same. | ||||||||||||||||

JourneyData.ArrivalLocation |

Mandatory for each container. | ||||||||||||||||

TravelData.TravelStartDateTime |

Mandatory for each container. | ||||||||||||||||

CustomerContact.FirstName |

Mandatory. | ||||||||||||||||

CustomerContact.LastName |

Mandatory. | ||||||||||||||||

JourneyData.CarrierName |

Mandatory. | ||||||||||||||||

JourneyData.TicketReference |

Mandatory when JourneyMode is valued with AIR or RAIL. | ||||||||||||||||

JourneyData.CarrierIdentifier |

Mandatory when JourneyMode is valued to AIR. | ||||||||||||||||

JourneyData.Sequence |

Optional. If the field is filled in at least once, all JourneyData must have one. The set of sequences must start at 1, be continuous, and unique. | ||||||||||||||||

MerchantOrderSpecificData |

At least one element in the list. | ||||||||||||||||

MerchantOrderSpecificData.MerchantOrderSpecificDataReference |

Possible references: 01, 02, 03, 04, 05, 06, 07. | ||||||||||||||||

MerchantOrderSpecificData.MerchantOrderSpecificDataType |

Possible types: 0001, 0002, 0003, 0004, 0005, 0006, 0007. | ||||||||||||||||

MerchantOrderSpecificData.MerchantOrderSpecificDataValue |

At least one MerchantOrderSpecificData must be provided.

The value's maximum length depends on the reference.

|

||||||||||||||||

merchantLocationId |

Optional. If provided in request, will be sent with the transaction in the remittance file to Amex. |

Analysing the response

The following table summarises the different response cases to be processed:

| Status | Response fields | Action to take |

|---|---|---|

| Payment accepted | acquirerResponseCode =

00authorisationId = (cf. Data

Dictionary).paymentMeanBrand =

AMEX_LOGEEresponseCode =

00 |

You can deliver the order. |

| Acquirer refusal | acquirerResponseCode = (cf.

Data Dictionary).responseCode =

05 |

The authorisation is refused for a reason unrelated to fraud, you can suggest your customer to pay with another mean of payment by generating a new request. |

| Refusal due to a technical issue | acquirerResponseCode =

90-98responseCode = 90,

99 |

Temporary technical issue when processing the transaction. Suggest your customer to retry a payment later. |

For the complete response codes (responseCode) and acquirer response

codes (acquirerResponseCode), please refer

to the Data dictionary.

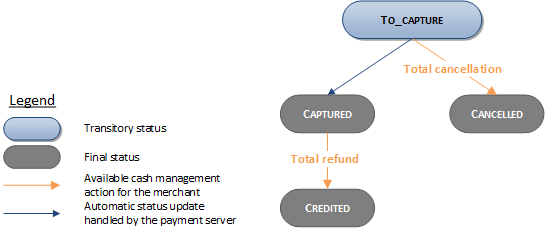

Managing your American Express Logee transactions

Available cash operations

The following operations are available on American Express Logee transactions:

| Cash management | ||

|---|---|---|

| Cancellation | V | Cancellation available only on the total amount of the transaction. |

| Validation | X | |

| Refund | V | Refund available only on the total amount of the transaction. |

| Duplication | X | |

| Credit | V | |

The diagram below allows you to know which cash management operation is available when a transaction is in a given state:

Viewing your American Express Logee transactions

Reports

The reports provided by Worldline Sips allow you to have a comprehensive and consolidated view of your transactions, cash operations, accounts and chargebacks. You can use this information to improve your information system.

The availability of American Express Logee transactions for each type of report is summarised in the table below:

| Reports availability | |

|---|---|

| Transactions report | V |

| Operations report | V |

| Reconciliations report | X |

| Chargebacks report | X |

paymentMeanBrand field is populated

with the value AMEX_LOGEE.Sips Office Extranet

You can view your American Express Logee transactions and perform various cash management operations with Sips Office Extranet.