Introduction

Worldline Sips is a secure multi-channel e-commerce payment solution that complies with the PCI DSS standard. It allows you to accept and manage payment transactions by taking into account business rules related to your activity (payment upon shipping, deferred payment, recurring payment, payment in instalments, etc.).

The purpose of this document is to explain the dynamic currency conversion (DCC) functionality integration into Worldline Sips.

Who does this document target?

This document is intended to help you implement the dynamic currency conversion (DCC) functionality on your e-commerce site.

It includes:

- functional information for you

- implementation instructions for your technical team

To get an overview of the Worldline Sips solution, we advise you to consult the following documents:

- Functional presentation

- Functionality set-up guide

Understanding the dynamic currency conversion with Worldline Sips

General principles

The dynamic currency conversion is a financial service that allows credit cardholders to benefit from the cost conversion of their transaction into their national currency when making a payment abroad.

This feature is currently available only for the Visa and MasterCard networks.

The DCC system is not a payment method. Therefore, it is not necessary to set up a new payment method. The transaction amount conversion in the customer's currency is made by the exchange office service provider Fexc.

The payment will be made in the currency of your customer or in euros.

Acceptance rules

Available functionalities

| Payment channels | ||

|---|---|---|

| Internet | V | Default payment channel |

| MOTO | X | |

| Fax | X | |

| IVS | X | |

| Means of payment | ||

|---|---|---|

| Immediate payment | X | |

| End-of-day payment | V | |

| Deferred payment | X | |

| Payment upon shipping | X | |

| Payment in instalments | X | |

| Subscription payment | X | |

| Batch payment | X | |

| OneClick payment | V | |

| Currency management | ||

|---|---|---|

| Multicurrency acceptance | V | The acquirer is responsible for the accepted currency. |

| Currency settlement | V | The acquirer is responsible for the accepted currency. |

Payment pages

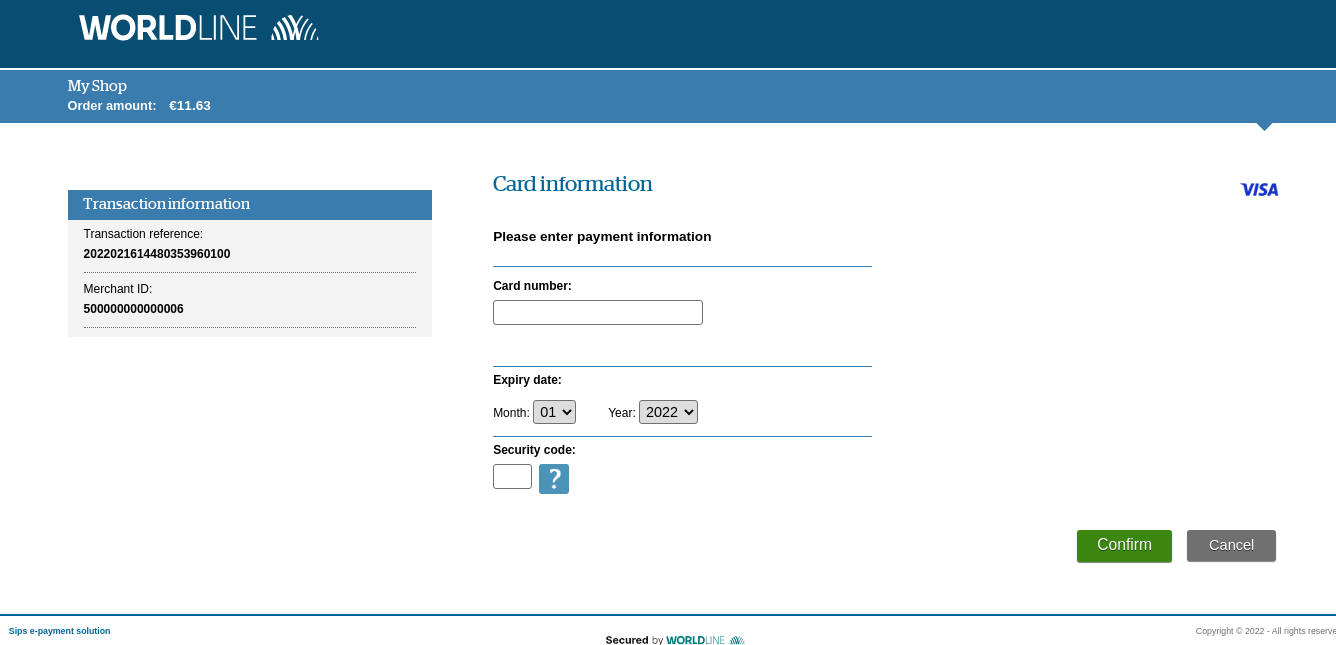

For illustration, the screen below shows a payment page.

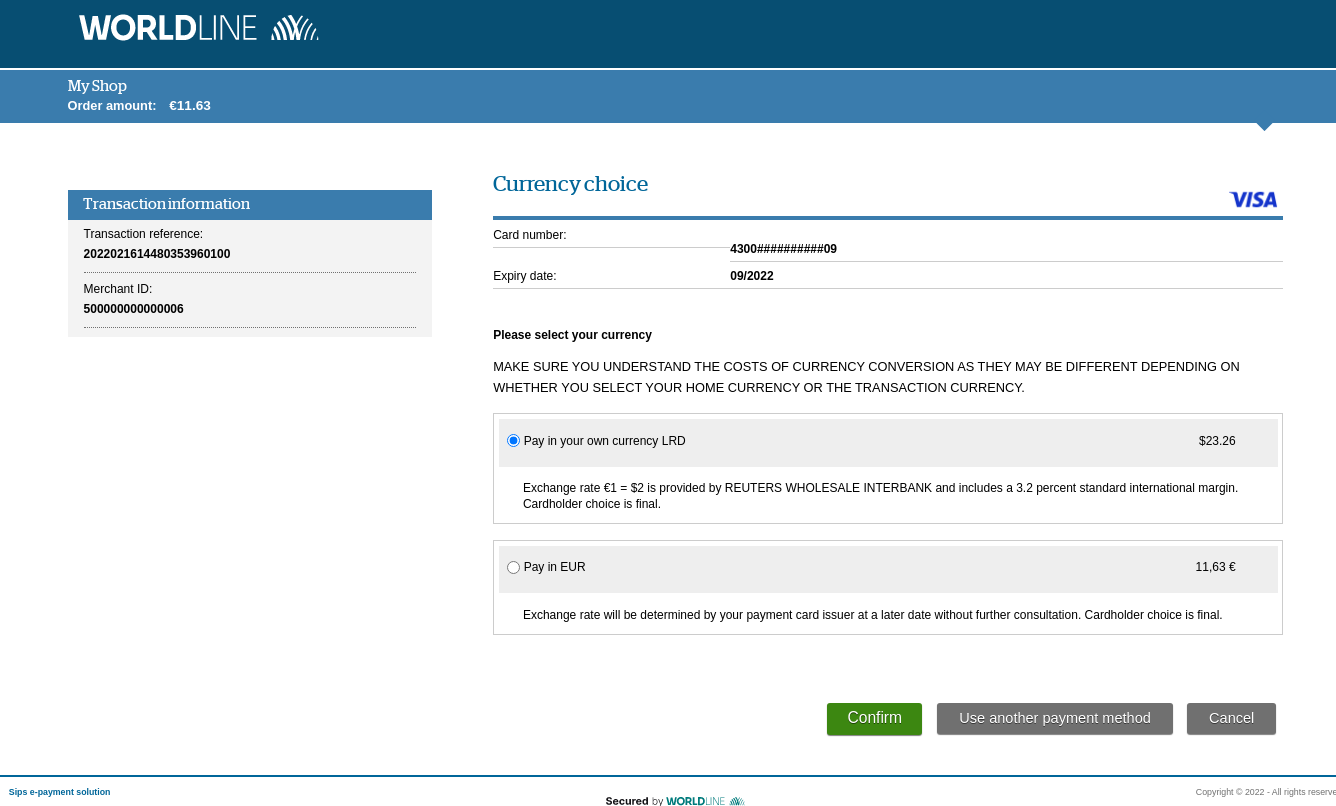

A second screen, below, presents the payment page with the choice of currency: pay in your own currency or pay in euros

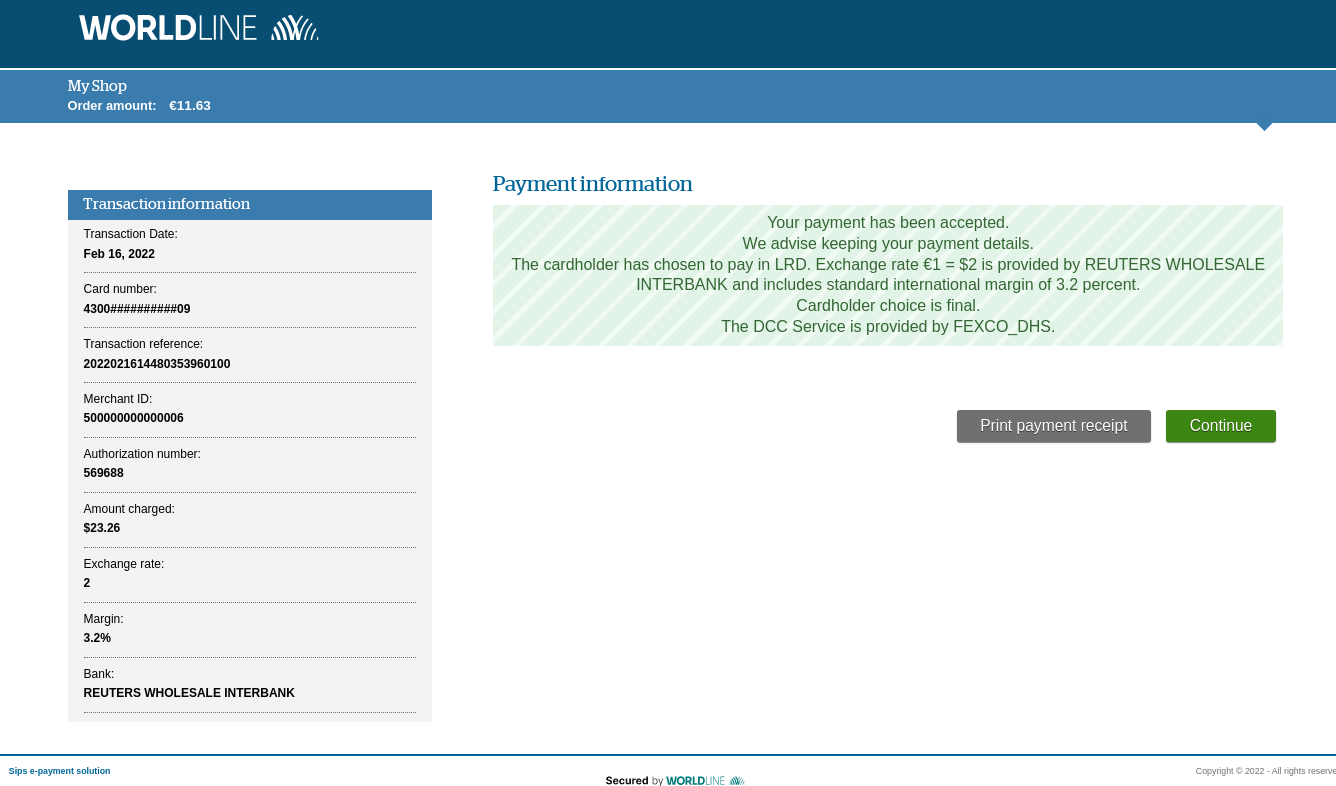

A third screen, below, presents the transaction realized (with details and information).

Payment collection

The payments are made by the acquirer, according to the methods you will define. In principle, the collection is made at night (from 10 pm, CET DST) by exchanging of files with the acquirer.

Signing a Distance selling contract

In order to offer the dynamic currency conversion, you must contact your acquirer who will tell you the contractual agreements of his DCC offer.

Making a dynamic currency conversion

You can offer the dynamic currency conversion through the Sips Paypage interface.

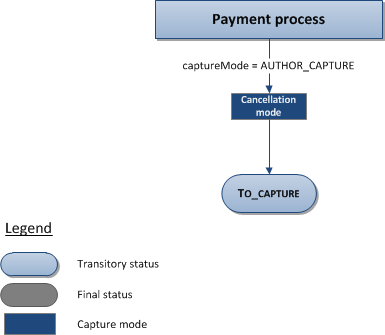

The remittance mode available for a DCC transaction is the cancellation.

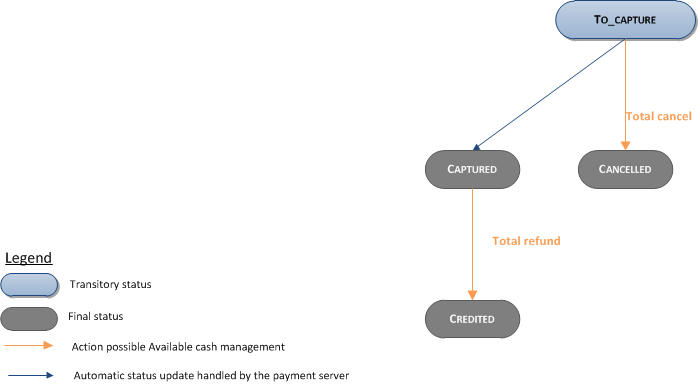

The diagram below explains the different transaction statuses according to the chosen capture mode:

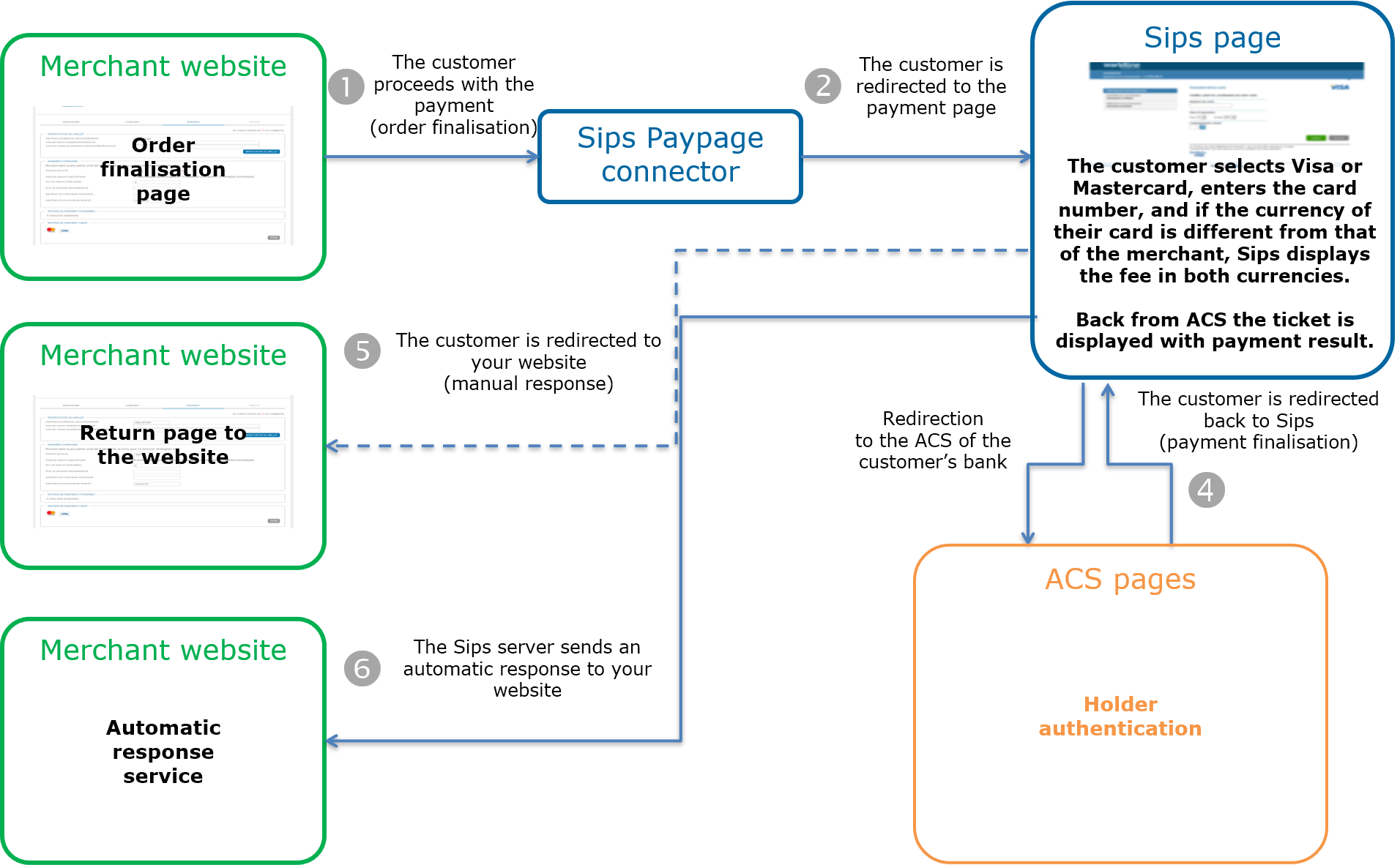

Making a dynamic currency conversion with Sips Paypage

The dynamic currency conversion for Sips Paypage is described below:

Setting the payment request

The following fields are characterised by a specific behaviour:

| Field name | Notes/rules | Sample field population |

|---|---|---|

| bypassDcc | Please consult the data dictionary for more information. | Y |

| currencyCode | Enter your base currency code (the currency in which you are usually paid). For a complete list of currency codes, please view the data dictionary. | 978 |

Analysing the response

The following fields are characterised by a specific behaviour:

| Field name | Notes/Rules | Setting example |

|---|---|---|

| dccStatus | Please view the data dictionary for more information. | 01 - Rejected by the cardholder |

| dccResponseCode | Please view the data dictionary for more information. | 00 – Successful operation |

| dccAmount | Final transaction amount in the cardholder’s currency. | 2000 |

| dccCurrency | Cardholder’s currency | 840 |

| dccExchangeRate | 2 | |

| dccRateValidity | 2014-01-29T07:27:43-12:00 |

Making a dynamic currency conversion with Sips Office

The dynamic currency conversion acceptance is not available through the Sips Office solution.

Managing your DCC transactions

Available cash operations

The following operations are available on DCC transactions:

| Cash management | ||

|---|---|---|

| Cancellation | V | Available only for a total amount. |

| Validation | X | |

| Refund | V | Available only for a total amount and in the merchant's currency. |

| Duplication | X | |

The diagram below allows you to know which cash management operation is available when a transaction is in a given state:

Viewing your DCC transactions

Reports

The reports provided by Worldline Sips allow you to consolidate your system.

The DCC transactions availability for each type of report is summarised in the table below:

| Reports availability | |

|---|---|

| Transactions report | V |

| Operations report | V |

| Reconciliations report | V |

| Chargebacks report | X |

| Sips Office Extranet | V |

Sips Office Extranet

You can view your DCC transactions details and perform various cash management operations with Sips Office Extranet.

the DCC status of the transaction:

- not offered, the transaction does not meet the application criteria (for example, the card is outside of the Visa/MasterCard scope).

- not applicable, the transaction is not acceptable (for example, the currency is not supported by the DCC provider).

- proposed but refused by the cardholder.

- accepted

- the DCC provider response

- the DCC amount (in the cardholder currency)

- the DCC currency code

- the exchange rate applied to the transaction

- the deadline for applying the exchange rate.