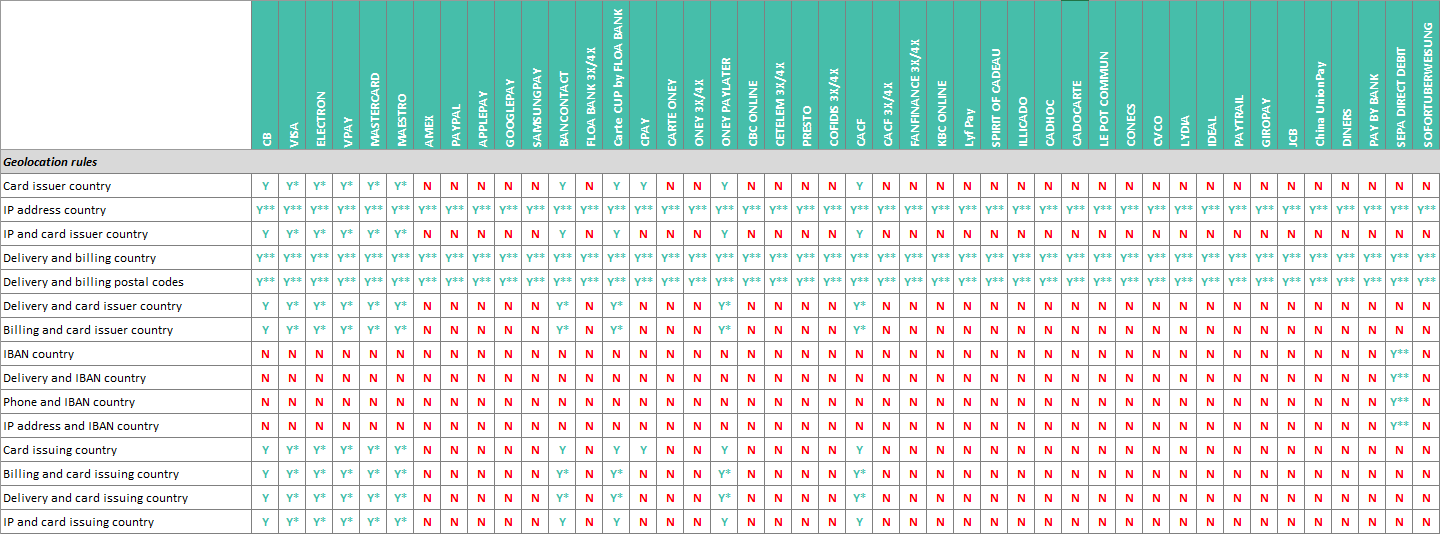

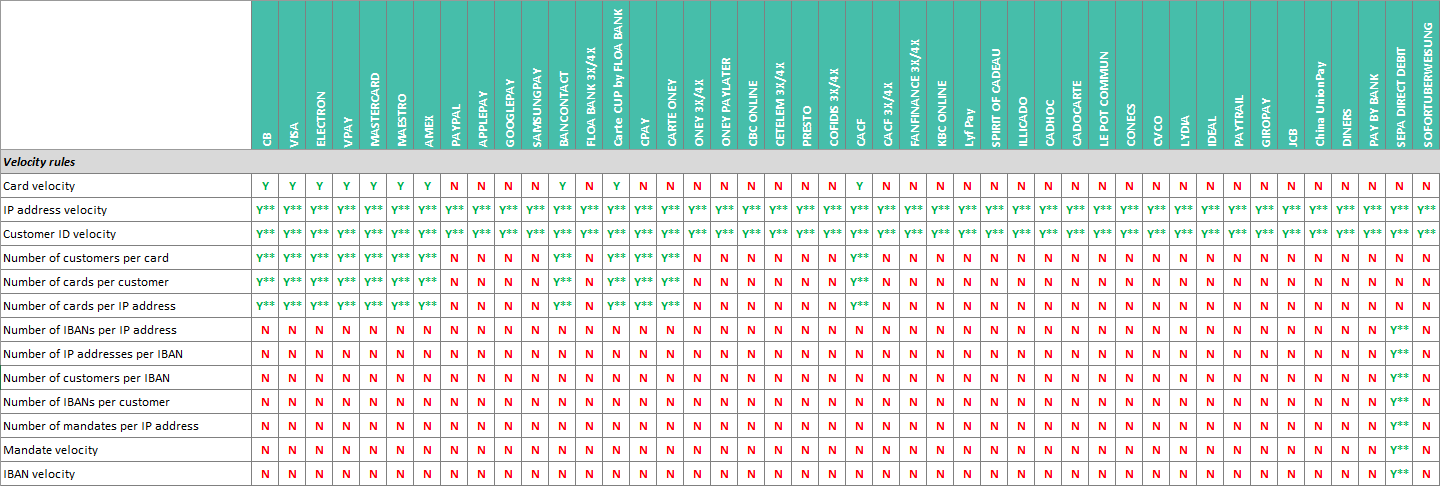

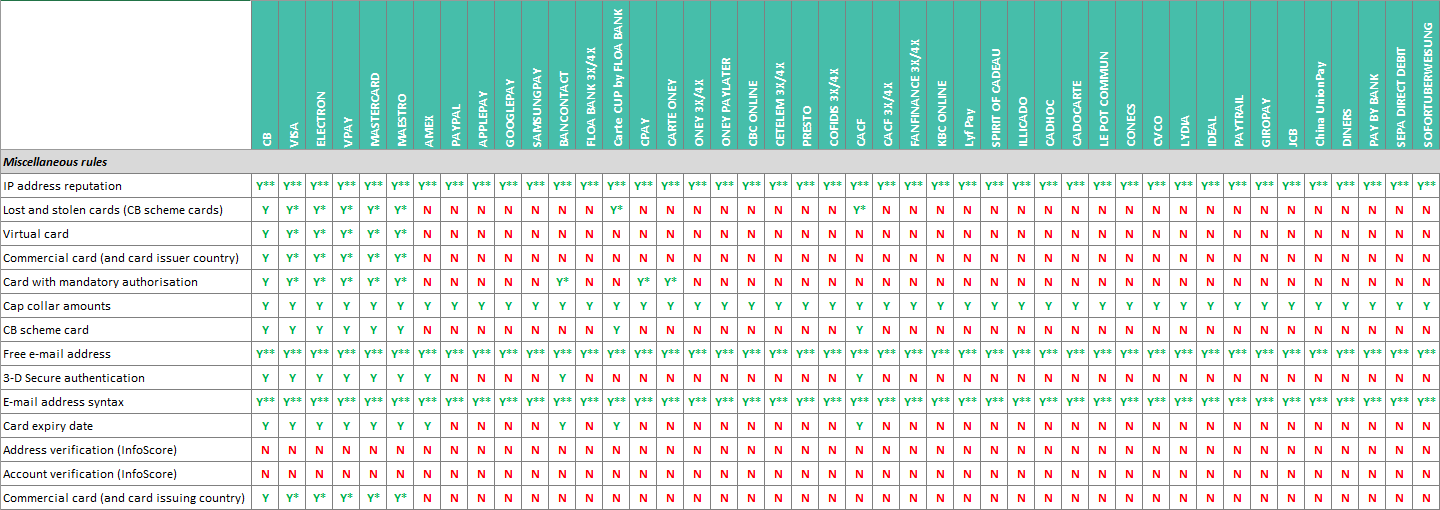

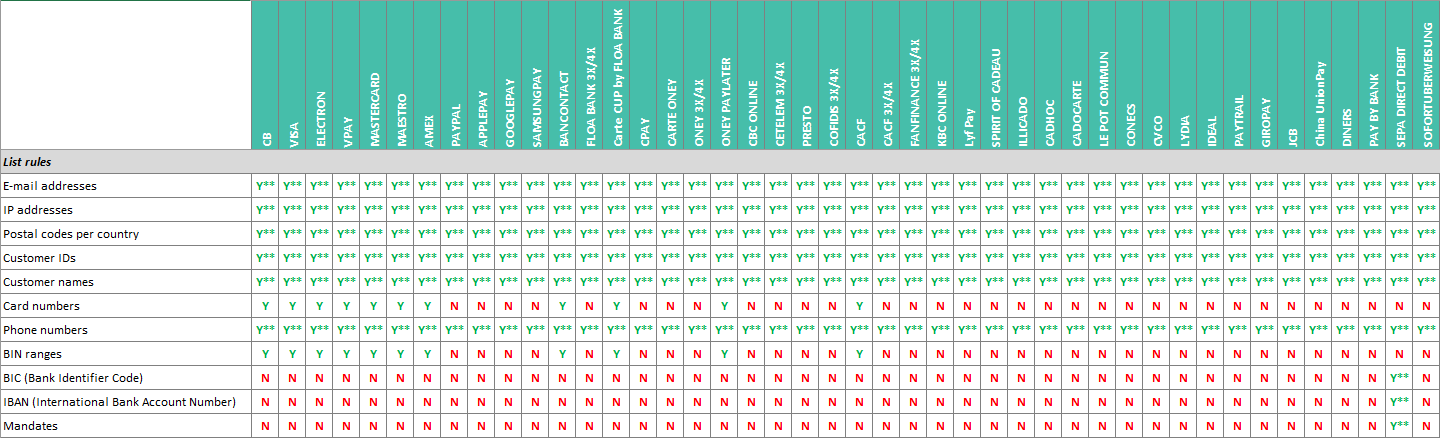

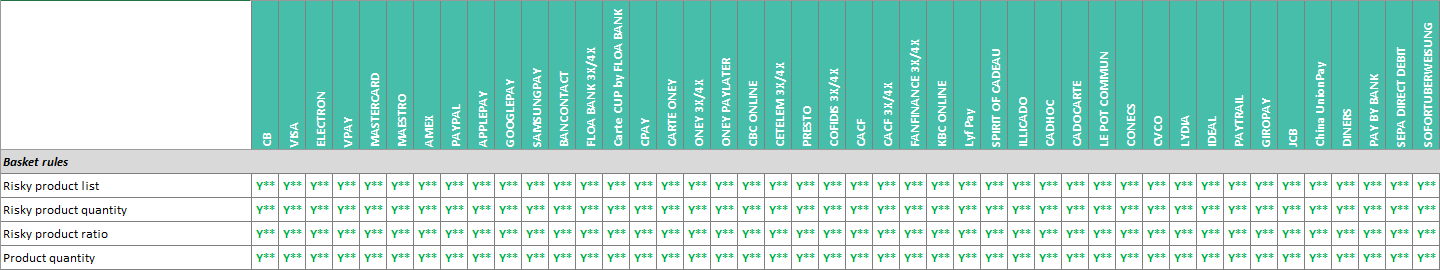

List of rules

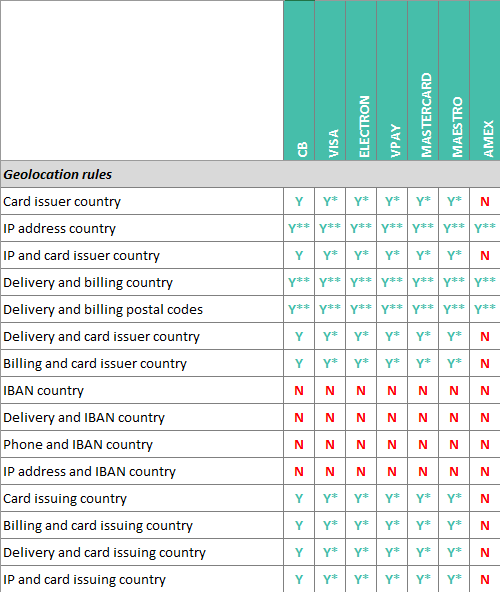

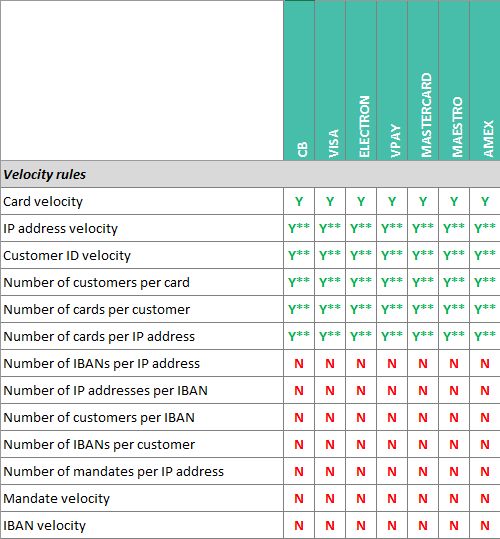

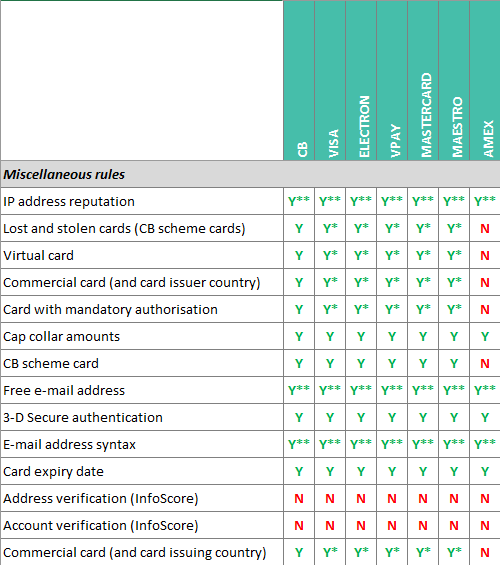

Geolocation rules: address and country

Card issuer country

Rule description

The card issuer country rule enables you to decide whether to accept or decline to provide a service depending on the issuer country (country of the bank that issued the card).

The rule queries a BIN range database to check whether the country is on a list of authorised or prohibited countries.

If there is no list of authorised or prohibited countries, the rule considers your country code as the only one authorised.

Conditions of use

If you would like to use this rule you must:

- activate the rule in the profile. To do so, you must:

- make a request to your account manager

- or activate the rule through the fraud GUI

- and set the list of authorised or prohibited card issuer countries.

To do so, you must:

- give your account manager the list of authorised or prohibited countries

- or set the list of authorised or prohibited countries through the fraud GUI

- or dynamically override the list of authorised or prohibited countries in your request

Our fraud module is based on the CIS (Card Info Service) database, which includes information on BIN ranges. However, this reference source does not include the nationality of American Express cards. It is therefore impossible for us, via the fraud module, to block American Express cards via the "Country issuer card" rule.

Expression of the result

Simple configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not a card). | 0 | CR;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The card country is unknown. | 0 | CR;N; CARD_COUNTRY=XXX* |

CARD_COUNTRY=XXX* |

| The card country is on the list of prohibited countries, is not on the list of authorised countries, or is the same as the merchant's country. | 0 to -4 depending on settings | ||

| The card country is on the list of authorised countries, is not on the list of prohibited countries, or differs from the merchant's country. | 0 |

* XXX: ISO 3166 alphabetical country code (see countryList field in the data dictionary)

Advanced configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not a card). | 0 | CR;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The card country is unknown. | 0 | CR;N; CARD_COUNTRY=XXX* |

CARD_COUNTRY=XXX* |

| The card country is on the list of “disadvantaged countries” or is not on the list of “non-disadvantaged countries”. | 0 to -4 depending on settings | ||

| The card country is on the list of “non-disadvantaged countries”, or is not on the list of “disadvantaged countries”, or is not on the list of “advantaged countries” or is not on the list of “non-advantaged countries”. | 0 | ||

| The card country is on the list of “advantaged countries” or is not on the list of “non-advantaged countries” or is the same as the merchant's country. | 0 to +4 depending on settings |

* XXX: ISO 3166 alphabetical country code (see countryList field in the data dictionary)

Dynamic override

You can dynamically supply a list of authorised or prohibited countries in the request. If a list is sent in the request, it takes precedence over any possible configuration except if it conflicts with the configuration imposed by the distributor.

There are 2 methods to override the rule parameters dynamically.

METHOD 1:

Choose the parameter to be overriden in the field...

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicParam...and send the country list in the following field:

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicValueThe parameters that apply to this rule are:

- default mode (simple configuration):

- AllowedCardCountryList for the list of authorised countries

- DeniedCardCountryList for the list of prohibited countries

- advanced configuration mode:

- NDeniedCardCountryList for the list of disadvantaged countries

- NDeniedExceptCardCountryList for the list of non-disadvantaged countries

- PAllowedCardCountryList for the list of advantaged countries

- PAllowedExceptCardCountryList for the list non-advantaged countries

<urn:fraudData>

<urn:riskManagementDynamicSettingList>

<urn:riskManagementDynamicSetting>

<urn:riskManagementDynamicParam>AllowedCardCountryList</urn:riskManagementDynamicParam>

<urn:riskManagementDynamicValue>FRA,BEL,GBR</urn:riskManagementDynamicValue>

</urn:riskManagementDynamicSetting>

</urn:riskManagementDynamicSettingList>

</urn:fraudData>"fraudData": {

“riskManagementDynamicSettingList”:[

{

“riskManagementDynamicParam”:“AllowedCardCountryList”,

“riskManagementDynamicValue”:“FRA,BEL,GBR”

}

]

}METHOD 2 (deprecated):

The card country list is sent in one of the following connector fields:

- fraudData.allowedCardCountryList for the list of authorised countries

- fraudData.deniedCardCountryList for the list of prohibited countries

<urn:fraudData>

<urn:allowedCardCountryList>FRA,BEL,GBR</urn:allowedCardCountryList>

</urn:fraudData>"fraudData": {

"allowedCardCountryList": ["FRA", "BEL", "GBR"]

}For both methods, the list sent must contain:

- either the ISO 3166 alphabetic country codes (see field countryList in the data dictionary) separated by commas

- or a list of preset country codes (see field areaList in the data dictionary).

In default mode, sending 2 lists (authorised and prohibited) in the same request is considered as an error, in which case the rule will not be executed.

In advanced configuration mode, sending 2 negative lists (disadvantaged and non-disadvantaged) or 2 positive lists (advantaged and non-advantaged) in the same request is considered as an error, in which case the rule will not be executed.

Dynamic bypass

You can deactivate this rule for a given transaction except if the rule is imposed by the distributor. For this rule to be bypassed for this transaction, the request must contain the ForeignBinCard instruction.

IP address country

Rule description

This rule enables you to decide whether to accept or decline to provide a service depending on the country associated with the customer's IP address.

The rule checks whether the IP address country is on a list of authorised or prohibited countries. This IP address comes from:

- the automatic detection performed by the customer's browser in Sips Paypage. In this case, doubts may remain about the customer's country, mostly due to the dynamic allocation of IP addresses by some ISPs, or because of dynamic addresses.

- or from the data transfer you do in the request in Sips Office.

If there is no list of authorised or prohibited countries, the rule considers the merchant's country code as the only one authorised.

Conditions of use

If you would like to use this rule you must:

- activate the rule in the profile. To do so, you must:

- make a request to your account manager

- or activate the rule through the fraud GUI

- set the list of authorised or prohibited IP address countries. To do

so, you must:

- give your account manager the list of authorised or prohibited countries

- or set the list of authorised or prohibited countries through the fraud GUI

- or dynamically override the list of authorised or prohibited countries in your request

Expression of the result

Simple configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| The IP address country is unknown. | 0 | CY;N;IP_COUNTRY=XXX | IP_COUNTRY=XXX |

| The IP address country is on the list of prohibited countries or is not on the list of authorised countries. | 0 to -4 depending on settings | CY;N;IP_COUNTRY=XXX* | IP_COUNTRY=XXX* |

| The IP address country is on the list of authorised countries or is not on the list of prohibited countries. | 0 |

* XXX: ISO 3166 alphabetical country code (see countryList field in the data dictionary)

Advanced configuration mode:

| Use case | ScoreValue | Scoreinfo | RuleDetailedInfo |

|---|---|---|---|

| The IP address country is unknown. | 0 | CY;N;IP_COUNTRY=XXX | IP_COUNTRY=XXX |

| The IP address country is on the list of “disadvantaged countries” or is not on the list of “non-disadvantaged countries”. | 0 to -4 depending on settings | CY;N;IP_COUNTRY=XXX* | IP_COUNTRY=XXX* |

| The IP address country is on the list of “non-disadvantaged countries”, or is not on the list of “disadvantaged countries”, or is not on the list of “advantaged countries” or is not on the list of “non-advantaged countries”. | 0 | ||

| The IP address country is on the list of “ advantaged countries” or is not on the list of “non-advantaged countries”. | 0 to +4 depending on settings |

* XXX: ISO 3166 alphabetical country code (see countryList field in the data dictionary)

Dynamic override

You can dynamically supply a list of authorised or prohibited countries in the request. If a list is sent in the request, it takes precedence over any possible configuration except if it conflicts with the configuration imposed by the distributor.

There are 2 methods to override the rule parameters dynamically.

METHOD 1:

Choose the parameter to be overriden...

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicParam...and send the country list in the following field:

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicValueThe parameters that apply to this rule are:

- default mode (simple configuration) :

- AllowedIpCountryList for the list of authorised countries

- DeniedIpCountryList for the list of prohibited countries

- advanced configuration mode:

- NDeniedIpCountryList for the list of disadvantaged countries

- NDeniedExceptIpCountryList for the list of non-disadvantaged countries

- PAllowedIpCountryList for the list of advantaged countries

- PAllowedExceptIpCountryList for the list of non-advantaged countries

Examples:

<urn:fraudData>

<urn:riskManagementDynamicSettingList>

<urn:riskManagementDynamicSetting>

<urn:riskManagementDynamicParam>AllowedIpCountryList</urn:riskManagementDynamicParam>

<urn:riskManagementDynamicValue>FRA,BEL,GBR</urn:riskManagementDynamicValue>

</urn:riskManagementDynamicSetting>

</urn:riskManagementDynamicSettingList>

</urn:fraudData>"fraudData": {

"riskManagementDynamicSettingList":[

{

"riskManagementDynamicParam":"AllowedIpCountryList",

"riskManagementDynamicValue”:“FRA,BEL,GBR"

}

]

}METHOD 2 (deprecated) :

The IP address country list is sent in one of the following connector fields:

- fraudData.allowedIpCountryList for the list of authorised countries

- fraudData.deniedIpCountryList for the list of prohibited countries

Examples:

<urn:fraudData>

<urn:allowedIpCountryList>FRA,BEL,GBR</urn:allowedCardCountryList>

</urn:fraudData>"fraudData": {

"allowedIpCountryList": ["FRA", "BEL", "GBR"]

} For both methods, the list sent must contain:

- either the ISO 3166 alphabetic country codes (see countryList in the data dictionary) separated by commas

- or a list of preset country codes (see field areaList in the data dictionary)

In default mode, sending 2 lists (authorised and prohibited) in the same request is considered as an error, in which case the rule will not be executed.

In advanced configuration mode, sending 2 negative lists (disadvantaged and non-disadvantaged) or 2 positive lists (advantaged and non-advantaged) in the same request is considered as an error, in which case the rule will not be executed.

Dynamic bypass

You can deactivate this rule for a given transaction except if the rule is imposed by the distributor. For this rule to be bypassed for this transaction, the request must contain the IpCountry instruction.

Examples:

IP and card issuer country

Rule description

This rule enables you to decide whether to accept or decline to provide a service depending on the combination of the card issuer country and the customer’s IP address country.

The rule queries the BIN range and IP address range databases to check whether the combination of both countries is on a list of authorised or prohibited country combinations.

This IP address comes from:

- the automatic detection performed by the customer's browser in Sips Paypage. In this case, uncertainty may remain about the customer's country, due mainly to the dynamic allocation of IP addresses by some ISPs or to dynamic addresses.

- or from the data transfer you do in the request in Sips Office.

If there is no authorised or prohibited combination, the rule checks whether the card issuer country matches the IP address country.

Conditions of use

If you would like to use this rule you must:

- activate the rule in the profile. To do so, you must:

- make a request to your account manager

- or activate the rule through the fraud GUI

- set the list of authorised or prohibited card issuer country and

IP adress country combinations. To do so, you must:

- give your account manager the list of authorised or prohibited combinations

- or set the authorised or prohibited combinations through the fraud GUI

- or dynamically override the authorised or prohibited combinations in your request

and provide the customer's IP address in the request (customerIpAddress field), if you use Sips Office.

Expression of the result

Simple configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not a card). | 0 | SI;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The card country and/or IP address country is/are unknown. | 0 | SI;N; CARD_COUNTRY=XXX; IP_COUNTRY=YYY* |

CARD_COUNTRY=XXX* ; IP_COUNTRY=YYY* |

| The “card country/IP address country” combination is prohibited. | 0 to -4 depending on settings | ||

| The “card country/IP address country” combination is authorised. | 0 |

* XXX, YYY: ISO 3166 alphabetical country codes (see countryList field in the data dictionary)

Advanced configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not a card). | 0 | SI;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The card country and/or IP address country is/are unknown. | 0 | SI;N; CARD_COUNTRY=XXX; IP_COUNTRY=YYY* |

CARD_COUNTRY=XXX* ; IP_COUNTRY=YYY* |

| The “card country/IP address country” combination is on the list of “disadvantaged countries” or is not on the list of “non-disadvantaged countries”. | 0 to -4 depending on settings | ||

| The “card country/IP address country” combination is on the list of ”non-disadvantaged countries”, or is not on the list of “disadvantaged countries”, or is not on the list of “advantaged countries”, or is on the list of “non-advantaged countries”. | 0 | ||

| The “card country/IP address country” combination is on the list of “advantaged countries” or is not on the list of “non-advantaged countries”. | 0 to +4 depending on settings |

* XXX, YYY: ISO 3166 alphabetical country codes (see countryList field in the data dictionary)

Dynamic override

You can dynamically supply the list of IP address countries/card countries combinations in the request. If a list is sent in the request, it takes precedence over any possible configuration except if it conflicts with the configuration imposed by the distributor.

Choose the parameter to be overriden...

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicParam...and set the country list in the following field:

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicValueThe parameters that apply to this rule are:

- default mode (simple configuration):

- AllowedIpCardCountryCombiList for the authorised IP and card issuer country combinations

- DeniedIpCardCountryCombiList for the prohibited IP and card issuer country combinations

- advanced configuration mode:

- NDeniedIpCardCountryCombiList for the list of disadvantaged countries

- NDeniedExceptIpCardCountryCombiList for the list of non-disadvantaged countries

- PAllowedIpCardCountryCombiList for the list of advantaged countries

- PAllowedExceptIpCardCountryCombiList for the list of non-advantaged countries

Examples:

<urn:fraudData>

<urn:riskManagementDynamicSettingList>

<urn:riskManagementDynamicSetting>

<urn:riskManagementDynamicParam> AllowedIpCardCountryCombiList </urn:riskManagementDynamicParam>

<urn:riskManagementDynamicValue>(FRA,FRA),(BEL,BEL),(FRA,BEL),(BEL,FRA)</urn:riskManagementDynamicValue>

</urn:riskManagementDynamicSetting>

</urn:riskManagementDynamicSettingList>

</urn:fraudData>"fraudData": {

"riskManagementDynamicSettingList":[

{

"riskManagementDynamicParam":"AllowedIpCardCountryCombiList",

"riskManagementDynamicValue":"(FRA,FRA),(BEL,BEL),(FRA,BEL),(BEL,FRA)"

}

]

}The list sent must contain pairs separated by commas and consisting of:

- either ISO 3166 alphabetic country codes (see countryList in the data dictionary)

- or a list of preset country codes (see areaList in the data dictionary)

In default mode, sending 2 lists (authorised and prohibited) in the same request is considered as an error, in which case the rule will not be executed.

In advanced configuration mode, sending 2 negative lists (disadvantaged and non-disadvantaged) or 2 positive lists (advantaged and non-advantaged) in the same request is considered as an error, in which case the rule will not be executed.

Dynamic bypass

You can deactivate this rule for a given transaction except if the rule is imposed by the distributor. For this rule to be bypassed for this transaction, the request must contain the SimilityIpCard instruction.

Examples:

Delivery and billing country

Rule description

This rule enables you to decide whether to accept or decline to provide a service by checking whether the delivery country matches the billing country.

Conditions of use

If you would like to use this rule you must:

- activate the rule in the profile. To do so, you must:

- make a request to your account manager

- or activate the rule through the fraud GUI

and provide the delivery and billing country in the request (billingAddress.country and deliveryAddress.country fields).

Expression of the result

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| The delivery country does not match the billing country. | 0 to -4 depending on settings | SB;N; SHIP_COUNTRY=XXX*; BILL_COUNTRY=YYY* |

SHIP_COUNTRY=XXX*; BILL_COUNTRY=YYY* |

| The delivery country matches the billing country. | 0 | ||

| The countries are unknown. | 0 |

* XXX, YYY: ISO 3166 alphabetical country codes (see countryList field in the data dictionary)

Dynamic override

Dynamic override is not available for this rule.

Dynamic bypass

You can deactivate this rule for a given transaction except if the rule is imposed by the distributor. For this rule to be bypassed for this transaction, the request must contain the SimilarityDeliveryBillingCountry instruction.

Examples:

Delivery and billing postal codes

Rule description

This rule enables you to decide whether to accept or decline to provide a service by checking whether the delivery postal code matches the billing postal code.

This rule can only be activated if the rule that compares the delivery and billing countries also is. Indeed, comparing the postal codes is irrelevant if the countries are not the same.

Conditions of use

If you would like to use this rule you must:

- have the "Delivery and billing country" rule activated

- activate the rule in the profile. To do so, you must:

- make a request to your account manager

- or activate the rule through the fraud GUI

and provide the delivery and billing postal codes in the request (billingAddress.zipCode and deliveryAddress.zipCode fields).

Expression of the result

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| The delivery postal code does not match the billing postal code. | 0 à -4 selon paramétrage | ZC;N; SHIP_COUNTRY=XXX; BILL_COUNTRY=YYY; SHIP_ZIP=A; BILL_ZIP=B* |

SHIP_COUNTRY=XXX*;

BILL_COUNTRY=YYY*; SHIP_ZIP=A*; BILL_ZIP=B* |

| The delivery postal code matches the billing postal code. | 0 | ||

| The postal codes are unknown. | 0 |

* XXX, YYY: ISO 3166 alphabetical country codes (see countryList field in the data dictionary)

A, B: postal codes

Dynamic override

Dynamic override is not available for this rule.

Dynamic bypass

You can deactivate this rule for a given transaction except if the rule is imposed by the distributor. For this rule to be bypassed for this transaction, the request must contain the SimilarityDeliveryBillingPostalCode instruction.

Examples:

Delivery and card issuer country

Rule description

This rule enables you to decide whether to accept or decline to provide a service depending on the card issuer country/delivery country combination.

First, the rule queries the BIN range database to determine the card issuer country. Then, the rule checks whether the combination formed by the newly determined card issuer country and the delivery country is on the list of authorised or prohibited combinations.

If no list of authorised or prohibited combinations has been defined, the rule checks whether the card issuer country matches the delivery country.

Conditions of use

If you would like to use this rule you must:

- activate the rule in the profile. To do so, you must:

- make a request to your account manager

- or activate the rule through the fraud GUI

- set the list of authorised or prohibited delivery and card issuer

country combinations. To do so, you must:

- give your account manager the list of authorised or prohibited combinations

- or set the authorised or prohibited combinations through the fraud GUI

- or dynamically override the authorised or prohibited combinations in your request

and provide the delivery country in the request (deliveryAddress.country field)

Expression of the result

Simple configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not a card). | 0 | CS;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The “Card country/Delivery country” combination is prohibited. | 0 to -4 depending on settings | CS;N; SHIP_COUNTRY=XXX*; CARD_COUNTRY=YYY* |

SHIP_COUNTRY=XXX*; CARD_COUNTRY=YYY* |

| The “Card country/Delivery country” combination is authorised. | 0 | ||

| The card country or delivery country are unknown. | 0 |

* XXX, YYY: ISO 3166 alphabetical country codes (see countryList field in the data dictionary)

Advanced configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not a card). | 0 | CS;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The “card country/ delivery country” combination is on the list of “disadvantaged countries” or is not on the list of “non-disadvantaged countries” | 0 to -4 depending on settings | CS;N; SHIP_COUNTRY=XXX*; CARD_COUNTRY=YYY* |

SHIP_COUNTRY=XXX*; CARD_COUNTRY=YYY* |

| The “card country/ delivery country” combination is on the list of ”non-disadvantaged countries”, or is not on the list of “disadvantaged countries”, or is not on the list of “advantaged countries”, or is on the list of “non-advantaged countries” | 0 | ||

| The card country or delivery country are unknown. | 0 | ||

| The “card country/ card country/ delivery country” combination is on the list of “advantaged countries” or is not on the list of “non-advantaged countries” | 0 to +4 depending on settings |

* XXX, YYY: ISO 3166 alphabetical country codes (see countryList field in the data dictionary)

Dynamic override

You can dynamically supply a list of authorised or prohibited delivery and card country combinations in the request. If a list is sent in the request, it takes precedence over any possible configuration except if it conflicts with the configuration imposed by the distributor.

Choose the parameter to be overriden...

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicParam...and send the country list in the following field:

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicValueThe parameters that apply to this rule are:

- default mode (simple configuration):

- AllowedDeliveryCardCountryCombiList for the authorised delivery and card country combinations

- DeniedDeliveryCardCountryCombiList for the prohibited delivery and card country combinations

- advanced configuration mode:

- NDeniedDeliveryCardCountryCombiList for the list of disadvantaged countries

- NDeniedExceptDeliveryCardCountryCombiList for the list of non-disadvantaged countries

- PAllowedDeliveryCardCountryCombiList for the list of advantaged countries

- PAllowedExceptDeliveryCardCountryCombiList for the list of non-advantaged countries

Examples:

<urn:fraudData>

<urn:riskManagementDynamicSettingList>

<urn:riskManagementDynamicSetting>

<urn:riskManagementDynamicParam>AllowedDeliveryCardCountryCombiList</urn:riskManagementDynamicParam>

<urn:riskManagementDynamicValue>(FRA,#ZEURO),(#ZEURO,FRA)</urn:riskManagementDynamicValue>

</urn:riskManagementDynamicSetting>

</urn:riskManagementDynamicSettingList>

</urn:fraudData>"fraudData": {

"riskManagementDynamicSettingList":[

{

"riskManagementDynamicParam":"AllowedDeliveryCardCountryCombiList",

"riskManagementDynamicValue":"(FRA,#ZEURO),(#ZEURO,FRA)"

}

]

}For both methods, the list sent must contain pairs separated by commas and consisting of:

- either ISO 3166 alphabetic country codes (see countryList in the data dictionary)

- or a list of preset country codes (see areaList in the data dictionary)

In default mode, sending 2 lists (authorised and prohibited) in the same request is considered as an error, in which case the rule will not be executed.

In advanced configuration mode, sending 2 negative lists (disadvantaged and non-disadvantaged) or 2 positive lists (advantaged and non-advantaged) in the same request is considered as an error, in which case the rule will not be executed.

Dynamic bypass

You can deactivate this rule for a given transaction except if the rule is imposed by the distributor. For this rule to be bypassed for this transaction, the request must contain the SimilarityDeliveryCardCountry instruction.

Examples:

Billing and card issuer country

Rule description

This rule enables you to decide whether to accept or decline to provide a service depending on the card issuer country/billing country combination.

First, this rule queries the BIN range database to determine the card issuer country. Then, the rule checks whether the combination formed by the newly determined card issuer country and the billing country is on the list of authorised or prohibited combinations.

If no list of authorised or prohibited combinations has been defined, the rule checks whether the card issuer country matches the billing country.

Conditions of use

If you would like to use this rule you must:

- activate the rule in the profile. To do so, you must:

- make a request to your account manager

- or activate the rule through the fraud GUI

- set the list of authorised or prohibited billing and card country

combinations. To do so, you must:

- give your account manager the list of authorised or prohibited combinations

- or set the authorised or prohibited combinations through the fraud GUI

- or dynamically override the authorised or prohibited combinations in your request

and provide the billing and card issuer country in the request (deliveryAddress.country field)

Expression of the result

Simple configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not a card). | 0 | CS;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The “Card country/Billing country” combination is prohibited. | 0 to -4 depending on settings | CS;N; BILL_COUNTRY=XXX*; CARD_COUNTRY=YYY* |

BILL_COUNTRY=XXX*; CARD_COUNTRY=YYY* |

| The “Card country/Billing country” combination is authorised. | 0 | ||

| The card country or billing country are unknown. | 0 |

* XXX, YYY: ISO 3166 alphabetical country codes (see countryList field in the data dictionary)

Advanced configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not a card). | 0 | CS;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The “card country/ billing country” combination is on the list of “disadvantaged countries” or is not on the list of “non-disadvantaged countries”. | 0 to -4 depending on settings | CS;N; BILL_COUNTRY=XXX*; CARD_COUNTRY=YYY* |

BILL_COUNTRY=XXX*; CARD_COUNTRY=YYY* |

| The “card country/ billing country” combination is on the list of ”non-disadvantaged countries”, or is not on the list of “disadvantaged countries”, or is not on the list of “advantaged countries”, or is on the list of “non-advantaged countries”. | 0 | ||

| The card country or billing country are unknown. | 0 | ||

| The “card country/ billing country” combination is on the list of “advantaged countries” or is not on the list of “non-advantaged countries”. | 0 to +4 depending on settings |

* XXX, YYY: ISO 3166 alphabetical country codes (see countryList field in the data dictionary)

Dynamic override

You can dynamically supply a list of authorised or prohibited billing and card country combinations in the request. If a list is sent in the request, it takes precedence over any possible configuration except if it conflicts with the configuration imposed by the distributor.

Choose the parameter to be overriden...

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicParam...and send the country list in the following field:

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicValueThe parameters that apply to this rule are:

- default mode (simple configuration) :

- AllowedBillingCardCountryCombiList for the authorised billing country and card country combinations

- DeniedBillingCardCountryCombiList for the prohibited billing country and card country combinations

- advanced configuration mode:

- NDeniedBillingCardCountryCombiList for the list of disadvantaged countries

- NDeniedExceptBillingCardCountryCombiList for the list of non-disadvantaged countries

- PAllowedBillingCardCountryCombiList for the list of advantaged countries

- PAllowedExceptBillingCardCountryCombiList for the list of non-advantaged countries

Examples:

<urn:fraudData>

<urn:riskManagementDynamicSettingList>

<urn:riskManagementDynamicSetting>

<urn:riskManagementDynamicParam>AllowedBillingCardCountryCombiList</urn:riskManagementDynamicParam>

<urn:riskManagementDynamicValue>(FRA,#ZEURO),(#ZEURO,FRA)</urn:riskManagementDynamicValue>

</urn:riskManagementDynamicSetting>

</urn:riskManagementDynamicSettingList>

</urn:fraudData>"fraudData": {

"riskManagementDynamicSettingList":[

{

"riskManagementDynamicParam":"AllowedBillingCardCountryCombiList",

"riskManagementDynamicValue":"(FRA,#ZEURO),(#ZEURO,FRA)"

}

]

}The list sent must contain pairs separated by commas and consisting of:

- either ISO 3166 alphabetic country codes (see countryList in the data dictionary)

- or a list of preset country codes (see areaList in the data dictionary)

In default mode, sending 2 lists (authorised and prohibited) in the same request is considered as an error, in which case the rule will not be executed.

In advanced configuration mode, sending 2 negative lists (disadvantaged and non-disadvantaged) or 2 positive lists (advantaged and non-advantaged) in the same request is considered as an error, in which case the rule will not be executed.

Dynamic bypass

You can deactivate this rule for a given transaction except if the rule is imposed by the distributor. For this rule to be bypassed for this transaction, the request must contain the SimilarityBillingCardCountry instruction.

Examples:

IBAN country

Rule description

The IBAN country rule enables you to measure the risk of a purchase based on the issuing country of the customer's IBAN.

The rule is executed on all payment transactions made with a SDD means of payment, and will analyse the IBAN number to extract the country from it and check whether it is included in a list of authorised or prohibited countries.

If no list of authorised or prohibited countries has been defined, the rule considers your country as the only one authorised.

Conditions of use

If you would like to use this rule you must:

- activate the rule in the profile. To do so, you must:

- make a request to your account manager

- or activate the rule through the fraud GUI

- set the list of authorised or prohibited IBAN countries. To do so,

you must:

- give your account manager the list of authorised or prohibited countries

- or set the authorised or prohibited countries through the fraud GUI

- or dynamically override the authorised or prohibited countries in your request

Expression of the result

Simple configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not SDD). | 0 | AC;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The IBAN country is in the list of prohibited countries or is not on the list of authorised countries or is different from your country. | 0 to -4 depending on settings | AC;N; IBAN_COUNTRY=XXX* |

IBAN_COUNTRY=XXX* |

| The IBAN country is on the list of authorised countries or is not on the list of prohibited countries or is equivalent to your country. | 0 |

* XXX: ISO 3166 alphabetical country code (see countryList field in the data dictionary)

Advanced configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not SDD). | 0 | AC;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The IBAN country is on the list of “disadvantaged countries” or is not on the list of “non-disadvantaged countries”. | 0 to -4 depending on settings | AC;N; IBAN_COUNTRY=XXX* |

IBAN_COUNTRY=XXX* |

| The IBAN country is on the list of “non-disadvantaged countries”, or is not on the list of “disadvantaged countries”, or is not on the list of “advantaged countries” or is not on the list of “non-advantaged countries”. | 0 | ||

| The IBAN country is on the list of “advantaged countries” or is not on the list of “non-advantaged countries”. | 0 to +4 depending on settings |

* XXX: ISO 3166 alphabetical country code (see countryList field in the data dictionary)

Dynamic override

You can dynamically supply a list of authorised countries or a list of prohibited countries in the request. If a list is sent in the request, it takes precedence over any possible configuration except if it conflicts with the configuration imposed by the distributor.

Choose the parameter to be overriden...

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicParam...and send the country list in the following field:

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicValueThe parameters that apply to this rule are:

- default mode (simple configuration):

- AllowedIbanCountryList for the list of authorised countries

- DeniedIbanCountryList for the list of prohibited countries

- advanced configuration modfe:

- NDeniedIbanCountryList for the list of disadvantaged countries

- NDeniedExceptIbanCountryList for the list of non-disadvantaged countries

- PAllowedIbanCountryList for the list of advantaged countries

- PAllowedExceptIbanCountryList for the list of non-advantaged countries

Examples:

<urn:fraudData>

<urn:riskManagementDynamicSettingList>

<urn:riskManagementDynamicSetting>

<urn:riskManagementDynamicParam>AllowedIbanCountryList</urn:riskManagementDynamicParam>

<urn:riskManagementDynamicValue>FRA,BEL,GBR</urn:riskManagementDynamicValue>

</urn:riskManagementDynamicSetting>

</urn:riskManagementDynamicSettingList>

</urn:fraudData>"fraudData": {

"riskManagementDynamicSettingList":[

{

"riskManagementDynamicParam":"AllowedIbanCountryList",

"riskManagementDynamicValue":"FRA,BEL,GBR"

}

]

}The list sent must contain pairs separated by commas and consisting of:

- either ISO 3166 alphabetic country codes (see countryList in the data dictionary)

- or a list of preset country codes (see areaList in the data dictionary)

In default mode, sending 2 lists (authorised and prohibited) in the same request is considered as an error, in which case the rule will not be executed.

In advanced configuration mode, sending 2 negative lists (disadvantaged and non-disadvantaged) or 2 positive lists (advantaged and non-advantaged) in the same request is considered as an error, in which case the rule will not be executed.

Dynamic bypass

You can deactivate this rule for a given transaction except if the rule is imposed by the distributor. For this rule to be bypassed for this transaction, the request must contain the IbanCountry instruction.

Examples:

Delivery and IBAN country

Rule description

This rule enables you to measure the risk of a purchase, based on the delivery country/customer's IBAN country combination.

The rule is executed on all payment transactions made with a SDD means of payment, and checks the presence of the delivery country/IBAN country combination in the list of authorised or prohibited combinations.

If no list of authorised or prohibited countries has been defined, the rule checks whether the delivery country matches the IBAN country.

Conditions of use

If you would like to use this rule you must:

- activate the rule in the profile. To do so, you must:

- make a request to your account manager

- or activate the rule through the fraud GUI

- set the combinations of authorised or prohibited delivery countries

and IBAN countries. To do so, you must:

- give your account manager the list of authorised or prohibited combinations

- or set the authorised or prohibited combinations through the fraud GUI

- or dynamically override the authorised or prohibited combinations in your request

and provide the delivery country in the request (deliveryAddress.country field).

Expression of the result

Simple configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not SDD). | 0 | DI;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The delivery country and IBAN country combination is prohibited. | 0 to -4 depending on settings | DI;N; SHIP_COUNTRY=XXX*; IBAN_COUNTRY=YYY* |

SHIP_COUNTRY=XXX*; IBAN_COUNTRY=YYY* |

| The delivery country and/or IBAN country is/are unknown. | 0 | ||

| Delivery country and IBAN country combination is authorised. | 0 |

* XXX, YYY: ISO 3166 alphabetical country codes (see countryList field in the data dictionary)

Advanced configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not SDD). | 0 | DI;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The “delivery country / IBAN country” combination is on the list of “disadvantaged countries” or is not on the list of “non-disadvantaged countries”. | 0 to -4 depending on settings | DI;N; SHIP_COUNTRY=XXX*; IBAN_COUNTRY=YYY* |

SHIP_COUNTRY=XXX*; IBAN_COUNTRY=YYY* |

| The delivery country and/or the IBAN country is/are unknown. | 0 | ||

| The “delivery country / IBAN country” combination is on the list of ”non-disadvantaged countries”, or is not on the list of “disadvantaged countries”, or is not on the list of “advantaged countries”, or is on the list of “non-advantaged countries”. | 0 | ||

| The “delivery country / IBAN country” combination is on the list of “advantaged countries” or is not on the list of “non-advantaged countries”. | 0 to +4 depending on settings |

* XXX, YYY: ISO 3166 alphabetical country codes (see countryList field in the data dictionary)

Dynamic override

You can dynamically supply a list of delivery and IBAN country combinations in the request. If a list is sent in the request, it takes precedence over any possible configuration except if it conflicts with the configuration imposed by the distributor.

Choose the parameter to be overriden...

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicParam...and send the country list in the following field:

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicValueThe parameters that apply to this rule are:

- default mode (simple configuration):

- AllowedDeliveryIbanCountryCombiList for the authorised delivery country and IBAN country combinations

- DeniedDeliveryIbanCountryCombiList for the prohibited delivery country and IBAN country combinations

- advanced configuration mode:

- NDeniedDeliveryIbanCountryCombiList for the list of disadvantaged countries

- NDeniedExceptDeliveryIbanCountryCombiList for the list of non-disadvantaged countries

- PAllowedDeliveryIbanCountryCombiList for the list of advantaged countries

- PAllowedExceptDeliveryIbanCountryCombiList for the list of non-advantaged countries

Examples:

<urn:fraudData>

<urn:riskManagementDynamicSettingList>

<urn:riskManagementDynamicSetting>

<urn:riskManagementDynamicParam>AllowedDeliveryIbanCountryCombiList</urn:riskManagementDynamicParam>

<urn:riskManagementDynamicValue>(FRA,FRA),(BEL,BEL),(FRA,BEL),(BEL,FRA)</urn:riskManagementDynamicValue>

</urn:riskManagementDynamicSetting>

</urn:riskManagementDynamicSettingList>

</urn:fraudData>"fraudData": {

"riskManagementDynamicSettingList":[

{

"riskManagementDynamicParam":"AllowedDeliveryIbanCountryCombiList",

"riskManagementDynamicValue":"(FRA,FRA),(BEL,BEL),(FRA,BEL),(BEL,FRA)"

}

]

}The list sent must contain pairs separated by commas and consisting of:

- either ISO 3166 alphabetic country codes (see countryList in the data dictionary)

- or a list of preset country codes (see areaList in the data dictionary)

In default mode, sending 2 lists (authorised and prohibited) in the same request is considered as an error, in which case the rule will not be executed.

In advanced configuration mode, sending 2 negative lists (disadvantaged and non-disadvantaged) or 2 positive lists (advantaged and non-advantaged) in the same request is considered as an error, in which case the rule will not be executed.

Dynamic bypass

You can deactivate this rule for a given transaction except if the rule is imposed by the distributor. For this rule to be bypassed for this transaction, the request must contain the SimilarityDeliveryIbanCountry instruction.

Examples:

Phone and IBAN country

Rule description

This rule enables you to measure the risk of a purchase, based on the customer's mobile phone number country/customer's IBAN country combination.

The rule is executed on all payment transactions made with a SDD means of payment, and checks the presence of the customer's mobile phone number country/IBAN country combination in the list of authorised or prohibited combinations.

The phone number is obtained by analysing its dialling code. If the dialling code is not specified, the country cannot be retrieved.

If no list of authorised or prohibited combinations has been defined, the rule checks whether the customer's mobile phone number country matches the IBAN country.

Conditions of use

If you would like to use this rule you must:

- activate the rule in the profile. To do so, you must:

- make a request to your account manager

- or activate the rule through the fraud GUI

- set the combinations of authorised or prohibited phone number

countries and IBAN countries. To do so, you must:

- give your account manager the list of authorised or prohibited combinations

- or set the authorised or prohibited combinations through the fraud GUI

- or dynamically override the authorised or prohibited combinations in your request

and provide the customer's mobile phone number in the request (with dialling code; the mobile field in one or several contact information groups: billingContact, customerContact, deliveryContact, holderContact).

Expression of the result

Simple configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not SDD). | 0 | PI;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The customer's mobile phone number country and IBAN country combination is prohibited. | 0 to -4 depending on settings | PI;N; PHONE_COUNTRY=XXX*; IBAN_COUNTRY=YYY* |

PHONE_COUNTRY=XXX*; IBAN_COUNTRY=YYY* |

| The customer's mobile phone number country and/or IBAN country is/are unknown. | 0 | ||

| The customer's mobile phone number country and IBAN country combination is authorised. | 0 |

* XXX, YYY: ISO 3166 alphabetical country codes (see countryList field in the data dictionary)

Advanced configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not SDD). | 0 | PI;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The “customer's mobile phone number country / IBAN country” combination is on the list of “disadvantaged countries” or is not on the list of “non-disadvantaged countries”. | 0 to -4 depending on settings | PI;N; PHONE_COUNTRY=XXX*; IBAN_COUNTRY=YYY* |

PHONE_COUNTRY=XXX*; IBAN_COUNTRY=YYY* |

| The customer's mobile phone number country and/or IBAN country is/are unknown. | 0 | ||

| The “customer's mobile phone number country / IBAN country” combination is on the list of ”non-disadvantaged countries”, or is not on the list of “disadvantaged countries”, or is not on the list of “advantaged countries”, or is on the list of “non-advantaged countries”. | 0 | ||

| The “customer's mobile phone number country / IBAN country” combination is on the list of “advantaged countries” or is not on the list of “non-advantaged countries”. | 0 to +4 depending on settings |

* XXX, YYY: ISO 3166 alphabetical country codes (see countryList field in the data dictionary)

Dynamic override

You can dynamically supply a list of customer's mobile phone number country/IBAN country combinations in the request. If a list is sent in the request, it takes precedence over any possible configuration except if it conflicts with the configuration imposed by the distributor.

Choose the parameter to be overriden...

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicParam...and send the country list in the following field:

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicValueThe parameters that apply to this rule are:

- default mode (simple configuration):

- AllowedPhoneIbanCountryCombiList for the authorised customer's mobile phone number country and IBAN country combinations

- DeniedPhoneIbanCountryCombiList for the prohibited customer's mobile phone number country and IBAN country combinations

- advanced configuration mode:

- NDeniedPhoneIbanCountryCombiList for the list of disadvantaged countries

- NDeniedExceptPhoneIbanCountryCombiList for the list of non-disadvantaged countries

- PAllowedPhoneIbanCountryCombiList for the list of advantaged countries

- PAllowedExceptPhoneIbanCountryCombiList for the list of non-advantaged countries

Example:

<urn:fraudData>

<urn:riskManagementDynamicSettingList>

<urn:riskManagementDynamicSetting>

<urn:riskManagementDynamicParam>AllowedPhoneIbanCountryCombiList</urn:riskManagementDynamicParam>

<urn:riskManagementDynamicValue>(FRA,FRA),(BEL,BEL),(FRA,BEL),(BEL,FRA)</urn:riskManagementDynamicValue>

</urn:riskManagementDynamicSetting>

</urn:riskManagementDynamicSettingList>

</urn:fraudData>"fraudData": {

"riskManagementDynamicSettingList":[

{

"riskManagementDynamicParam":"AllowedPhoneIbanCountryCombiList",

"riskManagementDynamicValue":"(FRA,FRA),(BEL,BEL),(FRA,BEL),(BEL,FRA)"

}

]

}The list sent must contain pairs separated by commas and consisting of:

- either ISO 3166 alphabetic country codes (see countryList in the data dictionary)

- or a list of preset country codes (see areaList in the data dictionary)

In default mode, sending 2 lists (authorised and prohibited) in the same request is considered as an error, in which case the rule will not be executed.

In advanced configuration mode, sending 2 negative lists (disadvantaged and non-disadvantaged) or 2 positive lists (advantaged and non-advantaged) in the same request is considered as an error, in which case the rule will not be executed.

Dynamic bypass

You can deactivate this rule for a given transaction except if the rule is imposed by the distributor. For this rule to be bypassed for this transaction, the request must contain the SimilarityPhoneIbanCountry instruction.

Example:

IP address and IBAN country

Rule description

This rule enables you to measure the risk of a purchase, based on the customer's IP address country/customer's IBAN country combination.

The rule is executed on all payment transactions made with a SDD means of payment, and checks whether the IP address country/IBAN country combination is on a list of authorised or prohibited country combinations.

This IP address comes from:

- the automatic detection via the customer's browser in Sips Paypage. In this case, uncertainty may remain regarding the customer's country, due mainly to the dynamic allocation of IP addresses by some ISPs or to dynamic IP addresses.

- or from the data transfer you do in the request in Sips Office.

If there is no authorised or prohibited combination, the rule checks whether the customer's IP address country matches the IBAN country.

Conditions of use

If you would like to use this rule you must:

- activate the rule in the profile. To do so, you must:

- make a request to your account manager

- or activate the rule through the fraud GUI

- set the combinations of authorised or prohibited IP address

countries and IBAN countries. To do so, you must:

- give your account manager the list of authorised or prohibited combinations

- or set the authorised or prohibited combinations through the fraud GUI

- or dynamically override the authorised or prohibited combinations in your request

and provide the customer's IP address in the request, if you are on Sips Office

Expression of the result

Simple configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not SDD). | 0 | IS;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The IP address country and IBAN country combination is prohibited. | 0 to -4 depending on settings | IS;N; IP_COUNTRY=XXX*; IBAN_COUNTRY=YYY* |

IP_COUNTRY=XXX*; IBAN_COUNTRY=YYY* |

| The IP address country and/or IBAN country is/are unknown. | 0 | ||

| The IP address country and IBAN country combination is authorised. | 0 |

* XXX, YYY: ISO 3166 alphabetical country codes (see countryList field in the data dictionary)

Advanced configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not SDD). | 0 | IS;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The “IP address country / IBAN country” combination is on the list of “disadvantaged countries” or is not on the list of “non-disadvantaged countries”. | 0 to -4 depending on settings | IS;N; IP_COUNTRY=XXX*; IBAN_COUNTRY=YYY* |

IP_COUNTRY=XXX*; IBAN_COUNTRY=YYY* |

| The IP address country and/or IBAN country is/are unknown. | 0 | ||

| The “IP address country / IBAN country” combination is on the list of ”non-disadvantaged countries”, or is not on the list of “disadvantaged countries”, or is not on the list of “advantaged countries”, or is on the list of “non-advantaged countries”. | 0 | ||

| The “IP address country / IBAN country” combination is on the list of “advantaged countries” or is not on the list of “non-advantaged countries”. | 0 to +4 depending on settings |

* XXX, YYY: ISO 3166 alphabetical country codes (see countryList field in the data dictionary)

Dynamic override

You can dynamically supply a list of IP address country/IBAN country combinations in the request. If a list is sent in the request, it takes precedence over any possible configuration except if it conflicts with the configuration imposed by the distributor.

Choose the parameter to be overriden...

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicParam...and send the country list in the following field:

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicValueThe parameters that apply to this rule are:

- default mode (simple configuration):

- AllowedIpIbanCountryCombiList for the authorised IP address country and IBAN country combinations

- DeniedIpIbanCountryCombiList for the prohibited IP address country and IBAN country combinations

- advanced configuration mode:

- NDeniedIpIbanCountryCombiList for the list of disadvantaged countries

- NDeniedExceptIpIbanCountryCombiList for the list of non-disadvantaged countries

- PAllowedIpIbanCountryCombiList for the list of advantaged countries

- PAllowedExceptIpIbanCountryCombiList for the list of non-advantaged countries

Examples:

<urn:fraudData>

<urn:riskManagementDynamicSettingList>

<urn:riskManagementDynamicSetting>

<urn:riskManagementDynamicParam>AllowedIpIbanCountryCombiList</urn:riskManagementDynamicParam>

<urn:riskManagementDynamicValue>>>(FRA,FRA),(BEL,BEL),(FRA,BEL),(BEL,FRA)</urn:riskManagementDynamicValue>

</urn:riskManagementDynamicSetting>

</urn:riskManagementDynamicSettingList>

</urn:fraudData>"fraudData": {

"riskManagementDynamicSettingList":[

{

"riskManagementDynamicParam":"AllowedIpIbanCountryCombiList",

"riskManagementDynamicValue":"(FRA,FRA),(BEL,BEL),(FRA,BEL),(BEL,FRA)"

}

]

}The list sent must contain pairs separated by commas and consisting of:

- either ISO 3166 alphabetic country codes (see countryList in the data dictionary)

- or a list of preset country codes (see areaList in the data dictionary)

In default mode, sending 2 lists (authorised and prohibited) in the same request is considered as an error, in which case the rule will not be executed.

In advanced configuration mode, sending 2 negative lists (disadvantaged and non-disadvantaged) or 2 positive lists (advantaged and non-advantaged) in the same request is considered as an error, in which case the rule will not be executed.

Dynamic bypass

You can deactivate this rule for a given transaction except if the rule is imposed by the distributor. For this rule to be bypassed for this transaction, the request must contain the SimilarityIpIbanCountry instruction.

Examples:

Card issuing country

Rule description

The card issuing country rule enables you to decide whether to accept or decline to provide a service depending on the card's issuing country (the country where the card was issued in)

The rule queries a BIN range database to check whether the country of origin of the card is on a list of authorised or prohibited countries.

If there is no list of authorised or prohibited countries, the rule considers your country code as the only one authorised.

Conditions of use

If you would like to use this rule you must:

- activate the rule in the profile. To do so, you must:

- make a request to your account manager

- or activate the rule through the fraud GUI

- and set the list of authorised or prohibited card issuing countries. To do

so, you must:

- give your account manager the list of authorised or prohibited issuing countries

- or set the list of authorised or prohibited issuing countries through the fraud GUI

- or dynamically override the list of authorised or prohibited issuing countries in your request

Our fraud module is based on the CIS (Card Info Service) database, which includes information on BIN ranges. However, this reference source does not include the nationality of American Express cards. It is therefore impossible for us, via the fraud module, to block American Express cards via the "Country card" rule.

Expression of the result

Simple configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not a card). | 0 | CR;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The card issuing country is unknown. | 0 | CR;N; CARD_ISSUING_COUNTRY=XXX* |

CARD_ISSUING_COUNTRY=XXX* |

| The card issuing country is on the list of prohibited countries, is not on the list of authorised countries, or is the same as the merchant's country. | 0 to -4 depending on settings | ||

| The card issuing country is on the list of authorised countries, is not on the list of prohibited countries, or differs from the merchant's country. | 0 |

* XXX: ISO 3166 alphabetical country code (see countryList field in the data dictionary)

Advanced configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not a card). | 0 | CR;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The card issuing country is unknown. | 0 | CR;N; CARD_ISSUING_COUNTRY=XXX* |

CARD_ISSUING_COUNTRY=XXX* |

| The card issuing country is on the list of “disadvantaged countries” or is not on the list of “non-disadvantaged countries”. | 0 to -4 depending on settings | ||

| The card issuing country is on the list of “non-disadvantaged countries”, or is not on the list of “disadvantaged countries”, or is not on the list of “advantaged countries” or is not on the list of “non-advantaged countries”. | 0 | ||

| The card issuing country is on the list of “advantaged countries” or is not on the list of “non-advantaged countries” or is the same as the merchant's country. | 0 to +4 depending on settings |

* XXX: ISO 3166 alphabetical country code (see countryList field in the data dictionary)

Dynamic override

You can dynamically supply a list of authorised or prohibited countries in the request. If a list is sent in the request, it takes precedence over any possible configuration except if it conflicts with the configuration imposed by the distributor.

There are 2 methods to override the rule parameters dynamically.

METHOD 1:

Choose the parameter to be overriden in the field...

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicParam...and send the country list in the following field:

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicValueThe parameters that apply to this rule are:

- default mode (simple configuration):

- AllowedCardIssuingCountryList for the list of authorised countries

- DeniedCardIssuingCountryList for the list of prohibited countries

- advanced configuration mode:

- NDeniedCardIssuingCountryList for the list of disadvantaged countries

- NDeniedExceptCardIssuingCountryList for the list of non-disadvantaged countries

- PAllowedCardIssuingCountryList for the list of advantaged countries

- PAllowedExceptCardIssuingCountryList for the list non-advantaged countries

<urn:fraudData>

<urn:riskManagementDynamicSettingList>

<urn:riskManagementDynamicSetting>

<urn:riskManagementDynamicParam>AllowedCardIssuingCountryList</urn:riskManagementDynamicParam>

<urn:riskManagementDynamicValue>FRA,BEL,GBR</urn:riskManagementDynamicValue>

</urn:riskManagementDynamicSetting>

</urn:riskManagementDynamicSettingList>

</urn:fraudData>"fraudData": {

“riskManagementDynamicSettingList”:[

{

“riskManagementDynamicParam”:“AllowedCardIssuingCountryList”,

“riskManagementDynamicValue”:“FRA,BEL,GBR”

}

]

}METHOD 2 (deprecated):

The card issuing country list is sent in one of the following connector fields:

- fraudData.AllowedCardIssuingCountryList for the list of authorised countries

- fraudData.DeniedCardIssuingCountryList for the list of prohibited countries

<urn:fraudData>

<urn:AllowedCardIssuingCountryList>FRA,BEL,GBR</urn:AllowedCardIssuingCountryList>

</urn:fraudData>"fraudData": {

"AllowedCardIssuingCountryList": ["FRA", "BEL", "GBR"]

}For both methods, the list sent must contain:

- either the ISO 3166 alphabetic country codes (see field countryList in the data dictionary) separated by commas

- or a list of preset country codes (see field areaList in the data dictionary).

In default mode, sending 2 lists (authorised and prohibited) in the same request is considered as an error, in which case the rule will not be executed.

In advanced configuration mode, sending 2 negative lists (disadvantaged and non-disadvantaged) or 2 positive lists (advantaged and non-advantaged) in the same request is considered as an error, in which case the rule will not be executed.

Dynamic bypass

You can deactivate this rule for a given transaction except if the rule is imposed by the distributor. For this rule to be bypassed for this transaction, the request must contain the ForeignBinCard instruction.

Billing and card issuing country

Rule description

This rule enables you to decide whether to accept or decline to provide a service depending on the card issuing country/billing country combination.

First, this rule queries the BIN range database to determine the card country. Then, the rule checks whether the combination formed by the newly determined card country and the billing country is on the list of authorised or prohibited combinations.

If no list of authorised or prohibited combinations has been defined, the rule checks whether the card country matches the billing country.

Conditions of use

If you would like to use this rule you must:

- activate the rule in the profile. To do so, you must:

- make a request to your account manager

- or activate the rule through the fraud GUI

- set the list of authorised or prohibited billing and card country

combinations. To do so, you must:

- give your account manager the list of authorised or prohibited combinations

- or set the authorised or prohibited combinations through the fraud GUI

- or dynamically override the authorised or prohibited combinations in your request

and provide the billing and card issuer country in the request (deliveryAddress.country field)

Expression of the result

Simple configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not a card). | 0 | CS;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The “Card issuing country/Billing country” combination is prohibited. | 0 to -4 depending on settings | CS;N; BILL_COUNTRY=XXX*; CARD_ISSUING_COUNTRY=YYY* |

BILL_COUNTRY=XXX*; CARD_ISSUING_COUNTRY=YYY* |

| The “Card issuing country/Billing country” combination is authorised. | 0 | ||

| The card issuing country or billing country are unknown. | 0 |

* XXX, YYY: ISO 3166 alphabetical country codes (see countryList field in the data dictionary)

Advanced configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not a card). | 0 | CS;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The “card issuing country/ billing country” combination is on the list of “disadvantaged countries” or is not on the list of “non-disadvantaged countries”. | 0 to -4 depending on settings | CS;N; BILL_COUNTRY=XXX*; CARD_ISSUING_COUNTRY=YYY* |

BILL_COUNTRY=XXX*; CARD_COUNTRY=YYY* |

| The “card issuing country/ billing country” combination is on the list of ”non-disadvantaged countries”, or is not on the list of “disadvantaged countries”, or is not on the list of “advantaged countries”, or is on the list of “non-advantaged countries”. | 0 | ||

| The card issuing country or billing country are unknown. | 0 | ||

| The “card issuing country/ billing country” combination is on the list of “advantaged countries” or is not on the list of “non-advantaged countries”. | 0 to +4 depending on settings |

* XXX, YYY: ISO 3166 alphabetical country codes (see countryList field in the data dictionary)

Dynamic override

You can dynamically supply a list of authorised or prohibited billing and card country combinations in the request. If a list is sent in the request, it takes precedence over any possible configuration except if it conflicts with the configuration imposed by the distributor.

Choose the parameter to be overriden...

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicParam...and send the country list in the following field:

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicValueThe parameters that apply to this rule are:

- default mode (simple configuration) :

- AllowedBillingCardIssuingCountryCombiList for the authorised billing country and card country combinations

- DeniedBillingCardIssuingCountryCombiList for the prohibited billing country and card country combinations

- advanced configuration mode:

- NDeniedBillingCardIssuingCountryCombiList for the list of disadvantaged countries

- NDeniedExceptBillingCardIssuingCountryCombiList for the list of non-disadvantaged countries

- PAllowedBillingCardIssuingCountryCombiList for the list of advantaged countries

- PAllowedExceptBillingCardIssuingCountryCombiList for the list of non-advantaged countries

Examples:

<urn:fraudData>

<urn:riskManagementDynamicSettingList>

<urn:riskManagementDynamicSetting>

<urn:riskManagementDynamicParam>AllowedBillingCardIssuingCountryCombiList</urn:riskManagementDynamicParam>

<urn:riskManagementDynamicValue>(FRA,#ZEURO),(#ZEURO,FRA)</urn:riskManagementDynamicValue>

</urn:riskManagementDynamicSetting>

</urn:riskManagementDynamicSettingList>

</urn:fraudData>"fraudData": {

"riskManagementDynamicSettingList":[

{

"riskManagementDynamicParam":"AllowedBillingCardIssuingCountryCombiList",

"riskManagementDynamicValue":"(FRA,#ZEURO),(#ZEURO,FRA)"

}

]

}The list sent must contain pairs separated by commas and consisting of:

- either ISO 3166 alphabetic country codes (see countryList in the data dictionary)

- or a list of preset country codes (see areaList in the data dictionary)

In default mode, sending 2 lists (authorised and prohibited) in the same request is considered as an error, in which case the rule will not be executed.

In advanced configuration mode, sending 2 negative lists (disadvantaged and non-disadvantaged) or 2 positive lists (advantaged and non-advantaged) in the same request is considered as an error, in which case the rule will not be executed.

Dynamic bypass

You can deactivate this rule for a given transaction except if the rule is imposed by the distributor. For this rule to be bypassed for this transaction, the request must contain the SimilarityBillingCardIssuingCountry instruction.

Examples:

Delivery and card issuing country

Rule description

This rule enables you to decide whether to accept or decline to provide a service depending on the card issuing country/delivery country combination.

First, the rule queries the BIN range database to determine the card country. Then, the rule checks whether the combination formed by the newly determined card country and the delivery country is on the list of authorised or prohibited combinations.

If no list of authorised or prohibited combinations has been defined, the rule checks whether the card issuing country matches the delivery country.

Conditions of use

If you would like to use this rule you must:

- activate the rule in the profile. To do so, you must:

- make a request to your account manager

- or activate the rule through the fraud GUI

- set the list of authorised or prohibited delivery and card issuing country

combinations. To do so, you must:

- give your account manager the list of authorised or prohibited combinations

- or set the authorised or prohibited combinations through the fraud GUI

- or dynamically override the authorised or prohibited combinations in your request

and provide the delivery country in the request (deliveryAddress.country field)

Expression of the result

Simple configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not a card). | 0 | CS;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The “Card issuing country/Delivery country” combination is prohibited. | 0 to -4 depending on settings | CS;N; SHIP_COUNTRY=XXX*; CARD_ISSUING_COUNTRY=YYY* |

SHIP_COUNTRY=XXX*; CARD_ISSUING_COUNTRY=YYY* |

| The “Card issuing country/Delivery country” combination is authorised. | 0 | ||

| The card issuing country or delivery country are unknown. | 0 |

* XXX, YYY: ISO 3166 alphabetical country codes (see countryList field in the data dictionary)

Advanced configuration mode:

| Use case | ScoreValue | ScoreInfo | RuleDetailedInfo |

|---|---|---|---|

| This rule cannot be executed (the means of payment is not a card). | 0 | CS;N;NOT_APPLICABLE | NOT_APPLICABLE |

| The “card issuing country/ delivery country” combination is on the list of “disadvantaged countries” or is not on the list of “non-disadvantaged countries” | 0 to -4 depending on settings | CS;N; SHIP_COUNTRY=XXX*; CARD_ISSUING_COUNTRY=YYY* |

SHIP_COUNTRY=XXX*; CARD_ISSUING_COUNTRY=YYY* |

| The “card issuing country/ delivery country” combination is on the list of ”non-disadvantaged countries”, or is not on the list of “disadvantaged countries”, or is not on the list of “advantaged countries”, or is on the list of “non-advantaged countries” | 0 | ||

| The card issuing country or delivery country are unknown. | 0 | ||

| The “card issuing country/ card country/ delivery country” combination is on the list of “advantaged countries” or is not on the list of “non-advantaged countries” | 0 to +4 depending on settings |

* XXX, YYY: ISO 3166 alphabetical country codes (see countryList field in the data dictionary)

Dynamic override

You can dynamically supply a list of authorised or prohibited delivery and card issuing country combinations in the request. If a list is sent in the request, it takes precedence over any possible configuration except if it conflicts with the configuration imposed by the distributor.

Choose the parameter to be overriden...

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicParam...and send the country list in the following field:

fraudData.

riskManagementDynamicSettingList.

riskManagementDynamicSetting.

riskManagementDynamicValueThe parameters that apply to this rule are:

- default mode (simple configuration):

- AllowedDeliveryCardIssuingCountryCombiList for the authorised delivery and card issuing country combinations

- DeniedDeliveryCardIssuingCountryCombiList for the prohibited delivery and card issuing country combinations

- advanced configuration mode:

- NDeniedDeliveryCardIssuingCountryCombiList for the list of disadvantaged countries

- NDeniedExceptDeliveryCardIssuingCountryCombiList for the list of non-disadvantaged countries

- PAllowedDeliveryCardIssuingCountryCombiList for the list of advantaged countries

- PAllowedExceptDeliveryCardIssuingCountryCombiList for the list of non-advantaged countries

Examples:

<urn:fraudData>

<urn:riskManagementDynamicSettingList>

<urn:riskManagementDynamicSetting>

<urn:riskManagementDynamicParam>AllowedDeliveryCardIssuingCountryCombiList</urn:riskManagementDynamicParam>

<urn:riskManagementDynamicValue>(FRA,#ZEURO),(#ZEURO,FRA)</urn:riskManagementDynamicValue>

</urn:riskManagementDynamicSetting>

</urn:riskManagementDynamicSettingList>

</urn:fraudData>"fraudData": {

"riskManagementDynamicSettingList":[

{

"riskManagementDynamicParam":"AllowedDeliveryCardIssuingCountryCombiList",

"riskManagementDynamicValue":"(FRA,#ZEURO),(#ZEURO,FRA)"

}

]

}For both methods, the list sent must contain pairs separated by commas and consisting of:

- either ISO 3166 alphabetic country codes (see countryList in the data dictionary)

- or a list of preset country codes (see areaList in the data dictionary)

In default mode, sending 2 lists (authorised and prohibited) in the same request is considered as an error, in which case the rule will not be executed.

In advanced configuration mode, sending 2 negative lists (disadvantaged and non-disadvantaged) or 2 positive lists (advantaged and non-advantaged) in the same request is considered as an error, in which case the rule will not be executed.

Dynamic bypass

You can deactivate this rule for a given transaction except if the rule is imposed by the distributor. For this rule to be bypassed for this transaction, the request must contain the SimilarityShippingCardIssuingCountry instruction.

Examples:

IP and card issuing country

Rule description

This rule enables you to decide whether to accept or decline to provide a service depending on the combination of the card issuing country and the customer’s IP address country.

The rule queries the BIN range and IP address range databases to check whether the combination of both countries is on a list of authorised or prohibited country combinations.

This IP address comes from:

- the automatic detection performed by the customer's browser in Sips Paypage. In this case, uncertainty may remain about the customer's country, due mainly to the dynamic allocation of IP addresses by some ISPs or to dynamic addresses.

- or from the data transfer you do in the request in Sips Office.

If there is no authorised or prohibited combination, the rule checks whether the card country matches the IP address country.

Conditions of use

If you would like to use this rule you must:

- activate the rule in the profile. To do so, you must:

- make a request to your account manager

- or activate the rule through the fraud GUI

- set the list of authorised or prohibited card issuing country and IP adress

country combinations. To do so, you must:

- give your account manager the list of authorised or prohibited combinations

- or set the authorised or prohibited combinations through the fraud GUI

- or dynamically override the authorised or prohibited combinations in your request

and provide the customer's IP address in the request (customerIpAddress field), if you use Sips Office.

Expression of the result

Simple configuration mode: