Introduction

Worldline Sips is a secure multi-channel e-commerce payment solution that complies with the PCI DSS standard. It allows you to accept and manage payment transactions by taking into account business rules related to your activity (payment upon shipping, deferred payment, recurring payment, payment in instalments, etc.).

The purpose of this document is to explain the Bancontact Mobile means of payment integration into Worldline Sips.

Who does this document target?

This document is intended to help you implement the Bancontact Mobile means of payment on your e-commerce site.

It includes:

- functional information for you

- implementation instructions for your technical team

To get an overview of the Worldline Sips solution, we advise you to consult the following documents:

- Functional presentation

- Functionality set-up guide

Understanding Bancontact Mobile payments with Worldline Sips

General principles

Bancontact is the market leader in electronic payments in Belgium. The Bancontact card is the Belgian national card.

The Bancontact Mobile means of payment allow customers to pay with their Bancontact card via their mobile phone or tablet.

To pay with a Bancontact card via the Bancontact Mobile application, cardholders must have the Bancontact application installed on their mobile device (computer, smartphone, tablet), and than, they can initialise the transaction. During the payment stage, the Bancontact Mobile application will be launched via two methods, depending on the device:

- If the transaction is initialised on a different computer or mobile device than the one used for the payment, the Bancontact Mobile application will be launched by the customer on the device used for the payment. By scanning the QR code displayed on the payment page, the customer is redirected to the authentication page.

- If the transaction is initialised on a mobile device that also serves as a payment device via the dedicated mobile application, that application is launched by clicking on the button URL-intent on the payment page.

As with the standard Bancontact card payments, an authentication step is required. You benefit from a guarantee of payment under certain conditions, according to the current banking regulations. During a Bancontact Mobile payment, the cardholder proceeds to the authentication through the same name application.

If the amount is greater than €1500.00, the transaction will be rejected (Worldline Sips response code 05).

Acceptance rules

Available functionalities

| Payment channels | ||

|---|---|---|

| Internet | V | Default payment channel |

| MOTO | X | |

| Fax | X | |

| IVS | X | |

| Means of payment | ||

|---|---|---|

| Immediate payment | V | Default method |

| End-of-day payment | X | |

| Deferred payment | X | |

| Payment upon shipping | X | |

| Payment in instalments | X | |

| Subscription payment | V | With WIP option. |

| Batch payment | X | |

| OneClick payment | X | |

| Currency management | ||

|---|---|---|

| Multicurrency acceptance | X | EURO only |

| Currency settlement | X | EURO only |

Payment pages

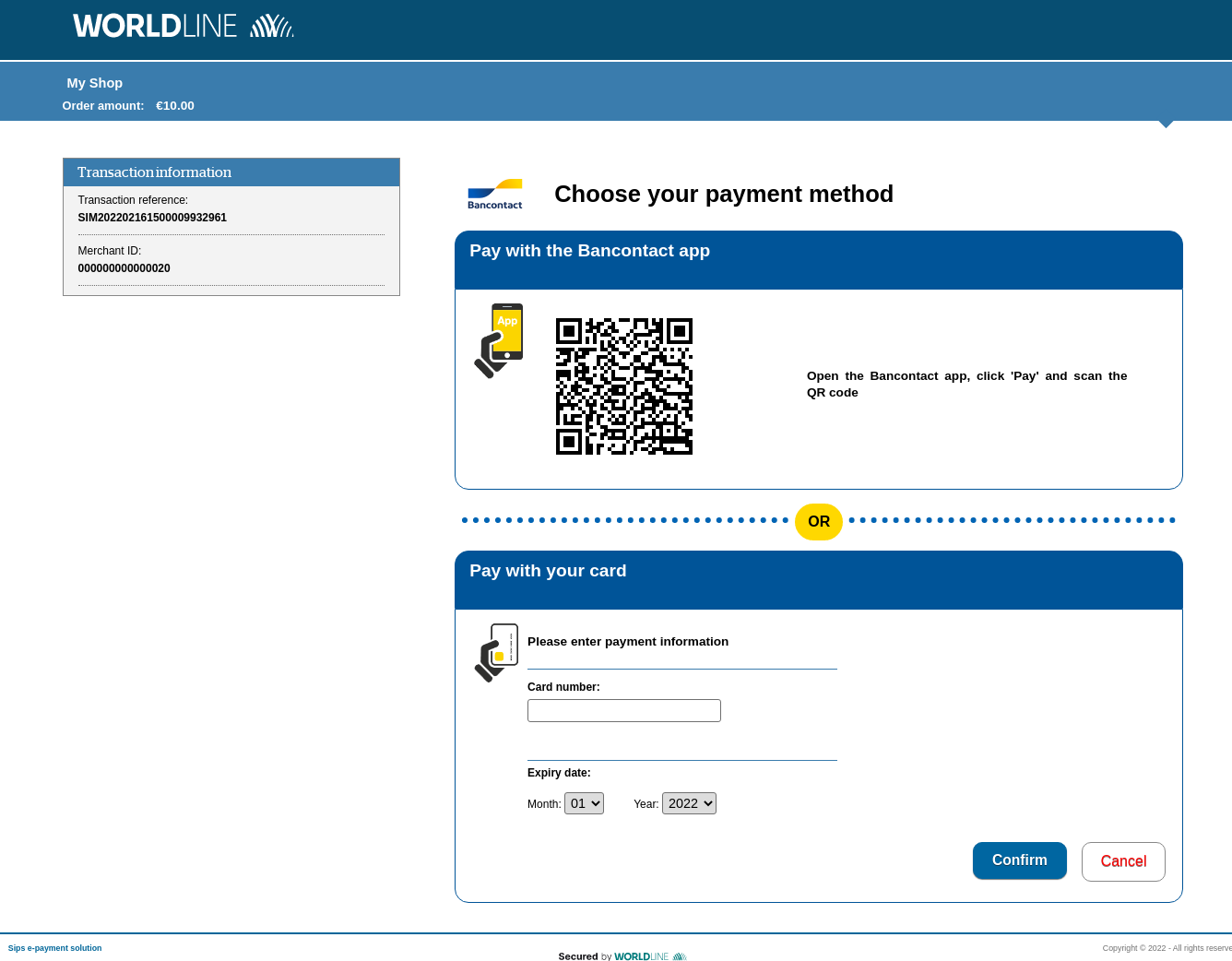

Shopping on the desktop platform (QR code)

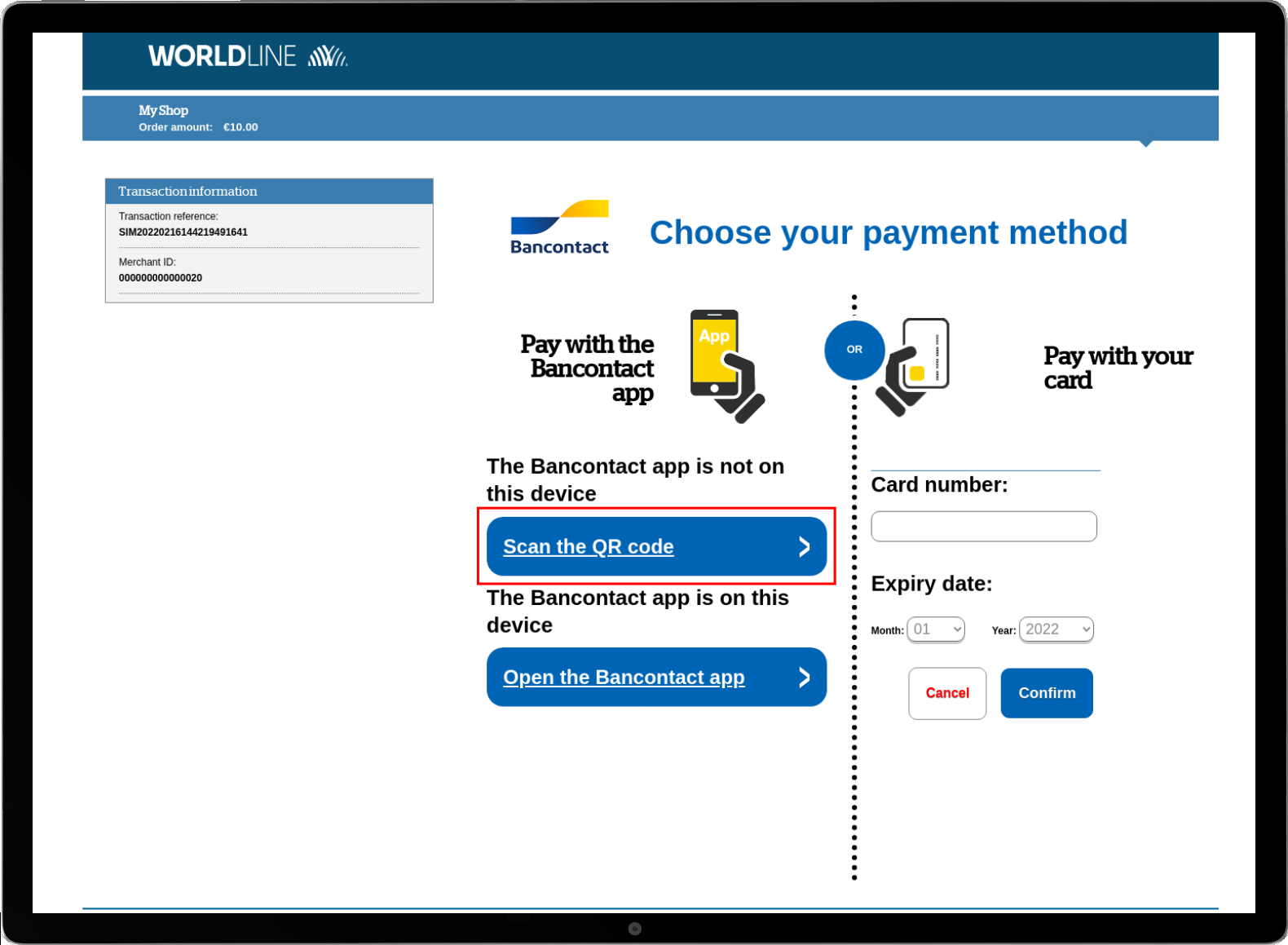

On a desktop platform (computer), the customer selects the Bancontact means of payment.

The customer can choose the Bancontact means of payment: standard (by card) or via mobile application. They choose to pay via the mobile application:

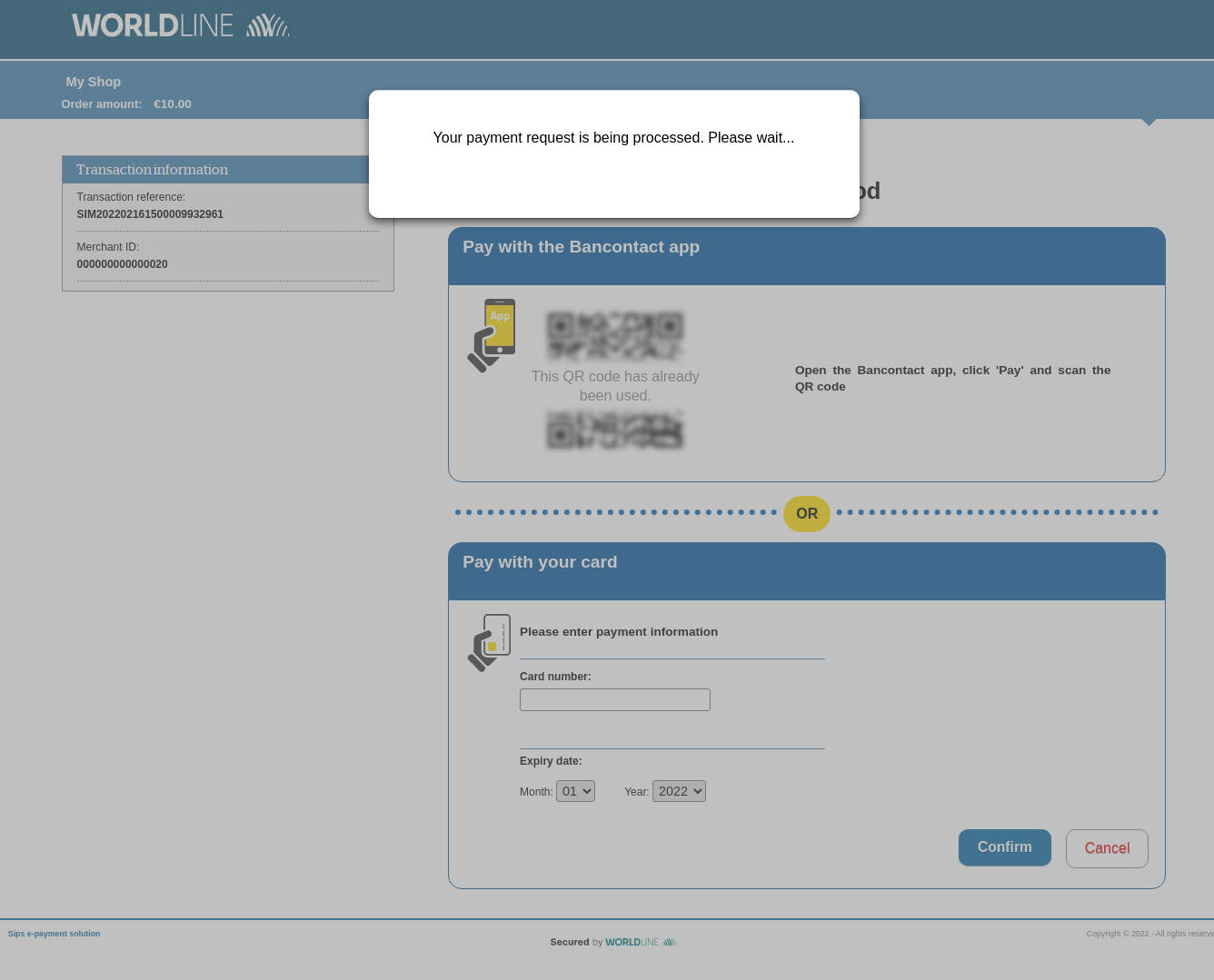

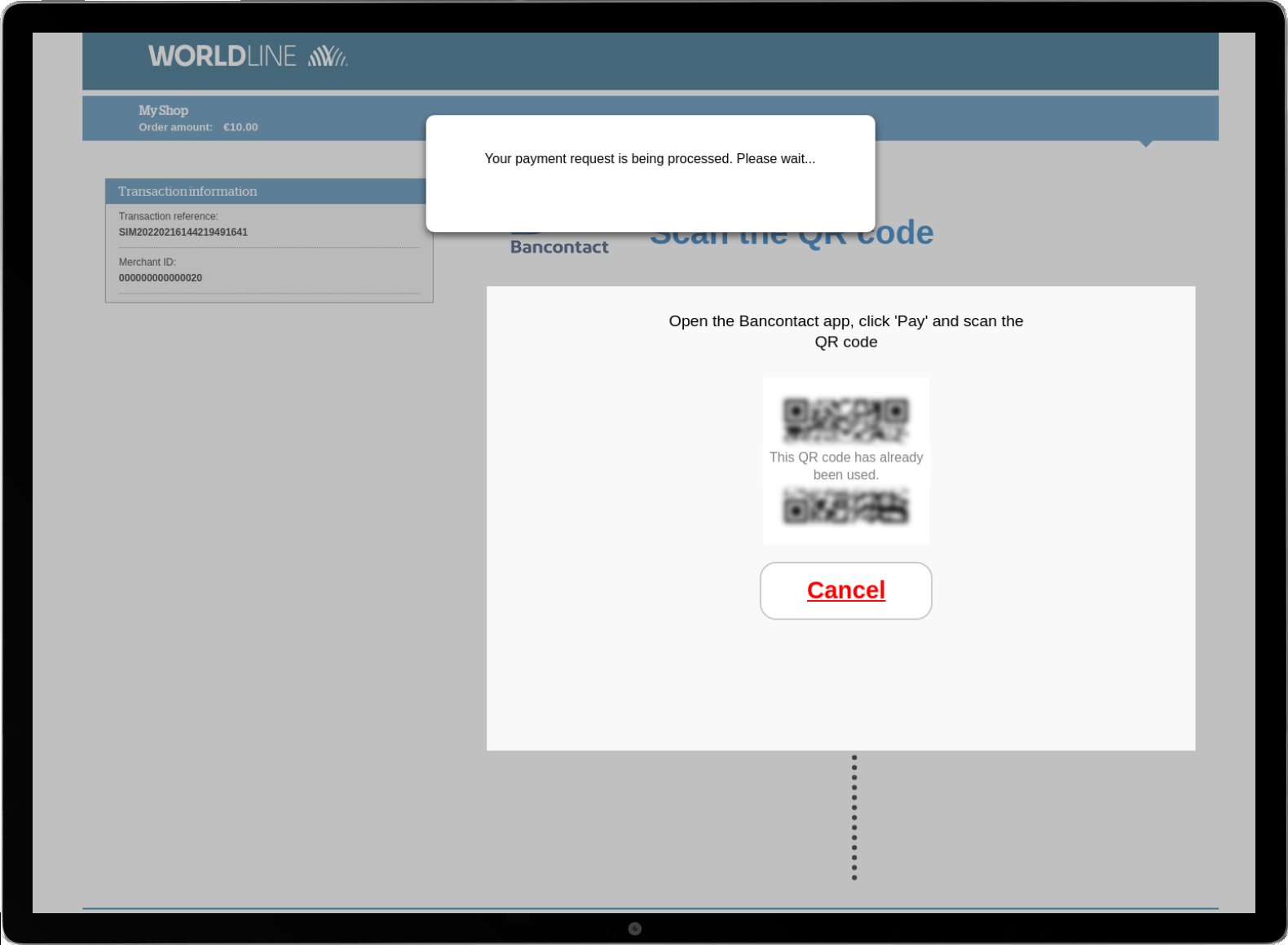

While the customer scans online the QR code and authenticates via the mobile device, a waiting message is displayed on the desktop platform:

The payment ticket is displayed, then the customer returns to your website.

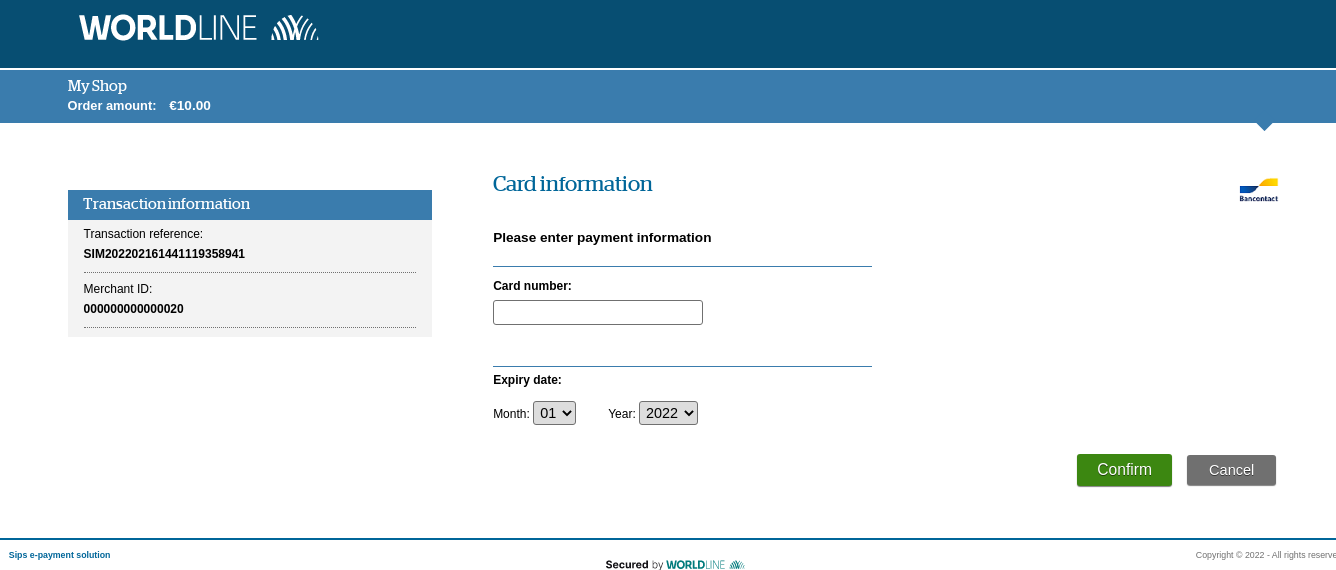

If Worldline Sips is unable to establish a connection with the Bancontact server, once the customer has selected the Bancontact logo on the payment selection page, the card payment entry is offered by Worldline Sips:

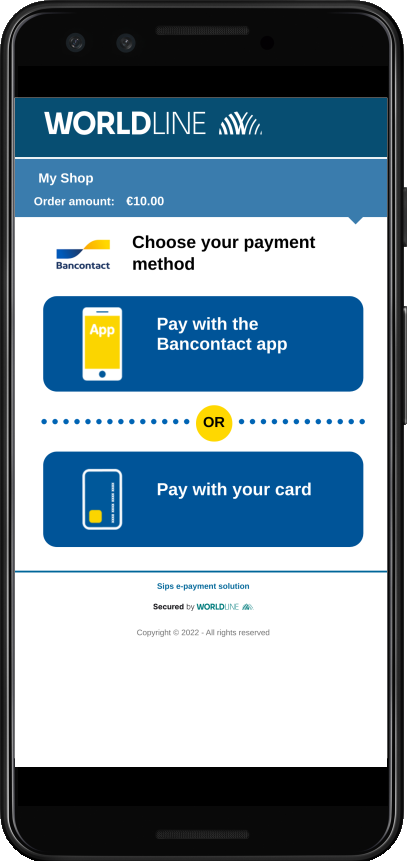

Shopping on the smartphone (URL-intent)

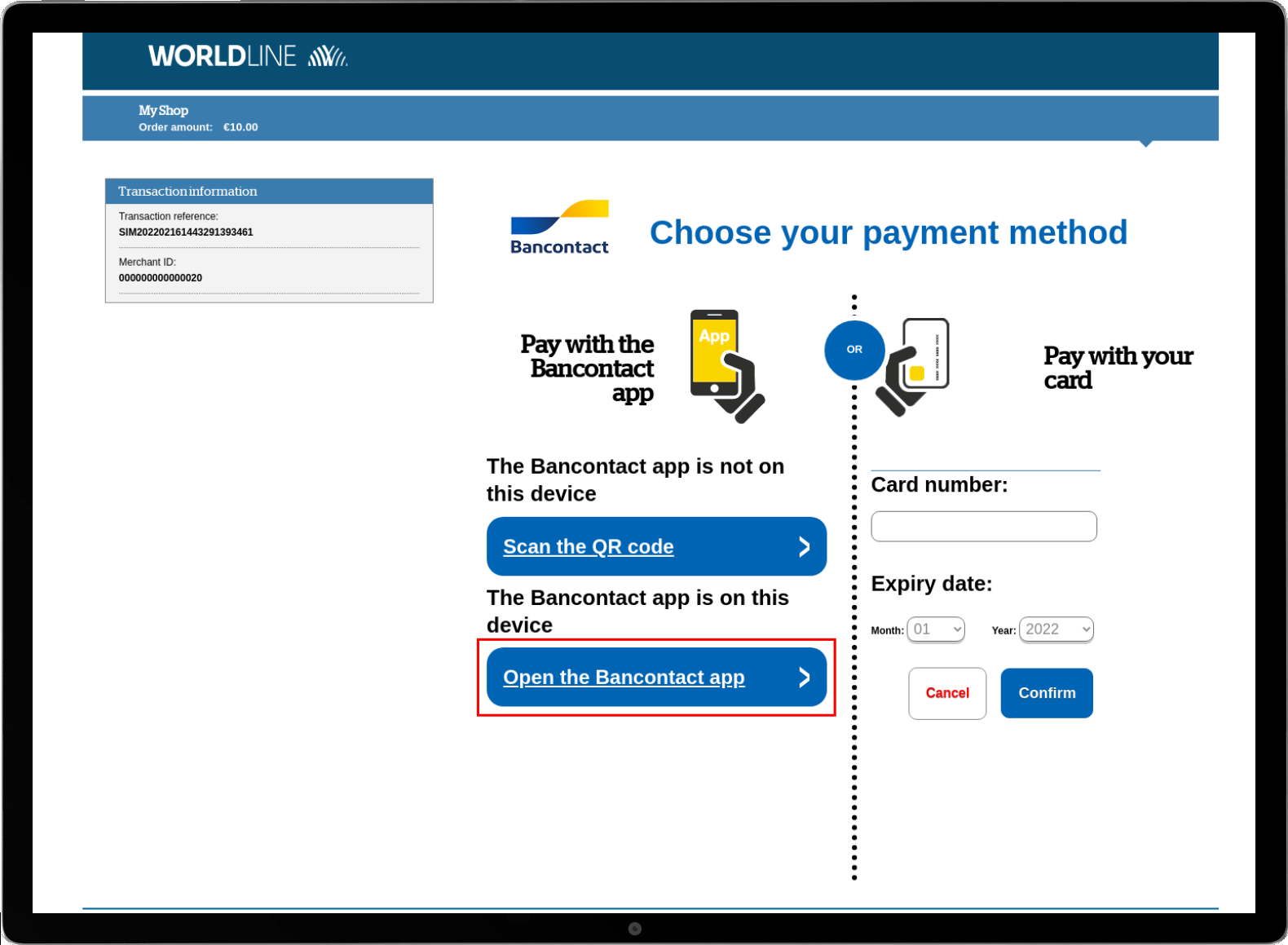

On smartphone, only mobile payments with URL-intent and standard Bancontact card payments are available on the payment page.

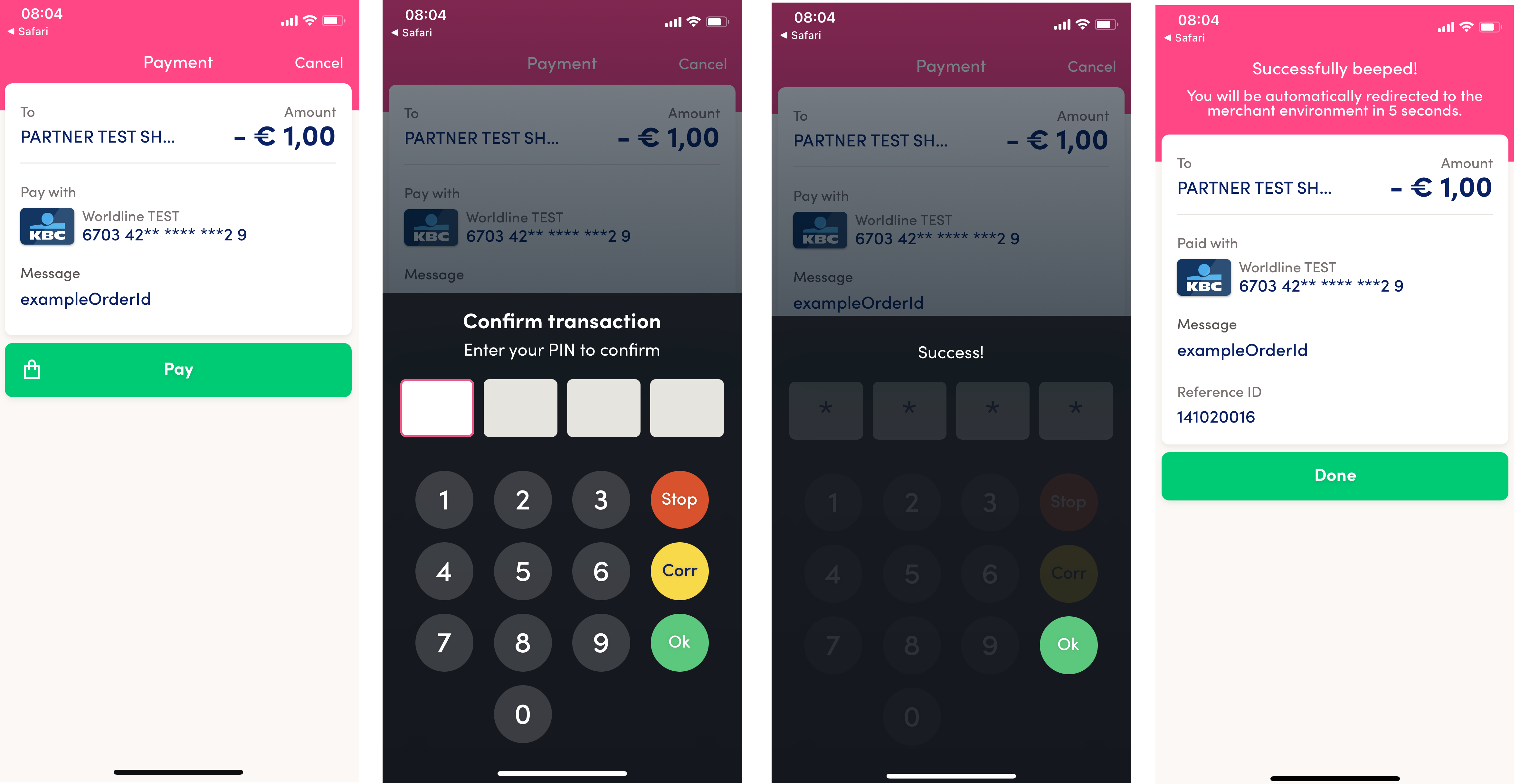

The customer selects to pay with the Bancontact Mobile application:

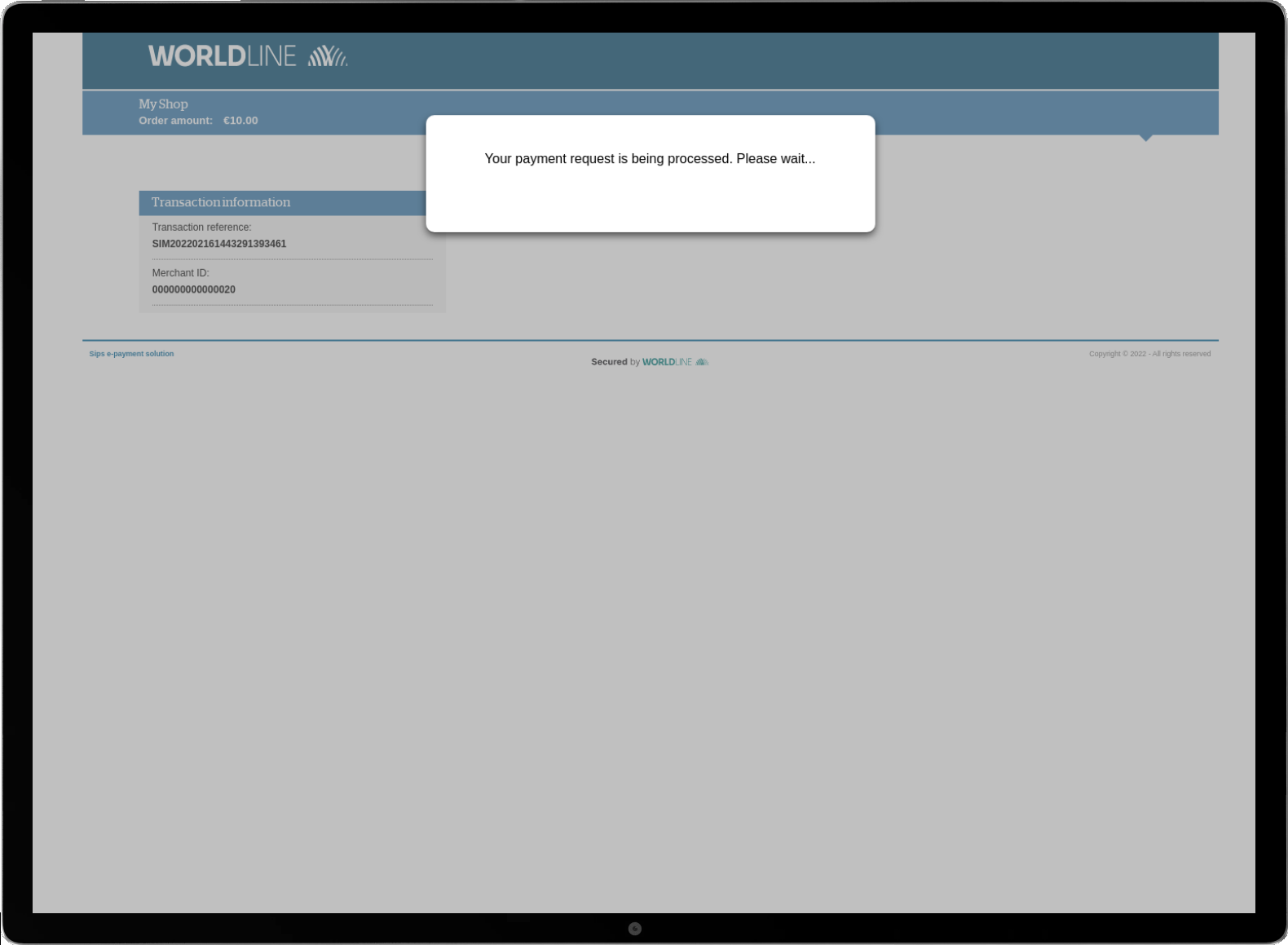

A Bancontact waiting message is displayed on the smartphone:

The customer is then redirected to the Bancontact pages. They choose the card, enter the PIN and confirm the payment:

The payment ticket is displayed, then the customer returns to your website.

Shopping on the tablet (QR code and URL-intent)

On the tablet, all mobile payments with QR code and URL-intent as well as standard Bancontact card payments are available on the payment page.

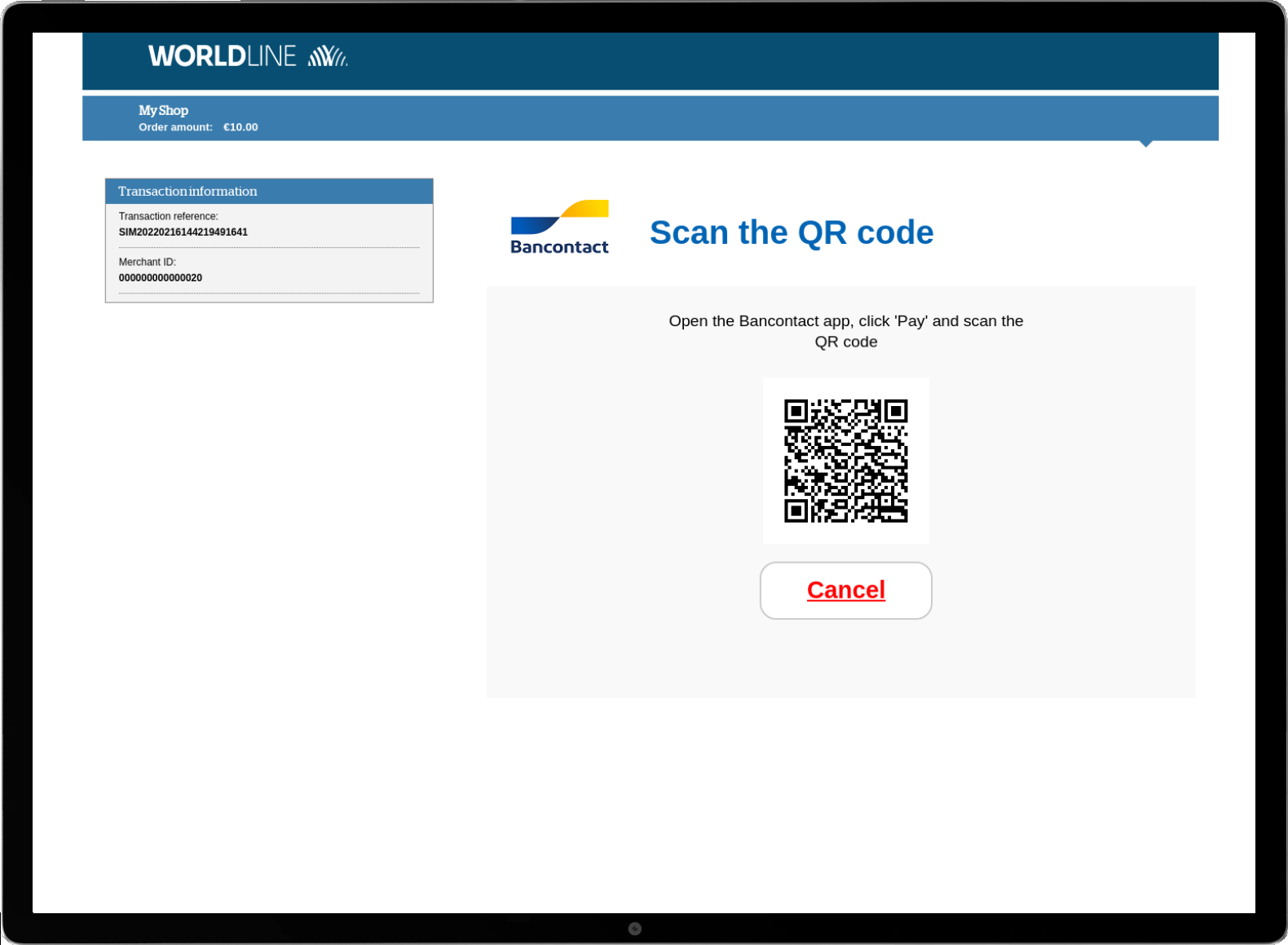

If the customer selects the option Scan the QR code, a QR code is displayed:

A Bancontact waiting message is displayed on the tablet:

The customer can also select the Open App option. The Bancontact mobile application will be launched automatically:

A waiting message is displayed on the payment page:

The payment ticket is displayed, then the customer returns to your website.

Signing your Bancontact Mobile acceptance contract

In order to offer the Bancontact Mobile means of payment on your website, you have to sign an acceptance contract with Worldline Acquiring Belgium. Thereafter, you transmit us the contract number for recording in our information system.

These means of payment are also co-badged with Maestro and soon with V-Pay (Visa debit), which means that they can be accepted as international Maestro or Visa cards.

WIP service

When you subscribe to the WIP service with Bancontact, Bancontact provides 2 id:

- Merchant Wallet ID: Unique identifier assigned by BANCONTACT to the WIP merchant. Disposition: 71xxxx.

- WIP BEPAF or WIP TOKEN: alphanumeric id on 16 positions, provided by Bancontact to each merchant and that must be provided in BPAF field for each WIP transaction

You must provide those two id to Worldline Sips to complete the subscription to WIP service.

Making a Bancontact Mobile payment

Worldline Sips offers you three solutions to integrate the Bancontact Mobile payment method:

- Sips Paypage which directly acts as the payment interface with customers via their web browser.

- Sips Office which gives you the opportunity to display your payment pages and works through a server-to-server dialog.

- Sips In-App which is an interface dedicated to mobile payments.

For Bancontact Mobile payments, it is not allowed to defer the remittance, you cannot adjust the date of funds transfers.

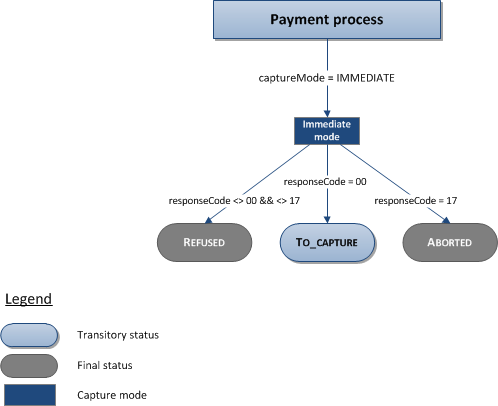

The diagram below explains the different transaction statuses according to the chosen capture mode:

Making a Bancontact Mobile payment with Sips Paypage

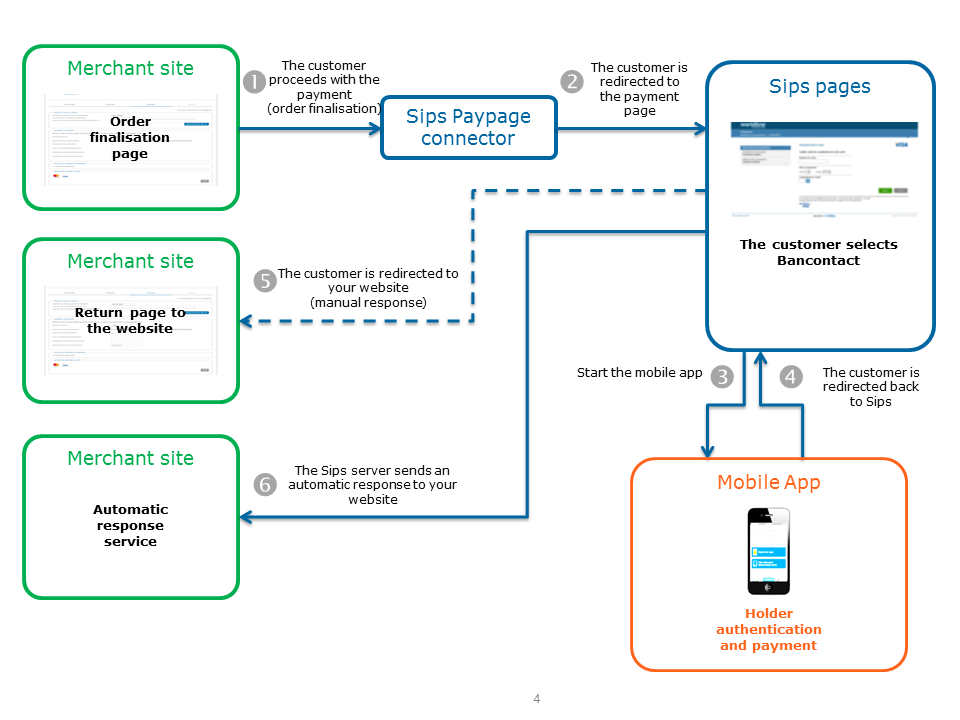

The payment process for Sips Paypage is described below:

Setting the payment request

Bancontact Mobile payment is a commercial option. No specific information (relative to the standard Bancontact payment) is required to submit a Bancontact Mobile payment request.

Analysing the response

The following table summarises the different response cases to be processed:

| Status | Response fields | Action to take |

|---|---|---|

| Payment accepted | acquirerResponseCode =

00authorisationId = (cf. the

Data Dictionary).holderAuthentMethod =

PASSWORDholderAuthentStatus =

SUCCESSholderAuthentProgram =

BCMCMOBILEpanEntryMode =

WALLETpaymentMeanBrand =

BCMCpaymentMeanType =

CARDresponseCode =

00walletType =

BCMCMOBILE |

You can deliver the order. |

| Acquirer refusal | acquirerResponseCode = (cf.

the Data Dictionary).responseCode =

05 |

The authorisation is refused for a reason unrelated to

fraud. If you have not opted for the "new payment attempt"

option (please read the Functionality

set-up Guide for more details), you can suggest that your

customer pay with another means of payment by generating a new

request. |

| Refusal due to the number of attempts reached | responseCode = 75 |

The customer has made several attempts that have all failed. |

| Refusal due to a technical issue | acquirerResponseCode = 90-98

responseCode = 90, 99

|

Temporary technical issue when processing the transaction. Suggest that your customer redo a payment later. |

For the complete response codes (responseCode) and acquirer response

codes (acquirerResponseCode), please refer

to the Data dictionary.

Making a Bancontact Mobile payment with Sips Office

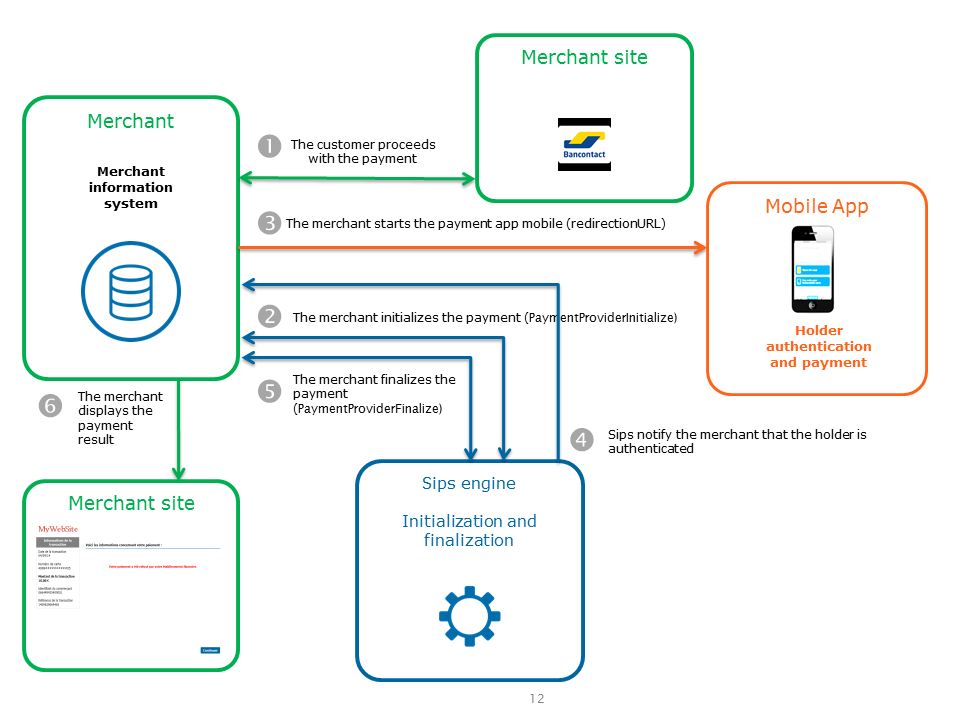

The payment process for Sips Office is described below:

Initialising a payment (PaymentProviderInitialize)

The Bancontact Mobile payment initialisation is done by calling the paymentProviderInitialize method.

Payment initialisation request

You must populate the following specific fields in the initialisation request for a Bancontact mobile payment:

| Field name | Remarks/rules |

|---|---|

| merchantReturnUrl | The URL for sending the authentication notification. |

| paymentMeanBrand | Must be populated with BCMCMOBILE. |

| responseKeyVersion | The secret key version used to encrypt the authentication notification. |

| paymentMeanData.bcmcMobile.defaultRedirectUrl | The optional URL for the Bancontact mobile application that can be used as a merchant callback URL for notifications. This callback can be triggered by the mobile application when the payment has not been successful, or if the connection between the mobile application and the payment service has been lost during the processing of the transaction. |

| paymentMeanData.bcmcMobile.completionRedirectUrl | The optional URL for the Bancontact mobile application that can be used as a merchant callback URL for notifications. This callback can be triggered by the mobile application after displaying the payment result to the client. |

Payment initialisation response

The following table summarises the different response cases to be processed:

| Status | Response fields | Action to take |

|---|---|---|

| Payment initialisation accepted | acquirerResponseCode = 00

authorisationId = (cf. the

Data Dictionary).messageVersion = message

version retrieved in response to the payment

initialisation.outerRedirectionUrl =

QRCodepaymentMeanBrand =

BCMCMOBILEresponseCode =

00redirectionData = redirection

data retrieved in response to the payment

initialisation.redirectionUrl =

URL-intent |

Redirect the customer to redirectionUrl. |

| Payment initialisation rejected | responseCode = <>

00 |

See the field errorFieldName, then fix the

request.If the problem persists, contact the technical

support. |

| Acquirer refusal | acquirerResponseCode = (cf.

the Data Dictionary).responseCode =

05 |

The authorisation is refused for a reason unrelated to fraud, you can suggest that your customer pay with another means of payment by generating a new request. |

| Refusal due to a technical issue | acquirerResponseCode = 90-98

responseCode = 90,

99 |

Temporary technical issue when processing the transaction. Suggest that your customer redo a payment later. |

For the complete response codes (responseCode) and acquirer response

codes (acquirerResponseCode), please refer

to the Data dictionary.

Customer redirection

At this point, you can choose the process to activate:

- with the redirectionUrl field, you are able to provide the URL-intent received via the PaymentProviderInitialize response on your mobile application.

- with the outerRedirectionUrl field, you can also generate a QR code to display on your pages.

Both processes will generate the launch of the mobile Bancontact application installed on the customer's mobile device. The customer will then have to identify himself.

Finalising a payment (PaymentProviderFinalize)

This last step allows you to obtain the payment status. The settings obtained during the redirection after the payment process on the Bancontact Mobile website are to be transmitted during this call. The method used to finalise a payment is paymentProviderFinalize.

Payment finalisation request

You must populate the following specific fields in the finalisation request for a Bancontact mobile payment:

| Field name | Remarks/rules |

|---|---|

| redirectionData | Redirection data |

| messageVersion | Message version |

Payment finalisation response

The following table summarises the different response cases to be processed:

| Status | Response fields | Action to take |

|---|---|---|

| Payment accepted | acquirerResponseCode = 00

authorisationId = (cf. the

Data Dictionary).panEntryMode =

WALLETpaymentMeanBrand =

BCMCMOBILEresponseCode =

00walletType =

BCMCMOBILE |

You can deliver the order. |

| Acquirer refusal | acquirerResponseCode = (cf.

the Data Dictionary).responseCode =

05 |

The authorisation is refused for a reason unrelated to fraud, you can suggest that your customer pay with another means of payment by generating a new request. |

| Refusal due to a technical issue | acquirerResponseCode = 90-98

responseCode = 90,

99 |

Temporary technical issue when processing the transaction. Suggest that your customer redo a payment later. |

For the complete response codes (responseCode) and acquirer response

codes (acquirerResponseCode), please refer

to the Data dictionary.

Cardholder authentication notification

A notification in HTTP POST is sent to the URL provided in the merchantReturnUrl field related to the initialisation method.

You have to configure a system receiving the notification message to make a call following the PaymentProviderFinalize method (for example, a control service waiting for notification).

Four fields are set in the request (case sensitive):

| Field name | Remarks/rules |

|---|---|

| Data | The field concatenation is necessary to finalise the

transaction. Setting example: keyVersion=1|merchantId =

099974849505999|… |

| Encode | Coding type in use |

| Seal | Message signature |

| InterfaceVersion | Context message version |

If the encoding value is "base64", the data must have a Base64.decode encoding to retrieve the concatenated string.

The concatenated string is structured as follows: key1 = value1 | key2 = value2...

Example:

merchantId=002474849505153|transactionReference=TEST87190508400|redirectionData=+n

lCo8T13xEspDheo56uxiYJql7rAoAVM...1aNpi9l85BveUkuoco=|messageVersion=0.1|keyVersion=1The following fields are populated in the "Data" field.

These fields must be used to process the payment finalisation.

| Field name | Remarks/rules |

|---|---|

| keyVersion | The secret key version used to encrypt the authentication notification. |

| merchantId | Merchant Identifier |

| messageVersion | Message version |

| redirectionData | Redirection data |

| transactionReference | Transaction reference |

Managing your Bancontact Mobile transactions

Available cash operations

The following operations are available on Bancontact transactions:

| Cash management | ||

|---|---|---|

| Cancellation | X | |

| Validation | X | |

| Refund | V | Maximum

amount allowed per refund: €3,000 (several partial refunds

required for any transaction over €3,000). |

| Duplication | V | With WIP option |

| Credit | X | |

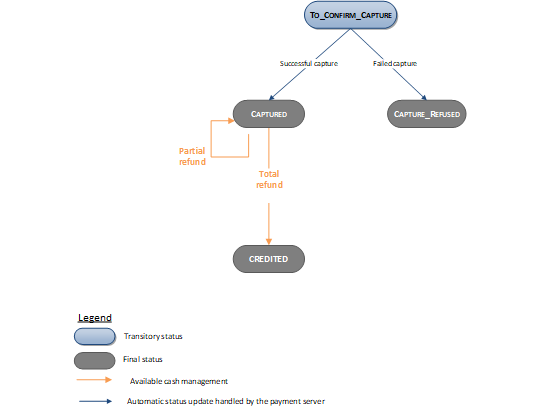

The diagram below explains which cash management operation is available when a transaction is in a given status:

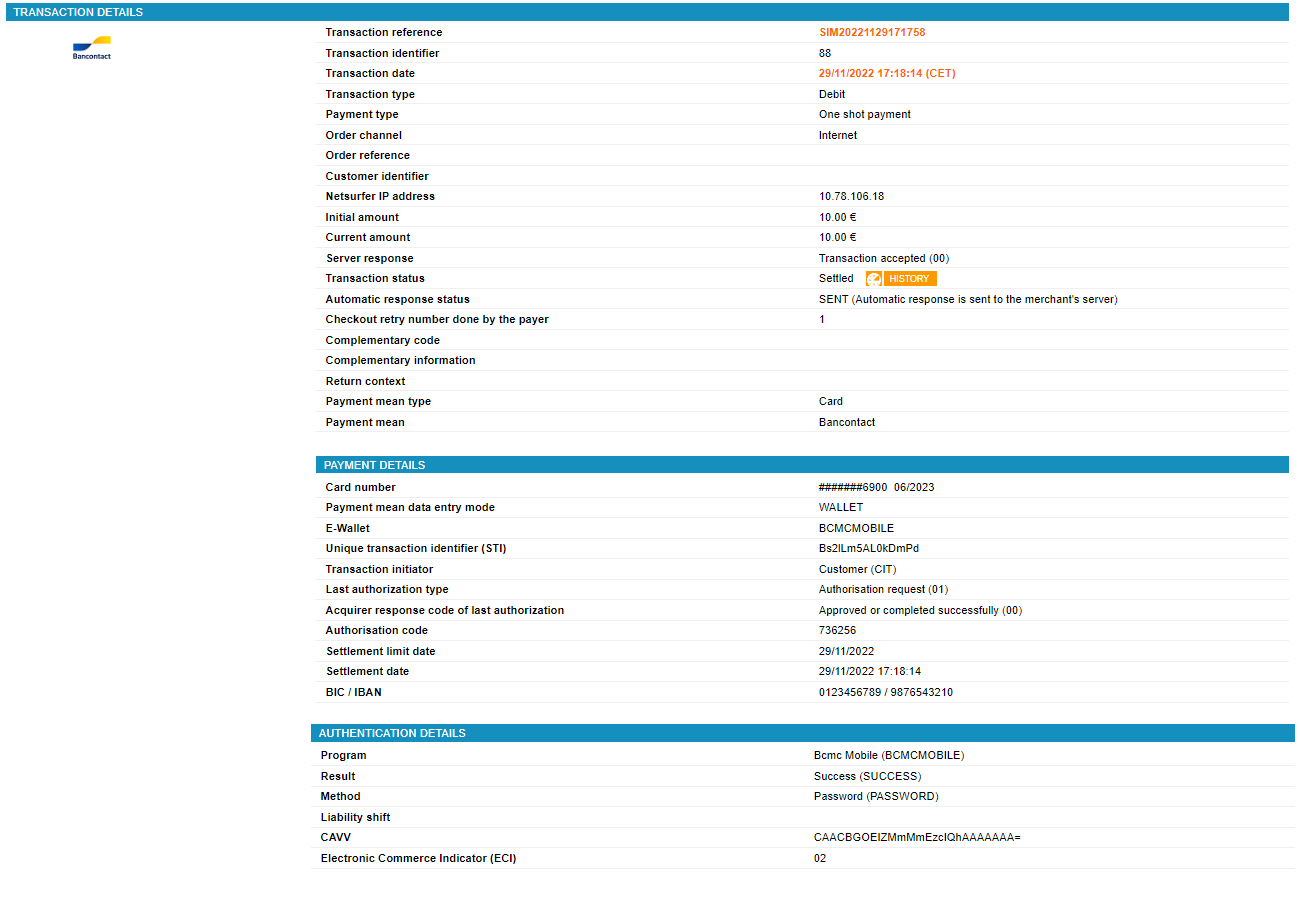

Viewing your Bancontact Mobile transactions

Reports

The reports provided by Worldline Sips allow you to have a comprehensive and consolidated view of your transactions, cash operations, accounts and chargebacks. You can use this information to improve your information system.

The availability of Bancontact Mobile transactions for each type of report is summarised in the table below:

| Reports availability | |

|---|---|

| Transactions report | V |

| Operations report | V |

| Reconciliations report | X |

| Chargebacks report | X |

Sips Office Extranet

You can view your Bancontact Mobile transactions and perform various cash management operations with Sips Office Extranet.