Introduction

Worldline Sips is a secure multi-channel e-commerce payment solution that complies with the PCI DSS standard. It allows you to accept and manage payment transactions by taking into account business rules related to your activity (payment upon shipping, deferred payment, recurring payment, payment in instalments, etc.).

The purpose of this document is to explain the CUP card by Floa Bank integration into Worldline Sips.

Who does this document target?

This document is intended to help you implement the CUP card by Floa Bank on your e-commerce site.

It includes:

- functional information for you

- implementation instructions for your technical team

To get an overview of the Worldline Sips solution, we advise you to consult the following documents:

- Functional presentation

- Functionality set-up guide

Understanding Lyf Pay payments with Worldline Sips

General principles

Lyf Pay is a European initiative bringing together BNP Paribas, Carrefour, Crédit Mutuel, Auchan, Mastercard, Oney and Total. This is a new means of payment allowing you to make online purchases with your smartphone.

The customer is redirected to a mobile phone number entry page before they validate the payment via the Lyf Pay smartphone application.

Acceptance rules

Available functionalities

| Payment channels | ||

|---|---|---|

| Internet | V | Default payment channel |

| MOTO | X | |

| Fax | X | |

| IVS | X | |

| Means of payment | ||

|---|---|---|

| Immediate payment | V | Default method |

| End-of-day payment | X | |

| Deferred payment | X | |

| Payment upon shipping | V | |

| Payment in instalments | X | |

| Subscription payment | X | |

| Batch payment | X | |

| OneClick payment | X | |

| Currency management | ||

|---|---|---|

| Multicurrency acceptance | X | EUR only |

| Currency settlement | X | EUR only |

Payment pages

The customer selects the Lyf Pay means of payment.

They are then redirected to their required information entry page:

After providing the required information, the customer is redirected to the verification page for a Lyf Pay payment:

The payment ticket is displayed, then the customer returns to your website.

Signing your Lyf Pay acceptance contract

In order to offer the Lyf Pay means of payment on your website, you have to sign an acceptance contract with your acquiring bank. Thereafter, you transmit us the contract number for recording in our information system.

Making a Lyf Pay payment

You can offer the Lyf Pay means of payment through the Sips Paypage interface which directly acts as the payment interface with customers via their web browser.

The remittance modes available for a Lyf Pay transaction are:

- Validation mode: you must validate the transaction to trigger the remittance. A capture delay must also be defined. When this capture delay is reached or exceeded, you will not be able to validate the transaction, which will therefore expire automatically.

- Immediate mode: the authorisation and remittance are executed online simultaneously.

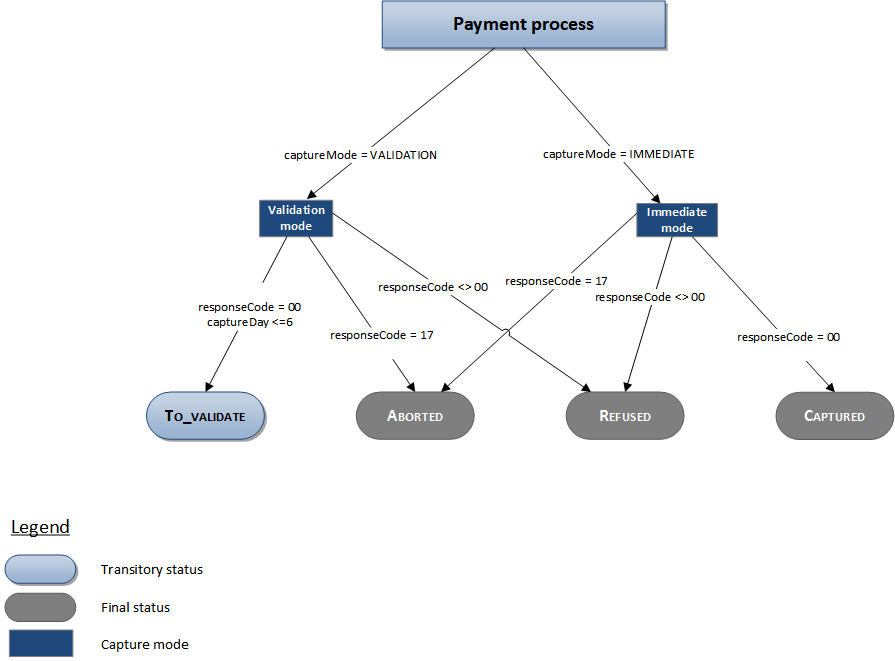

The diagram below explains the different transaction statuses according to the chosen capture mode:

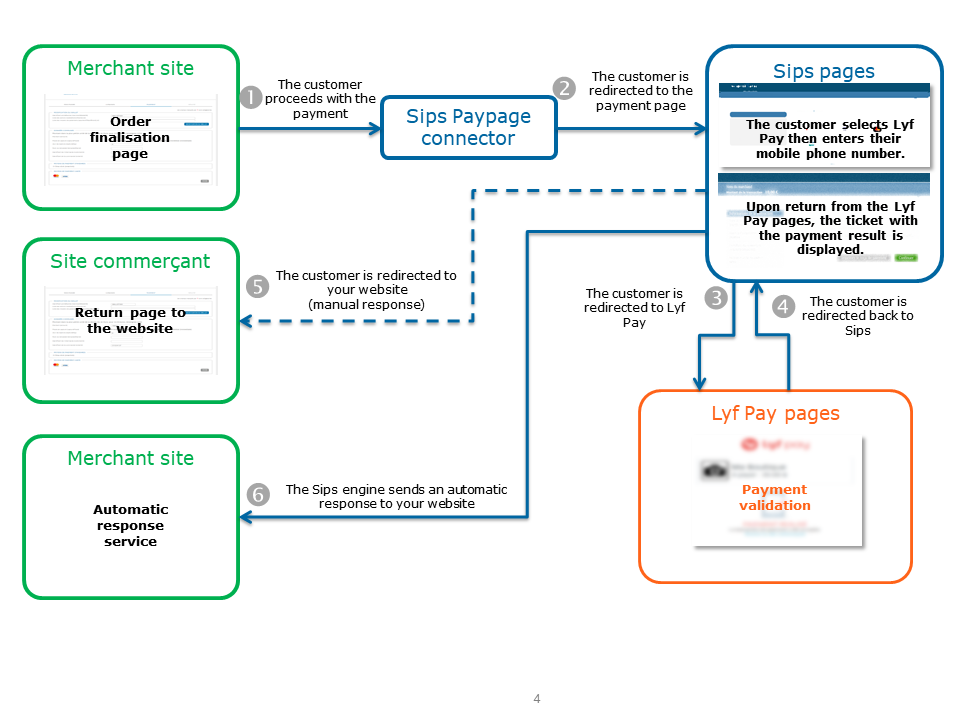

Making a Lyf Pay payment with Sips Paypage

The payment process for Sips Paypage is described below:

Setting the payment request

The following fields have a particular behaviour:

| Field name | Remarks/rules |

|---|---|

| captureDay | The value sent in the request must be 30 at a

maximum. A larger value will be forced to 30. |

| paymentPattern | Tհe value sent in the request is ignored. The payment

type is forced to ONE_SHOT. |

Analysing the response

The following table summarises the different response cases to be processed:

| Status | Response fields | Action to take |

|---|---|---|

| Payment accepted | acquirerResponseCode = 00

authorisationId = (cf. the

Data Dictionary).paymentMeanBrand =

AMEXpaymentMeanType =

CARDresponseCode =

00 |

You can deliver the order. |

| Acquirer refusal | acquirerResponseCode = (cf.

the Data Dictionary).responseCode =

05 |

The authorisation is refused for a reason unrelated to

fraud. If you have not opted for the "new payment attempt"

option (please read the Functionality

set-up Guide for more details), you can suggest that your

customer pay with another means of payment by generating a new

request. |

| Refusal due to the number of attempts reached | responseCode = 75 |

The customer has made several attempts that have all failed. |

| Refusal due to a technical issue | acquirerResponseCode = 90-98

responseCode = 90,

99 |

Temporary technical issue when processing the transaction. Suggest that your customer redo a payment later. |

For the complete response codes (responseCode) and acquirer response

codes (acquirerResponseCode), please refer

to the Data dictionary.

Making a Lyf Pay payment with Sips Office

The Lyf Pay means of payment acceptance is not available through the Sips Office solution.

Managing your Lyf Pay transactions

Available cash operations

The following operations are available on Lyf Pay transactions:

| Cash management | ||

|---|---|---|

| Cancellation | V | |

| Validation | V | |

| Refund | V | |

| Duplication | X | |

| Credit | X | |

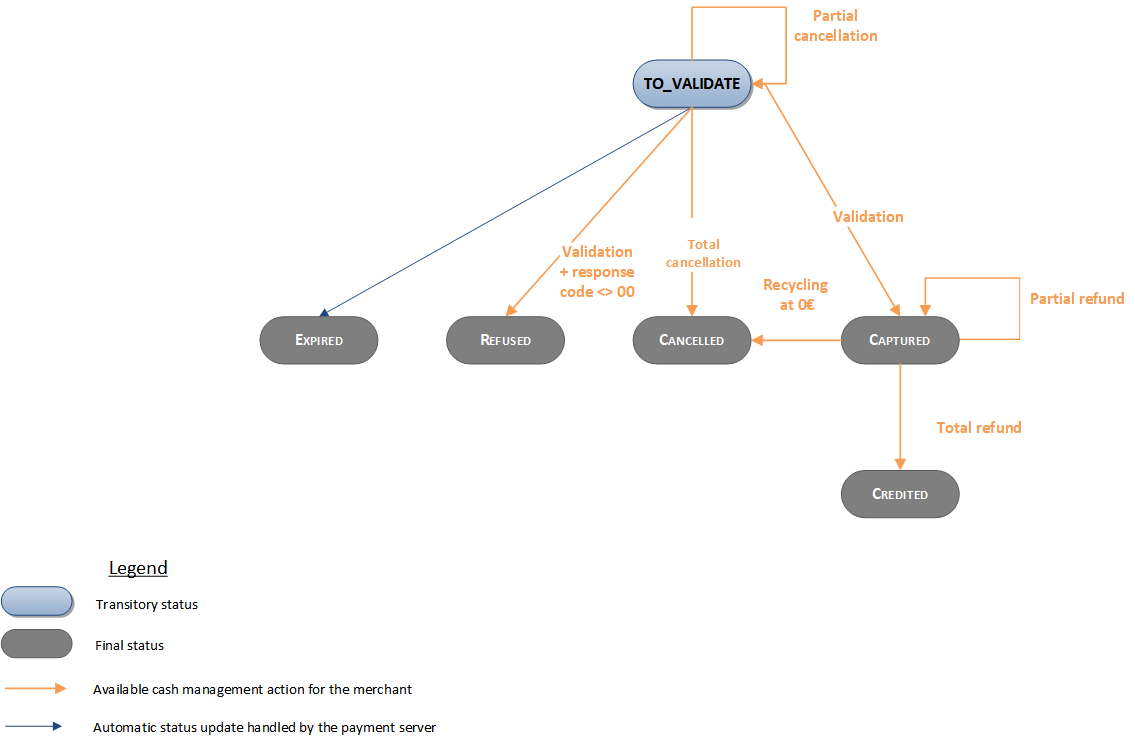

The diagram below allows you to know which cash management operation is available when a transaction is in a given state:

Setting funds aside/releasing funds

When making a Lyf Pay payment, the authorisation request results in setting funds aside. This feature has several consequences on the transaction life cycle in validation mode.

Partial validation:

- by default, a partial validation results in releasing the non-validated funds

- if you release the funds during a partial validation, the non-validated amount will remain set aside by Lyf Pay.

The additional field below can be used in the validation request.

| Field name | Remarks/rules | Value setting example |

|---|---|---|

| lastRecoveryIndicator | Optional: is set to TRUE by default. Allows you to ask

Lyf Pay to release the remaining funds in case of partial

validation. |

TRUE or FALSE |

Cancellation:

- total cancellation is authorised, resulting in the releasing of funds

| Field name | Remarks/rules | Value setting example |

|---|---|---|

| lastRecoveryIndicator | Optional: is set to FALSE by default. Allows you to

ask Lyf Pay to release the remaining funds in case of partial

recycling. In the case of a recycling set to 0, the

field is mandatory and must be set to "TRUE". |

TRUE or FALSE |

Expiry: (i.e. if the transaction is neither validated nor cancelled within the time limit):

- the funds are not automatically released when the transaction expires.

Viewing your Lyf Pay transactions

Reports

The reports provided by Worldline Sips allow you to have a comprehensive and consolidated view of your transactions, cash operations, accounts and chargebacks. You can use this information to improve your information system.

The availability of Lyf Pay transactions for each type of report is summarised in the table below:

| Reports availability | |

|---|---|

| Transactions report | V |

| Operations report | V |

| Reconciliations report | V |

| Chargebacks report | X |

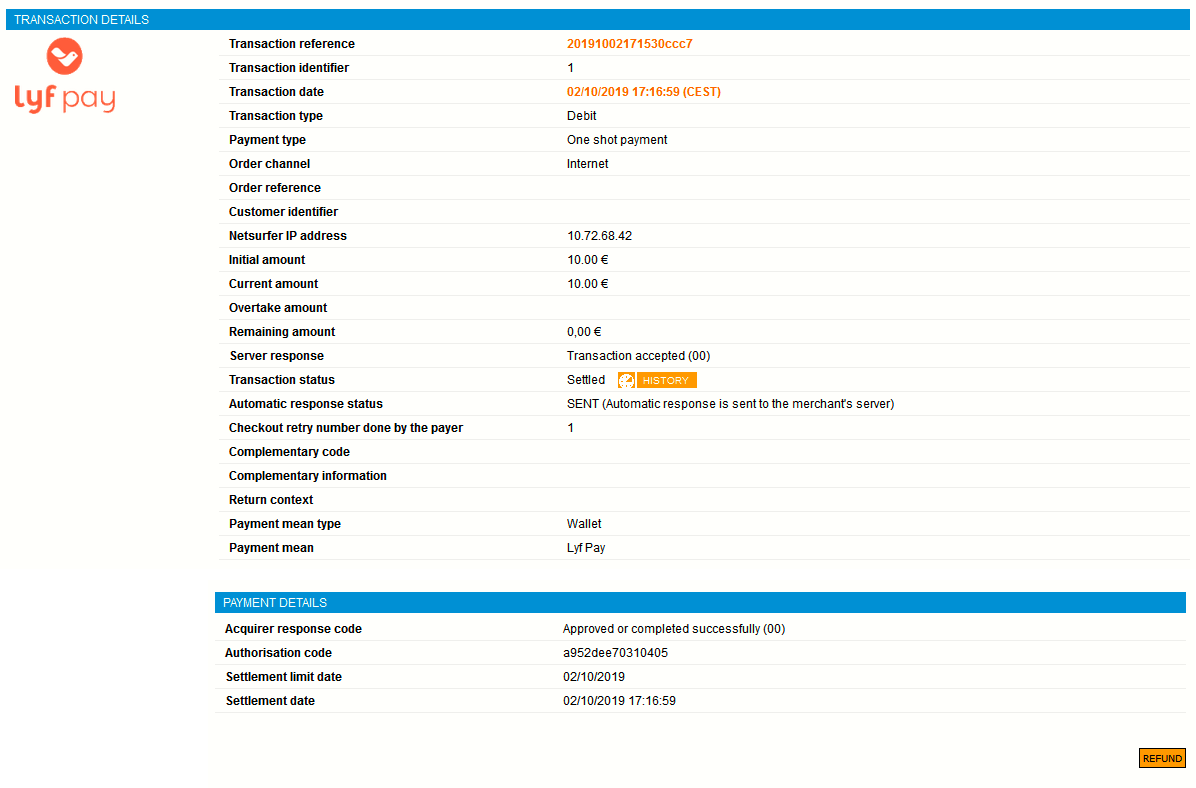

Sips Office Extranet

You can view your Lyf Pay transactions and perform various cash management operations with Sips Office Extranet.

Annexes

Response codes

Payment creation

For the Lyf Pay means of payment, Worldline Sips can return any of the codes below:

| Acquirer response code | Worldline Sips response code | Meaning |

|---|---|---|

| 00 | 00 | The transaction is accepted. |

| 05 | 05 | The transaction is refused. |

| 17 | 17 | The transaction is cancelled. |

| - | 17 | The transaction is cancelled on Worldline Sips |

| 60 | 60 | The transaction is pending. |

| 0 | 90 | Technical problem |

| 97 | 97 | Session expired |

| - | 99 | Technical problem |

Payment interruption

In the case of a payment interruption, you will receive a response code 60. These cases are:

- case 1: a technical error where Worldline Sips did not receive a response from Lyf Pay

- case 2: a sudden interruption of the payment process (a customer who closes their browser while making the payment, network interruption...)

These are exceptional cases where the final payment result is not immediately known.

In both cases, after 20 minutes you will receive an automatic response from Worldline Sips that will contain the final code of the transaction:

- response code 00: the transaction is accepted

- response code 90: the transaction is declined

You can handle these interruption cases as follows:

- case 1: the customer is redirected to your website and you receive a manual and automatic response with a code 60. You can then display a generic message to your customer and wait for the second automatic response (after 20 minutes) to decide on the final status of the payment

- case 2: the customer is not redirected to your website and there is no immediate response. After 20 minutes you will receive the automatic response with the final result