Introduction

Worldline Sips is a secure multi-channel e-commerce payment solution that complies with the PCI DSS standard. It allows you to accept and manage payment transactions by taking into account business rules related to your activity (payment upon shipping, deferred payment, recurring payment, payment in instalments, etc.).

The purpose of this document is to explain the SDD means of payment integration into Worldline Sips.

Who does this document target?

This document is intended to help you implement the SDD means of payment on your e-commerce site.

It includes:

- functional information for you

- implementation instructions for your technical team

To get an overview of the Worldline Sips solution, we advise you to consult the following documents:

- Functional presentation

- Functionality set-up guide

Understanding SDD payments with Worldline Sips

General principles

The SDD (SEPA Direct Debit) is a direct debit mean of payment used by debtors and creditors in the SEPA zone.

The drect debit is a payment initiated by the creditor (the merchant), previously authorised by the debtor (the customer) through a mandate. This mean of payment can be used for recurring or one-time payments.

Acceptance rules

Available functionalities

| Payment channels | ||

|---|---|---|

| Internet | V | Default payment channel |

| MAIL_ORDER, TELEPHONE_ORDER | V | |

| Fax | X | |

| IVS | X | |

| Means of payment | ||

|---|---|---|

| Immediate payment | X | |

| End-of-day payment | V | |

| Deferred payment | V | |

| Payment upon shipping | V | |

| Payment in instalments | V | |

| Subscription payment | V | |

| Batch payment | V | |

| OneClick payment | V | |

| Currency management | ||

|---|---|---|

| Multicurrency acceptance | X | EUR only |

| Currency settlement | X | EUR only |

Currency

The SEPA direct debit is a payment method in euros. The payment order can only be expressed in euros. However, the clients’ accounts can be held in another currency. In this case, the client’s bank carries out the conversion, which takes place outside of the SEPA direct debit transaction itself.

Mandate

The permission that your client has given you for issuing direct debit orders and submitting them for account debiting is formalised by the signature of SEPA direct debit mandates. The direct debit is based on a clear contract concluded between you and your clients, evidenced by explicit consent: the mandate.

The SEPA direct debit mandate materialises a client's consent to his merchant. SPS assigns a Unique Mandate Reference (UMR) to each mandate (see parts "Setting the payment request" of the connector Sips Paypage or Sips Office). You can also assign the UMR by yourself. In that case, you must ensure their uniqueness. Changes may occur to the mandate during its life cycle (changes to the client’s account number, etc.). Therefore, you will need an up-to-date mandate.

SDD schemes

The SEPA direct debit is available in two schemes:

- The SEPA CORE direct debit available to all types of clients. Two

sub-types are available in Worldline Sips:

- Core (BToC). This scheme applies to all payers, individuals or companies.

- Business (BToF): for associations which have or do not have a registration number (ex: a SIRET number in France). This sub-type has been created to allow sending additional data, but it is still subject to the same rules as the standard Core type.

- The SEPA BToB direct debit exclusively for payments between companies, professionals and associations, and which has specific management rules. It is prohibited for a creditor to debit an individual with a BtoB SDD. The debtor's bank has the obligation to ensure the validity of the BtoB mandate with its client before being able to initiate payments by SDD. The debtor must therefore send a copy of the SDD BtoB mandate to his bank upon signature so that it can record the characteristics of the mandate in its information system. If the debtor's bank is not informed of the signed mandate, the direct debit will be automatically rejected. The debtor also undertakes to inform his bank of any modification or deletion of mandate. The debtor cannot contest a BtoB SDD once he has been regularly paid (i.e. existence of a mandate), it is therefore not possible to ask his bank to refund a BtoB direct debit

Direct debit type

The SEPA direct debit can be used for recurring or one-time payments:

- recurring mandate: the mandate is valid for a series of direct debits. It is revocable at any time by the creditor or the debtor and becomes obsolete if not used for a period of 36 months.

- one–time mandate: the mandate is valid only for a single direct debit and expires automatically.

Amount restrictions

The SEPA direct debit order amount must be between 0.01 and 999,999,999.99 euros.

Payment guarantee SafeDebit

The SEPA platform is also connected to the SafeDebit solution, proposed by the Score & Secure Payment (SSP) society, and which allows to deliver a payment guarantee for the unpaid SEPA payments.

To benefit from this guarantee, you must have a SafeDebit contract with SSP and obtain a beneficiary number to communicate to us during your subscription to this functionality.

Overview

The Score Score & Secure Payment (SSP) company proposes a solution allowing the guarantee of payments done by SEPA transfer. On the basis of fraud scoring, this independent company offers to guarantee SEPA direct debits on your merchant websites. Worldline Sips is connected to the SSP SafeDebit offer through SPS.

If you subscribe to the SafeDebit offer, you will benefit from this solution. You will need to follow the procedure described in the chapter "Signing your SDD acceptance contract". The SEPA debits will be guaranteed by SSP (and thus you can be compensated by SSP in case of unpaid).

Risk taking

There is currently an additional option associated with SafeDebit. It's the risk taking.

Activate the guarantee on the mandate and the SEPA debits allows to make a certain number of verification of the data (detection of false IBAN, type of account, digital identity, ...) and to refuse the creation of mandates and SEPA debits if the guarantee payment can not be applied. In order for SEPA direct debits or mandates not to be rejected, although not guaranteed by SSP, you have the option to opt for the option "risk taking". In this case you lose the payment guarantee. You will not be able to claim compensation for any outstanding payments.

This option must be indicated when registering or via your usual contacts for the option modification.

Mandate modification

Modification of a mandate is not allowed if guaranteed SEPA direct debits have been created on this mandate and are not finalized.

Indeed, the guarantee of a payment is based on the information of a mandate and could be revised in case of modification of the mandate.

Mandate electronic validation

The electronic validation of SEPA direct debit mandates is used during an online mandate creation by the client or an electronic mandate creation in Sips Office Extranet or in Sips Office by you.

The electronic validation uses an “Organisation” type certificate in your name, that guarantees document integrity, enables time stamping and provides proof sealing of actions that led to the mandate validation.

In order to obtain this certificate, your legal representative must sign a subscription contract.

The electronic validation is compatible with the European standard ETSI 102-042 (European Telecommunications Standards Institution).

A SEPA direct debit can lead to the contestation of a non-authorised transaction, but in the event of legal action, it is the existence of the consent to the main contract (binding the merchant and the client - e.g. subscription contract) that will be primarily considered. The mandate validation may take place through two payment processes:

- validation through a code entry received by email.

- validation through a code entry received by text message.

Choosing the right solution lies between the risk to be covered, the payment guarantee and the process ergonomics.

You have to specify your choice when sending the mandate creation request.

Validation through code entry

Principles

Clients validate their direct debit mandate by entering a code received:

- by text message to a known telephone number of the merchant

- or by email to a known email address of the merchant

Prerequisites for the merchant

- You must be able to transmit the customer details: title, surname, first name for an individual customer; company name, last name and first name of the legal representative for a business customer.

- You must have the customer's phone number or e-mail address: the client can neither enter or modify his email address or phone number during the session used to validate the mandate.

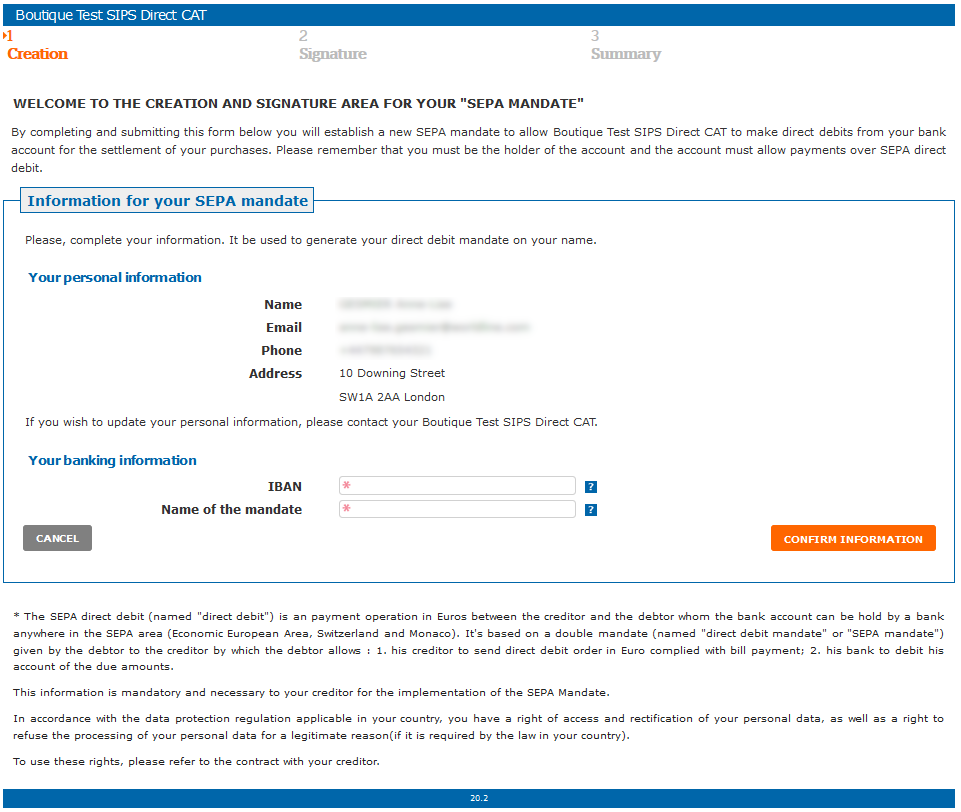

Payment pages

- When the customer clicks on the SEPA Direct Debit logo, the server verifies if the they already have a direct debit mandate (OneClick option).

- If the customer has no mandate, they are advised to validate their direct debit mandate online.

- You have to transmit details related to the customer (identification and contact details), and the customer cannot modify these details during the mandate creation.

- The customer validates their information, provides their bank

details (IBAN) and confirms that the pre-filled mandate contains the

correct information.

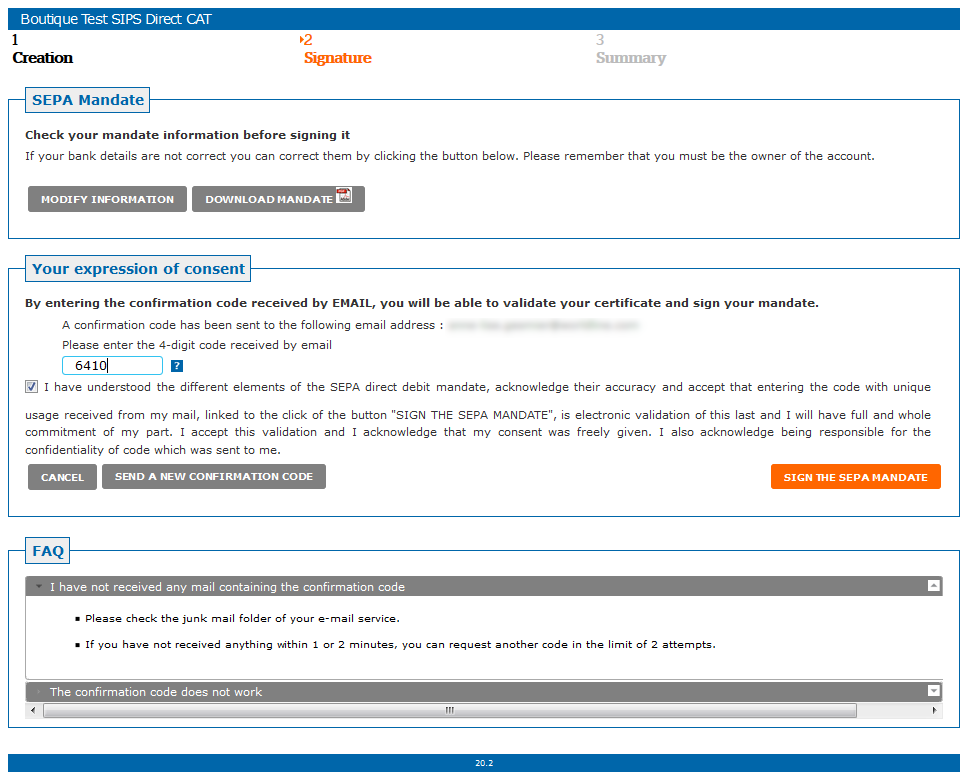

- The customer receives a code on their mobile phone or e-mail address

to be re-entered on the page in order to confirm their mandate.

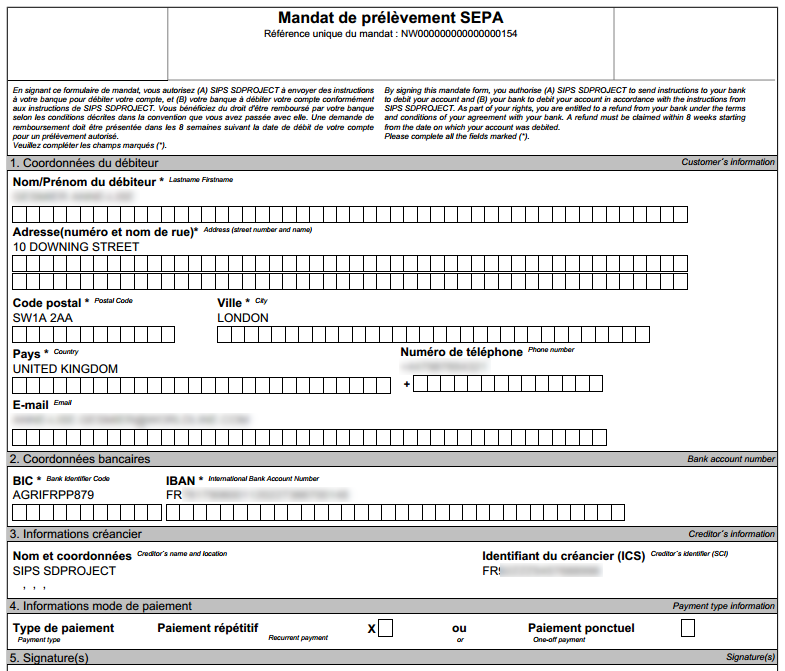

- If you click on DOWNLOAD MANDATE, You can check the information

inside your mandate:

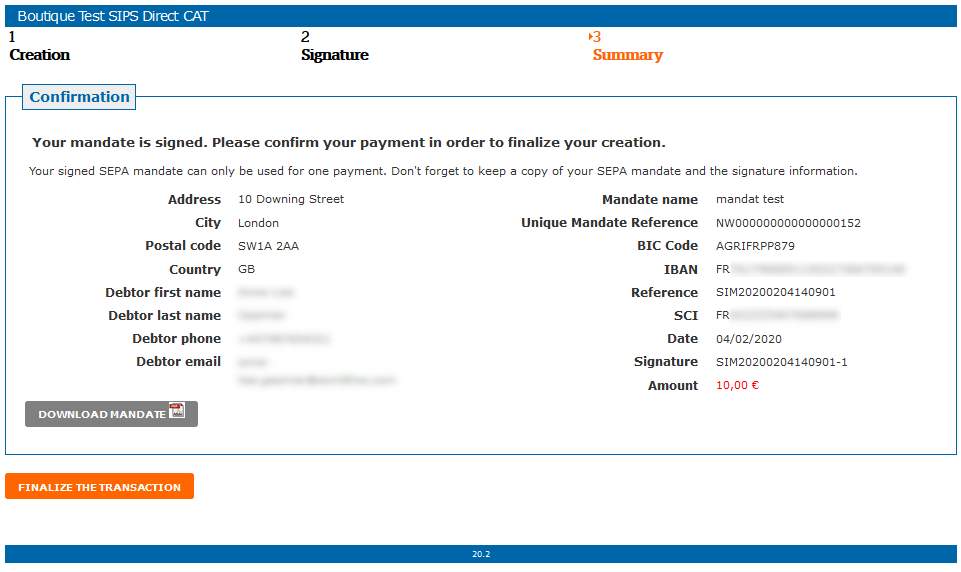

- The customer receives confirmation that his mandate has been

successfully registered. He can download the mandate in PDF format or

print it. The total of his purchase or of the next instalment will be

deducted from his bank account.

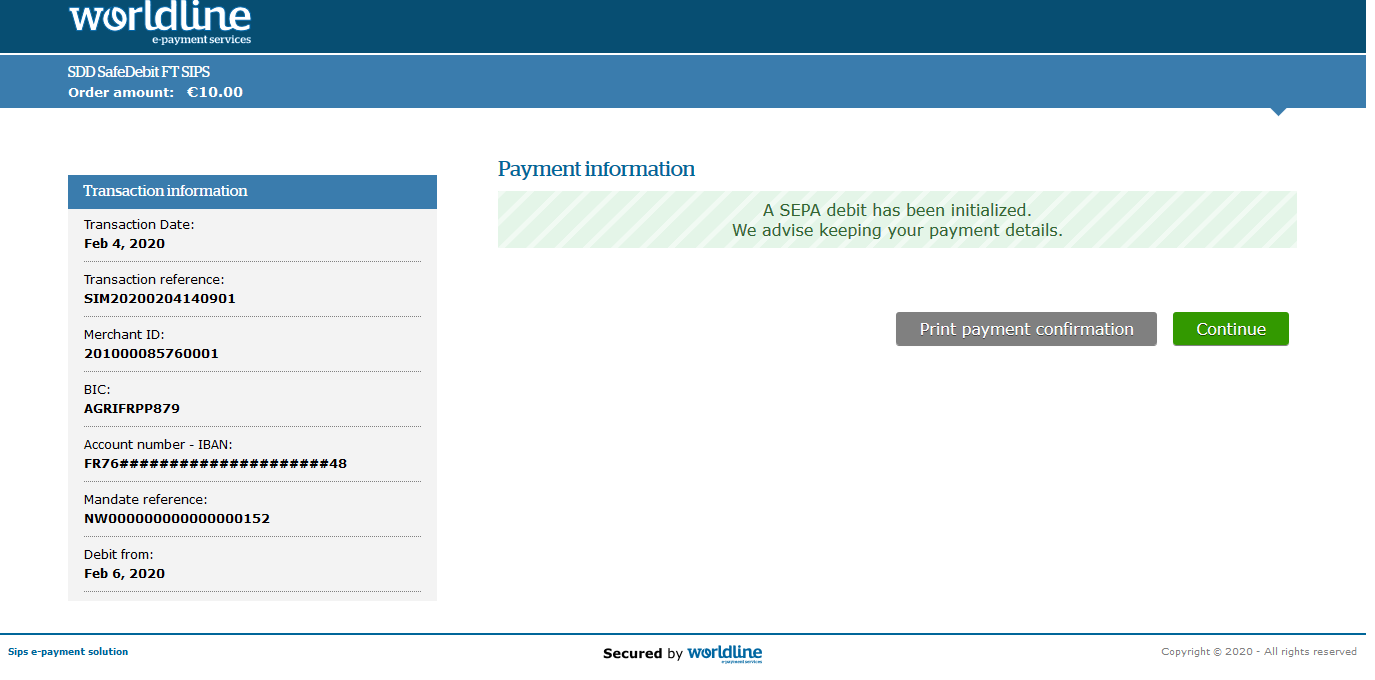

- You will have a message of Transaction Information:

- The next direct debit date is indicated on the summary ticket.

Submission deadline

Unlike card payments, a submission deadline is to be observed before interbank exchanges.

Thus, for a payment/maturity date, the direct debit must be presented in compensation at D-1 of BBD (Banking Business Day) at the latest.

Payment remittance in the bank

Depending on your banking institution the files are:

- transmitted by SPS

- transmitted by yourself

Please contact your banking institution to find out how it works.

Pre-notification

You are bound to supply the debtor with a notification at least 14 calendar days, prior to the direct debit maturity date.

Payment review

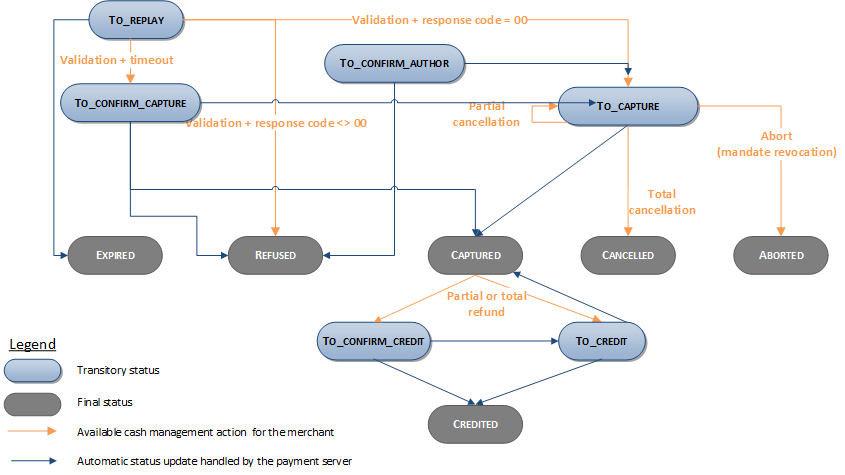

During the payment kinematics, it is possible that we don't receive the expected return (timeout), the status of the transaction can be one of the followings.

- TO_CONFIRM_AUTHOR

- TO_CONFIRM_CAPTURE

- TO_CONFIRM_CREDIT

A batch processing is carried out daily to update these transactions to final statuses:

- REFUSED

- TO_CAPTURE/TO_VALIDATE

- CAPTURED

- TO_CREDIT

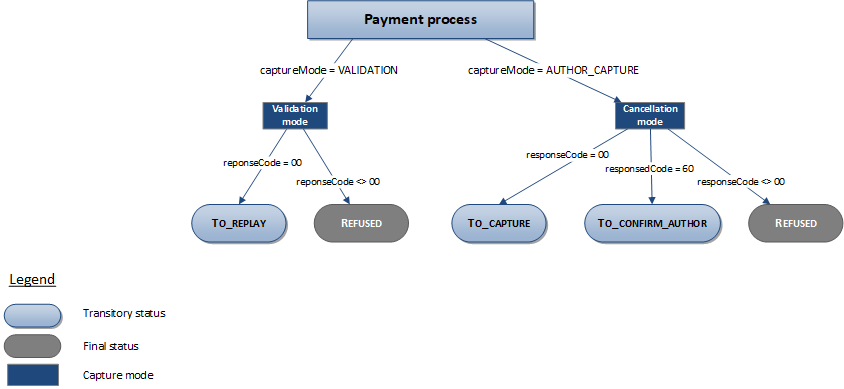

The diagram of the Making an SDD payment paragraph illustrates these statuses as well as the transitions.

The final status will appear in your transaction report to allow you to continue processing the order.

Signing your SDD acceptance contract

In order to issue SEPA direct debits, you must first:

- Sign a service contract with the bank (i.e. an agreement to issue SEPA direct debits).

- Have a SEPA Creditor Identifier (SCI) issued by the Banque de France (for France).

- Sign a service contract with Score & Secure Payment (SSP) in order to obtain and give us the beneficiary number if you wish to subscribe to the SafeDebit payment guarantee solution.

Operations available by interface

Some operations are not available on all the interfaces. Here is a table summarizing the actions available in each interface:

| Actions/Interfaces | Sips Paypage | Sips Office | Sips Office Extranet | Sips Office Batch |

|---|---|---|---|---|

| Creation of a mandate and payment | Yes | Yes | Yes | Non |

| Making a payment from an already existing mandate | Yes if the mandate has been enrolled in OneClick mode when it was created | Yes: directDebitOrder function | Yes | Yes: directDebitOrder function |

| Cash management on debit orders | No | Yes | Yes | Yes |

| Searching a mandate | No | Yes: searchMandate function | Yes | No |

| Retrieving a signed pdf mandate | No | Yes: getPdfMandate function | Yes | No |

| Retrieving/viewing a mandate | No | Yes: getMandateData function | Yes (search a mandate and open it in the interface) | No |

Making an SDD payment

Worldline Sips offers you three solutions to integrate the SDD mean of payment:

- Sips Paypage which directly acts as the payment interface with customers via their web browser.

- Sips Office which gives you the opportunity to display your payment pages and works through a server-to-server dialog.

- Sips Office Batch which allows you to process batch payments.

The remittance modes available for an SDD transaction are:

- Cancellation mode: default mode allowing transaction remittance on a predefined date, called capture delay. When this capture delay is reached, the remittance is sent automatically. This delay is set via the captureDay field with its 0 default value (end-of-day payment).

- Validation mode: you must validate the transaction to trigger the remittance. A capture delay must also be defined. When this capture delay is reached or exceeded, you will not be able to validate the transaction, which will therefore expire automatically.

The diagram below explains the different transaction statuses according to the chosen capture mode:

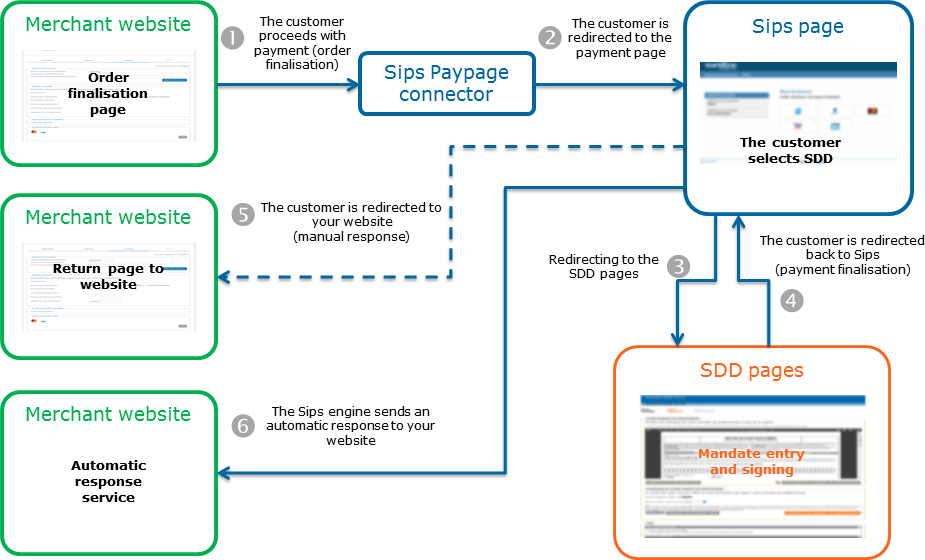

Making an SDD Payment with Sips Paypage

The payment process for Sips Paypage is described below:

Setting the payment request

As part of the SDD acceptance you need to:

- Check of the client identity.

- Pre-fill the mandate creation page and thus promote the SDD type of transaction processing.

The Unique Mandate Reference (UMR) can be sent in the payment request. If the UMR is not sent, then the reference is automatically generated.

Warning: in case you choose to send the UMR, you are responsible for the UMR unicity. In case of duplicated UMR, the mandate signature will be refused and the customer will not have the possibility to pay.

Below is a list of settings enabling the transfer of the cardholder’s personal information.

| Field name | Remarks/rules |

|---|---|

| customerContact.email | Mandatory if authentication method is EMAIL_OTP. Mandatory with SafeDebit option |

| customerContact.firstname | Mandatory |

| customerContact.gender | Optional |

| customerContact.lastname | Mandatory |

| customerContact.mobile | Mandatory if the authentication method is SMS_OTP. The expected format will include the area code (+33, etc). Mandatory with SafeDebit option |

| customerContact.legalId | Optional, only used with a BTOF transactionActors mandate. |

| customerContact.positionOccupied | Optional, only used with a BTOF transactionActors mandate. |

| customerAddress.city (*) | Optional If not valued, the customer will have to enter this information on the mandate entry page. |

| customerAddress.country (*) | Optional If not valued, the customer will have to enter this information on the mandate entry page. |

| customerAddress.street (*) | Optional If not valued, the customer will have to enter this information on the mandate entry page. |

| customerAddress.streetNumber (*) | Optional If not valued, the customer will have to enter this information on the mandate entry page. |

| customerAddress.zipCode (*) | Optional If not valued, the customer will have to enter this information on the mandate entry page. |

| customerAddress.company | Mandatory if the transactionActors field is filed with BTOF. |

| customerAddress.businessName | Optional, only used if the transactionActors field is filled with BTOF. |

| customerLanguage | Allows to choose the language used on Worldline Sips and SDD pages. |

| mandateId | Optional. If not filled in, the mandate unique reference is generated by SPS. WARNING: It is the merchant's responsibility to guarantee its uniqueness if he provides it. |

| customerId | Optional must be provided to use the searchMandate function |

| paymentMeanData.sdd.mandateAuthentMethod | Optional restricted values : MAIL_OTP, SMS_OTP if not filled, default value is MAIL_OTP |

| paymentMeanData.sdd.mandateUsage | Optional restricted values : ONE_OFF, RECURRENT if not filled, default value is RECURRENT |

| statementReference | Optional Available for some acquirer |

| transactionActors | Optional restricted values : BTOC ou BTOF if not filled, default value is BTOC |

(*) You must necessarily fill in the 5 fields: city, country, street, streetNumber and zipCode, so that the address is taken into account and pre-filled on the mandate entry page.

Analysing the response

The following table summarises the different response cases to be processed:

| Status | Response fields | Action to take |

|---|---|---|

| Payment accepted | acquirerResponseCode = 00

authorisationId = (cf. the

Data Dictionary).captureDay = with

AUTHOR_CAPTURE mode, the value is corrected by SPS according to the submission rules chosen by the

acquirer (captureDay = captureLimitDate - today's date).With

VALIDATION mode, the value remains the same as for the

request. captureLimitDate = the

submission date is returned in the response in AUTHOR_CAPTURE mode

only. In VALIDATION mode, the direct debit submission date is

returned during the validation of the SDD

transaction.customerBusinessName = the

company name set in input or sent by SPS.customerLegalId = the company

registration number set in input or sent by SPS.customerPositionOccupied =

the legal identifier set in input or sent by SPS.maskedPan = BIC.IBAN hidden

format rules: Example: AXABFRPP314.FR76

######################44 BIC: shown; IBAN: only the

first 4 and last 2 digits shown. mandateId = UMR to be

retained by you.mandateUsage = ONE_OFF or

RECURRENTpaymentMeanBrand =

SEPA_DIRECT_DEBITpaymentMeanType =

DIRECT_DEBITresponseCode =

00secureReference = transaction

warranty proof as part of the SafeDebit option.This proof

will be transmitted to SSP for any claim for

compensation. transactionActors = BTOB,

BTOF ou BTOC |

You can deliver the order. |

| Acquirer refusal | acquirerResponseCode = (cf.

the Data Dictionary).responseCode =

05 |

The authorisation is refused for a reason unrelated to

fraud. If you have not opted for the "new payment attempt"

option (please read the Functionality

set-up Guide for more details), you can suggest that your

customer pay with another means of payment by generating a new

request. |

| Refusal due to the number of attempts reached | responseCode = 75 |

The customer has made several attempts that have all failed. |

| Refusal due to a technical issue | acquirerResponseCode = 90-98

responseCode = 90, 99

|

Temporary technical issue when processing the transaction. Suggest that your customer redo a payment later. |

For the complete response codes (responseCode) and acquirer response

codes (acquirerResponseCode), please refer

to the Data dictionary.

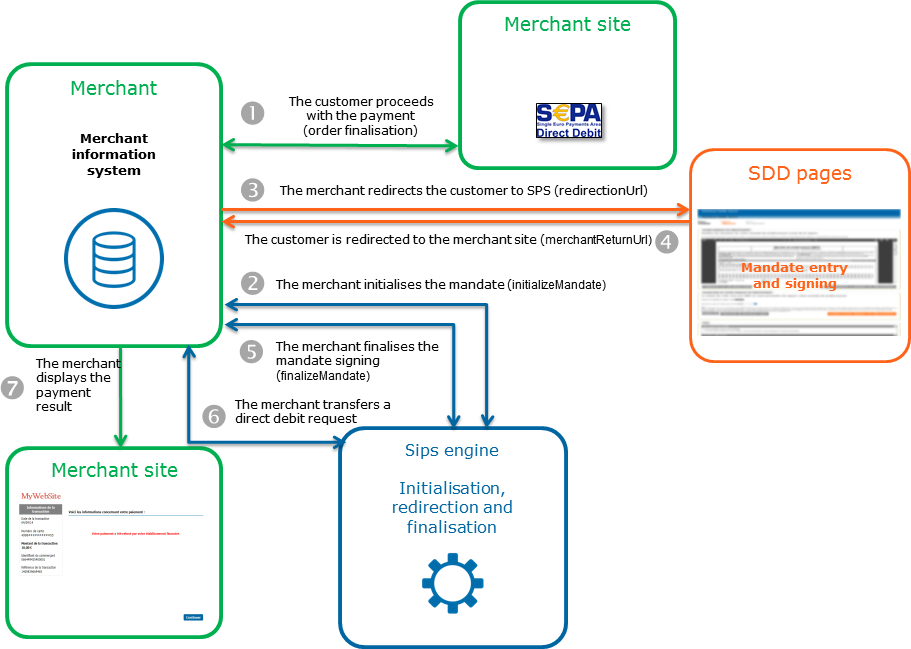

Making an SDD payment with Sips Office

The payment process for Sips Office is described below:

Initialising a mandate (initializeMandate)

The SEPA mandate initialisation is performed by calling the initializeMandate method.

Mandate creation initialisation request (InitializeMandate)

You must populate the following specific fields in the initialisation request for an SDD mandate creation:

| Field name | Remarks/rules |

|---|---|

| iban | Mandatory French IBAN are composed of 27

digits |

| mandateId | Optional (set by SPS if not provided). |

| merchantReturnUrl | Mandatory |

| transactionActors | Optional Possible values = BTOC, BTOB, BTOFIf not filled, default value is BTOC |

| customerId | Optional must be provided to use the searchMandate function |

| customerLanguage | Allows to choose the language used on Worldline Sips and SDD pages. |

| statementReference | Optional Available for some acquirer |

| customerContact.email | Mandatory if authentication method by MAIL_OTP Mandatory with SafeDebit option |

| customerContact.firstname | Mandatory |

| customerContact.gender | Optional |

| customerContact.lastname | Mandatory |

| customerContact.mobile | Mandatory if the authentication method is SMS_OTP. The expected format will include the area code (+33, etc). Mandatory with SafeDebit option |

| customerContact.legalId | Mandatory if transactionActors is BTOB Optional if transactionActors is BTOF Don't fill if transactionActors is BTOC |

| customerContact.positionOccupied | Optional if transactionActors is BTOB or BTOF Don't fill if transactionActors is BTOC |

| customerAddress.city | Mandatory |

| customerAddress.country | Mandatory |

| customerAddress.street | Mandatory |

| customerAddress.streetNumber | Mandatory |

| customerAddress.zipCode | Mandatory |

| customerAddress.company | Mandatory if the transactionActors field is filled in with BTOB or BTOF. Don't fill if transactionActors is BTOC |

| customerAddress.businessName | Mandatory if the transactionActors field is filled in with BTOB or BTOF. Don't fill if transactionActors is BTOC |

Request example: initializeMandate via Sips Office JSON

{

"customerAddress":

{

"city":"PARIS",

"country":"FRA",

"street":"Rue de la Bastille",

"streetNumber":"19",

"zipCode":"75000"

},

"customerContact":

{

"email":"julie.dupont@mail.com",

"firstname":"Julie",

"gender":"F",

"lastname":"DUPONT"

},

"customerId":"JAU001"

"iban":"FR7617906001120227366700148",

"interfaceVersion":"MR_WS_2.19",

"keyVersion":"1",

"merchantId":"210011990011607",

"merchantReturnUrl":"https://merchantReturnUrl.com",

"paymentMeanAlias":"SEPA_DIRECT_DEBIT",

"paymentMeanData":

{

"sdd":

{

"mandateAuthentMethod":"MAIL_OTP"

}

},

"transactionActors":"BTOC",

"seal":"12682c81e701f171b9f33061846c60dcade2afb73eb064027fbb88cc6068382e"

}Mandate creation initialisation response

The following table summarises the different response cases to be processed:

| Status | Response fields | Action to take |

|---|---|---|

| Mandate creation initialisation accepted | acquirerResponseCode = 00

messageVersion = message

version retrieved in response to the payment

initialisation.mandateId = mandate number

(identical to the one in the request if provided, otherwise

generated by SPS).mandateResponseCode = server

response code.redirectionData = redirection

data retrieved in response to the payment

initialisation.redirectionUrl = redirection

URL to the SDD website. |

Redirect the customer to redirectionUrl. |

| Mandate creation initialisation rejected | responseCode = <>

00 |

See the field errorFieldName, then fix the

request.If the problem persists, contact the technical

support. |

| Acquirer refusal | acquirerResponseCode = (cf.

the Data Dictionary).responseCode =

05 |

The authorisation is refused for a reason unrelated to fraud, you can suggest that your customer pay with another means of payment by generating a new request. |

| Refusal due to a technical issue | acquirerResponseCode = 90-98

responseCode = 90,

99 |

Temporary technical issue when processing the transaction. Suggest that your customer redo a payment later. |

For the complete response codes (responseCode) and acquirer response

codes (acquirerResponseCode), please refer

to the Data dictionary.

Redirecting the client to the SDD pages

The customer must be redirected to the URL provided in initializeMandate response. The redirection is done by calling the HTTP POST method to the redirectionUrl received with parameters messageVersion and redirectionData.

At the end of the payment processes, the client is redirected to the URL provided in the initialisation request, merchantReturnUrl. The following fields are sent in POST and must be retrieved to finalise the payment:

| Field name | Remarks/rules |

|---|---|

| responseCode | Process response code |

| redirectionData | Redirection data retrieved in response to the payment initialisation. |

| messageVersion | Message version retrieved in response to the payment initialisation. |

| amount | Transaction amount in cents |

| merchantId | Shop identifier |

| transactionReference | Transaction reference |

| transactionId | Transaction identifier |

| transactionDate | Transaction date |

Finalising the mandate creation (finalizeMandate)

Once the customer has signed his mandate on the SDD pages, he is redirected to the URL that was provided during the initializeMandate call in the field merchantReturnUrl.

The redirection to this URL is done by Worldline Sips by calling the HTTP POST method on that URL using the messageVersion and redirectionData settings. Those POST settings must be provided as inputs of the finalizeMandate method to complete the mandate creation process.

Mandate creation finalisation request

You have to populate the following specific fields in the finalisation request for an SDD payment.

| Field name | Remarks/Rules |

|---|---|

| redirectionData | Redirection data retrieved after the customer returns to your website (cf. Redirecting the client to the SDD pages). |

| messageVersion | Message version retrieved after the customer returns to your website (cf. Redirecting the client to the SDD pages). |

Mandate creation finalisation response

The following table summarises the different response cases to be processed:

| Status | Response fields | Action to take |

|---|---|---|

| Payment accepted | acquirerResponseCode = 00

authorisationId = (cf. the

Data Dictionary).bic = bank Identifier Code

(BIC).iban = international Bank

Account Number (IBAN). French IBAN have 27 digits.mandateId = mandate

numbermandateResponseCode =

response code returned by Worldline Sips (indicates the

overall result of the mandate creation).paymentMeanBrand =

SEPA_DIRECT_DEBITpaymentMeanAlias = means of

payment alias defined and used by the customer in his

portfolio.responseCode =

00transactionActors = terms of

mandate:BTOC|BTOB|BTOF |

You can deliver the order. |

| Acquirer refusal | acquirerResponseCode = (cf.

the Data Dictionary).responseCode =

05 |

The authorisation is refused for a reason unrelated to fraud, you can suggest that your customer pay with another means of payment by generating a new request. |

| Refusal due to a technical issue | acquirerResponseCode = 90-98

responseCode = 90,

99 |

Temporary technical issue when processing the transaction. Suggest that your customer redo a payment later. |

For the complete response codes (responseCode) and acquirer response

codes (acquirerResponseCode), please refer

to the Data dictionary.

Submitting a SEPA Direct Debit Request

SEPA Direct Debit request

To create an SDD direct debit, use the directDebitOrder method and indicate the SDD payment type and the unique mandate reference in the request.

| Field name | Remarks/rules |

|---|---|

| paymentMeanBrand | Doit être valorisé avec SEPA_DIRECT_DEBIT. |

Request example: directDebitOrder with Sips Office JSON

{

"amount":"1000",

"captureDay":"0",

"captureMode":"AUTHOR_CAPTURE",

"currencyCode":"978",

"customerId":"customerId1",

"customerIpAddress":"127.0.0.1",

"interfaceVersion":"IR_WS_2.18",

"keyVersion":"1",

"mandateId":"000000000000000031",

"merchantId":"210043956120001",

"merchantTransactionDateTime":"2017-10-16T16:13:11.602+02:00",

"orderChannel":"INTERNET",

"paymentMeanBrand":"SEPA_DIRECT_DEBIT",

"transactionOrigin":"SIPS-SIM",

"transactionReference":"SIM20171016161311",

"seal":"108458787fe9dfe063605b21f946c727aab94468683482da1a5e2eb7ac08a016"

}SEPA Direct Debit request response

In the case of SDD payments, the following specific fields are filled in.

| Field name | Remarks/Rules |

|---|---|

| maskedPan | Hidden format: BIC.IBAN as follows: AXABFRPP314.FR76 ######################44 BIC: shown; IBAN: the first 4 and last 2 digits shown The BIC can vary from 8 to 11 characters, the IBAN varies in each country and has a maximum length of 34 characters |

| transactionActors | Possible values:

This value comes from the mandate type. |

| mandateId | UMR to be retained by merchant |

| captureLimitDate | YYYYMMDD format The submission date is returned in the response in AUTHOR_CAPTURE mode only. In VALIDATION mode, it's the current date plus captureDay that is returned, the real direct debit submission date is returned during the validation of the SDD transaction. |

| captureDay | Value corrected by SPS according to the

rules of submission chosen by the acquirer. captureDay = captureLimitDate - today's date |

| authorisationId | In VALIDATION mode, the “0” value is returned and the real value is returned during the SDD transaction validation. |

| secureReference | Proof of warranty of the transaction with SafeDebit option. This reference will be transmitted to SSP for the compensation in case of chargebacks. |

Response example: directDebitOrder via Sips Office JSON

{

"authorisationId":"32100000010020171016",

"acquirerResponseCode":"00",

"complementaryCode":"00",

"responseCode":"00",

"transactionDateTime":"2017-10-16T16:14:06+02:00",

"holderAuthentStatus":"NO_AUTHENT",

"scoreProfile":"10_GONOGO_PRE_AUTHORISATION",

"maskedPan":"SOGEFRPPXXX/FR7630003005050005001582616",

"captureLimitDate":"20171018",

"transactionActors":"BTOC",

"mandateId":"000000000000000031",

"valueDate":"20171018",

"s10TransactionReference":

{

"s10TransactionId":"10",

"s10TransactionIdDate":"20171016"

},

"transactionReference":"SIM20171016161311",

"seal":"d87ab3c1fac4d3eb53cdf3fb02d31b9da7483cb72898b4c639eeb1b52ed5a708",

"preAuthorisationProfile":"10_GONOGO_PRE_AUTHORISATION",

"preAuthorisationProfileValue":"unknown",

"captureDay":2,

"captureMode":"AUTHOR_CAPTURE",

"transactionPlatform":"PROD",

"secureReference":"SF_16957"

}Implementing SDD recurring payments

SEPA direct debits are perfectly suited for recurring payments. Compared to recurring card payments, they do not have any constraint on the expiry of the means of payment, nor do they have any amount limit linked to the card authorisation limit. There are two ways of implementing SDD recurring payments:

- “basic” recurring payment

- subscription payment

“Basic” recurring payments

Implementing recurring payments is done in two steps:

- the debtor signs their mandate

- you submit a direct debit request on each instalment

Having the mandate signed

In order to have your customer sign an online mandate:

- either you use the Sips Paypage connector. Please follow instructions in chapter Making an SDD payment with Sips Paypage

- or you use the Sips Office connector. Please follow

instructions in chapter Making a payment with

Sips Office

- initialise the mandate using the initializeMandate method

- redirect the customer to the mandate signature pages

- finalise the mandate creation using the finalizeMandate method

Whatever connector you choose, the paymentMeanData.sdd.mandateUsage has to be populated with RECURRENT. You must keep the value of the mandateId field, to resubmit this value during recurring direct debit requests.

Submitting direct debit requests

In order to trigger your customer’s direct debit:

- either you use the Sips Office connector. Please

follow instructions in chapter Making an SDD payment

with Sips Office:

- charge your customer from the mandate number, using the directDebitOrder method

- charge your customer from the transaction reference (created when signing the mandate), using the duplicate method

- or you use the Sips Office Batch connector:

- charge your customer from the mandate number, using the directDebitOrder method

- or charge your customer from the transaction reference (created when signing the mandate), using the duplicate method

Recurring subscription payments

SDD payment using a subscriber ID is described in the subscription payment guide.

Managing your SDD transactions

Available cash operations

The following operations are available on SDD transactions:

| Cash management | ||

|---|---|---|

| Cancellation | V | The SDD can be cancelled via Sips Office or

Sips Office Extranet; no field specific to this mean of payment

is to be sent. The cancellation must take place before the

bank deposit order and it is your responsibility to check that the

deposit has not been implemented. |

| Validation | V | During the validation of a SDD transaction,

the submission date of the direct debit created during the

validation of the SDD transaction is returned in the

captureLimitDate field. In accordance with SEPA

regulations, it is your responsibility to present this date to the

customer. |

| Refund | V | The SDD reimbursement with Sips Office or

Sips Office Extranet generates a SCT. It is not possible to

make multiple reimbursements on the same SDD. An unlimited refund (higher

than the original amount) is not authorised. The

potential chargebacks on refund appear in the chargebacks

report. |

| Duplication | V | The SDD can be duplicated via Sips Office or

Sips Office Extranet. No field specific to this mean of payment

is to be sent. In accordance with SEPA regulations, it is

your responsibility to present to the customer the direct debit

date created by duplication. |

| SDD transaction abandonment | V | The mandate revocation operation is available only with Sips Office Extranet. This operation induces the abandonment of all transactions planned and not already remitted without any other action required from your side. |

| Credit | X | |

The diagram below informs you which cash management operation is available when a transaction is in a given state:

Viewing your SDD transactions

Reports

The reports provided by Worldline Sips allow you to have a comprehensive and consolidated view of your transactions, cash operations, accounts and chargebacks. You can use this information to improve your information system.

The availability of SDD transactions for each type of report is summarised in the table below:

| Reports availability | |

|---|---|

| Transactions report | V |

| Operations report | V |

| Reconciliations report | V |

| Chargebacks report | V |

The minimum reports versions for the SafeDebit option are :

- Transaction Report : TAB20_V18

- Operation Report : TAB20_V9

Sips Office Extranet

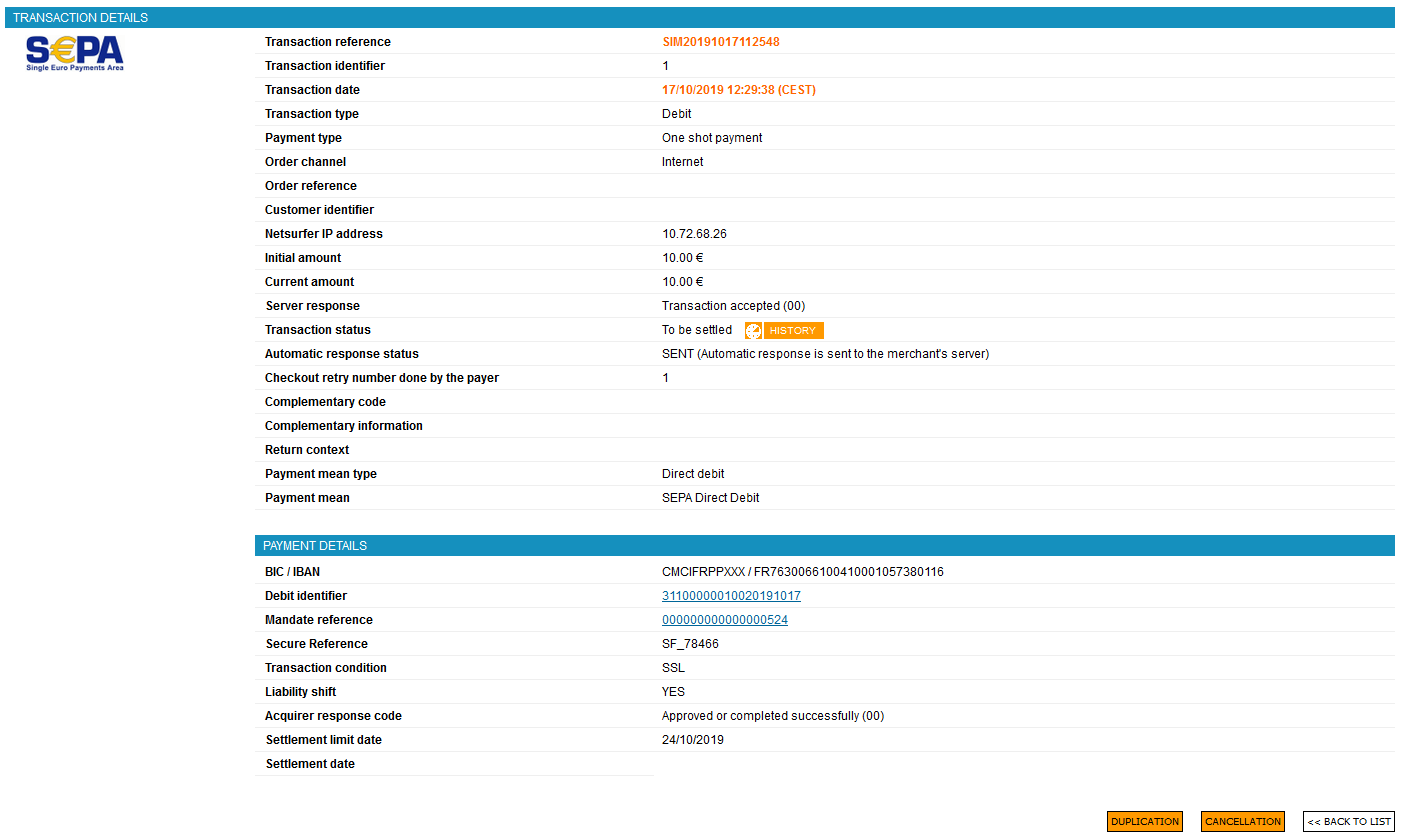

You can view your SDD transactions and perform various cash management operations with Sips Office Extranet.

The field Liability shift is valued at YES if the SEPA direct debit is guaranteed and at NO if it isn't. It remains empty if not applicable.

Managing your mandates via Sips Office

Searching for mandates

You can search for all the mandates of a given customer if the customer ID was provided during the mandate creation (when calling "initializeMandate" on Sips Office or when requesting payment on Sips Paypage).

searchMandate request

| Field name | Remarks/rules |

|---|---|

| customerId |

A example of a searchMandate request is available on this page.

searchMandate response

| Field name | Remarks/rules |

|---|---|

| mandateResponseCode | |

| mandateList |

Returned mandate data (mandateList):

| Field name | Remarks/rules |

|---|---|

| bic | |

| iban | French IBAN are composed of 27 digits. |

| mandateLastUpdateDate | |

| mandateCreationDate | |

| mandateId | |

| mandateSignatureDate | |

| mandateStatus | |

| mandateUsage | |

| transactionActors | |

| mandateSecureReference | Related to the SafeDebit option |

| riskyMandate | Y or N. Related to the SafeDebit option |

A example of a searchMandate response is available on this page.

Retrieving a mandate PDF format

You can retrieve the PDF content using Sips Office to offer customers the direct download from your website for example.The getPdfMandate method is used to retrieve the PDF content in a base64 encoded format. It must then be decoded to build the PDF file.

getPdfMandate request

| Field name | Remarks/rules |

|---|---|

| mandateId |

A example of a getPdfMandate request is available on this page.

getPdfMandate response

| Field name | Remarks/rules |

|---|---|

| mandateResponseCode | |

| mandatePdf |

A example of a getPdfMandate response is available on this page.

Implementation example to decode the getPdfMandate response

The example below is coded in JAVA and can be used to build an HTTP response to offer customers to download a PDF file from the received mandatePdf field:

byte[] decodedBytes = Base64.decodeBase64(%MANDATE_PDF_RECEIVED%).getBytes("UTF-8"));

response.setContentType("application/pdf");

response.setHeader("Content-disposition", "attachment; filename=MandatePDFFile.pdf");

try (final ByteArrayInputStream in = new ByteArrayInputStream(decodedBytes);

final OutputStream out = response.getOutputStream()) {

final byte[] buffer = new byte[4096];

int length;

while ((length = in.read(buffer)) > 0) {

out.write(buffer, 0, length);

}

}Getting mandate data

You can get the global data of a particular mandate. These are mandate specific data (status, IBAN, BIC, etc.), data related to the customer who created the mandate, as well as the list of transactions associated with this mandate, if applicable.

getMandateData request

| Field name | Remarks/rules |

|---|---|

| mandateId |

A example of a getMandateData request is available on this page.

getMandateData response

Data related to the mandate and the client:

| Field name | Remarks/rules |

|---|---|

| mandateResponseCode | |

| acquirerResponseCode | |

| mandateId | |

| mandateCreationDate | |

| mandateLastUpdateDate | |

| mandateSignatureDate | |

| mandateUsage | ONE_OFF|RECURRENT |

| mandateStatus | |

| bic | |

| debtorName | |

| iban | French IBAN are composed of 27 digits. |

| transactionActors | BTOB|BTOC|BTOF |

| directDebitList | |

| customerContact.email | |

| customerContact.gender | |

| customerContact.mobile | |

| customerContact.legalId | |

| customerContact.positionOccupied | |

| customerAddress.city | |

| customerAddress.country | |

| customerAddress.street | |

| customerAddress.street Number | |

| customerAddress.zipCode | |

| customerAddress.company | |

| customerAddress.businessName |

Returned debit data (mandateList):

| Field name | Remarks/rules |

|---|---|

| amount | |

| dueDate | |

| directDebitCreationDate | |

| directDebitStatus |

A example of a getMandateData response is available on this page.