Introduction

Worldline Sips is a secure multi-channel e-commerce payment solution that complies with the PCI DSS standard. It allows you to accept and manage payment transactions by taking into account business rules related to your activity (payment upon shipping, deferred payment, recurring payment, payment in instalments, etc.).

The purpose of this document is to explain the Cofidis Pay 5X 10X 20X means of payment integration integration into Worldline Sips.

Who does this document target?

This document is intended to help you implement the Cofidis Pay 5X 10X 20X means of payment integration on your e-commerce site.

It includes:

- functional information for you

- implementation instructions for your technical team

To get an overview of the Worldline Sips solution, we advise you to consult the following documents:

- Functional presentation

- Functionality set-up guide

Understanding CofidisPay-5X10X20X payments with Worldline Sips

General principles

CofidisPay-5X10X20X is an online shopping financing solution offered by Cofidis. This is a revolving credit to pay in several instalments, but also in cash.

With this solution, customers benefit from a deferred payment up to 45 days and pay for purchases without having to transmit their credit card number.

The principle of CofidisPay-5X10X20X payment is based on the virtual account use for purchases. The online creation of this virtual account is done during the first payment (personal data entry and guarantee on the credit card).

For the following purchases, the use of this account is authenticated by login credentials.

Acceptance rules

Available functionalities

| Payment channels | ||

|---|---|---|

| Internet | V | Default payment channel |

| MOTO | X | |

| Fax | X | |

| IVS | X | |

| Means of payment | ||

|---|---|---|

| Immediate payment | X | |

| End-of-day payment | V | |

| Deferred payment | V | |

| Payment upon shipping | V | |

| Payment in instalments | X | |

| Subscription payment | X | |

| Batch payment | X | |

| OneClick payment | X | |

| Currency management | ||

|---|---|---|

| Multicurrency acceptance | X | EUR (978) only |

| Currency settlement | X | EUR (978) only |

Payment path

Two paths are available for customers:

- the "Already a customer" path (the customer has an account).

- the "Prospect" path (the customer creates his account, which implies a longer payment process).

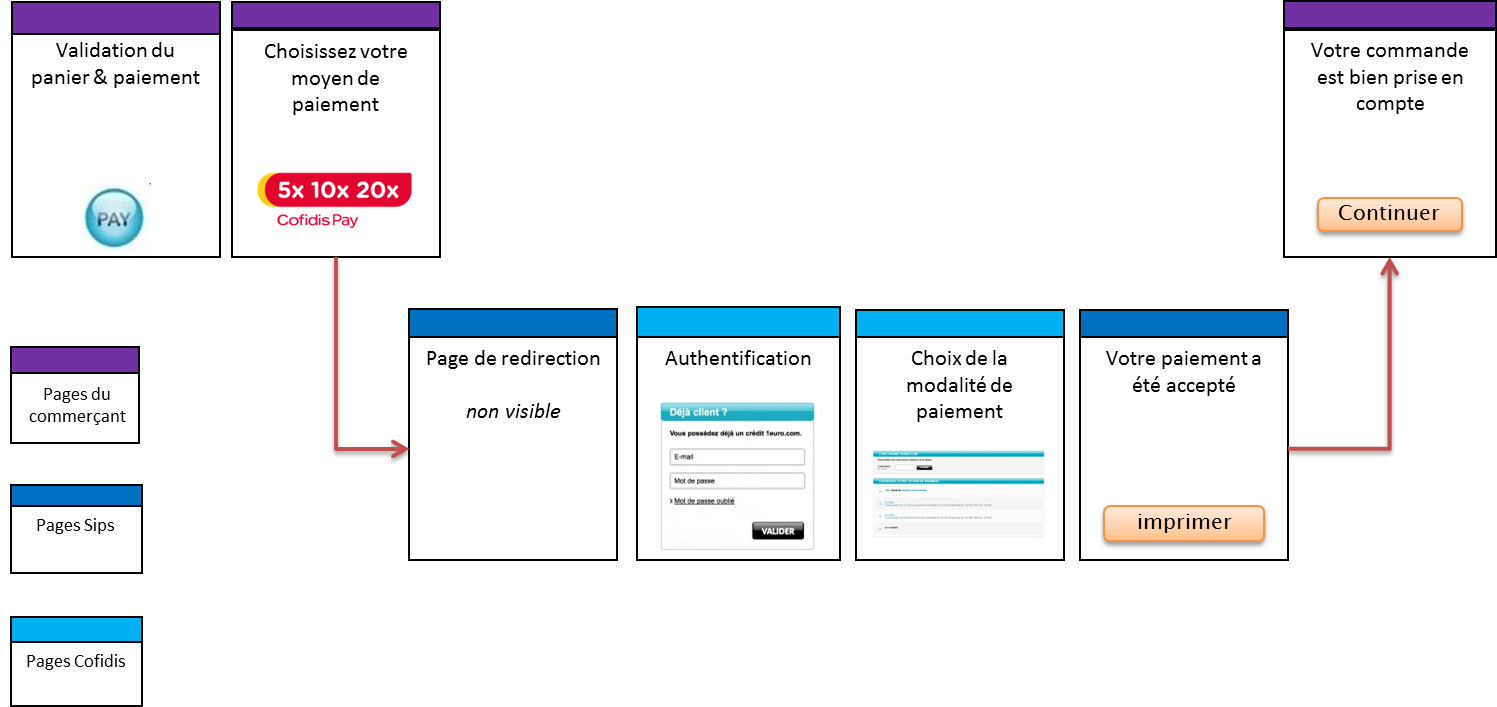

"Already a customer" path

| Pages | Steps |

|---|---|

| Merchant | Cart validation |

| Merchant or Worldline Sips | Mean of payment selection (here on the merchant website). |

| Worldline Sips | The customer is automatically redirected to the Worldline Sips platform to initiate the transaction. The Worldline Sips platform can display the "mean of payment choice" page to the customer. |

| Cofidis | The customer authenticates with virtual account identifiers. |

| Cofidis | Mean of payment choice (cash, 5 instalments, 10 instalments, etc). |

| Worldline Sips | Ticket presentation |

| Merchant | The customer is redirected to the merchant website. |

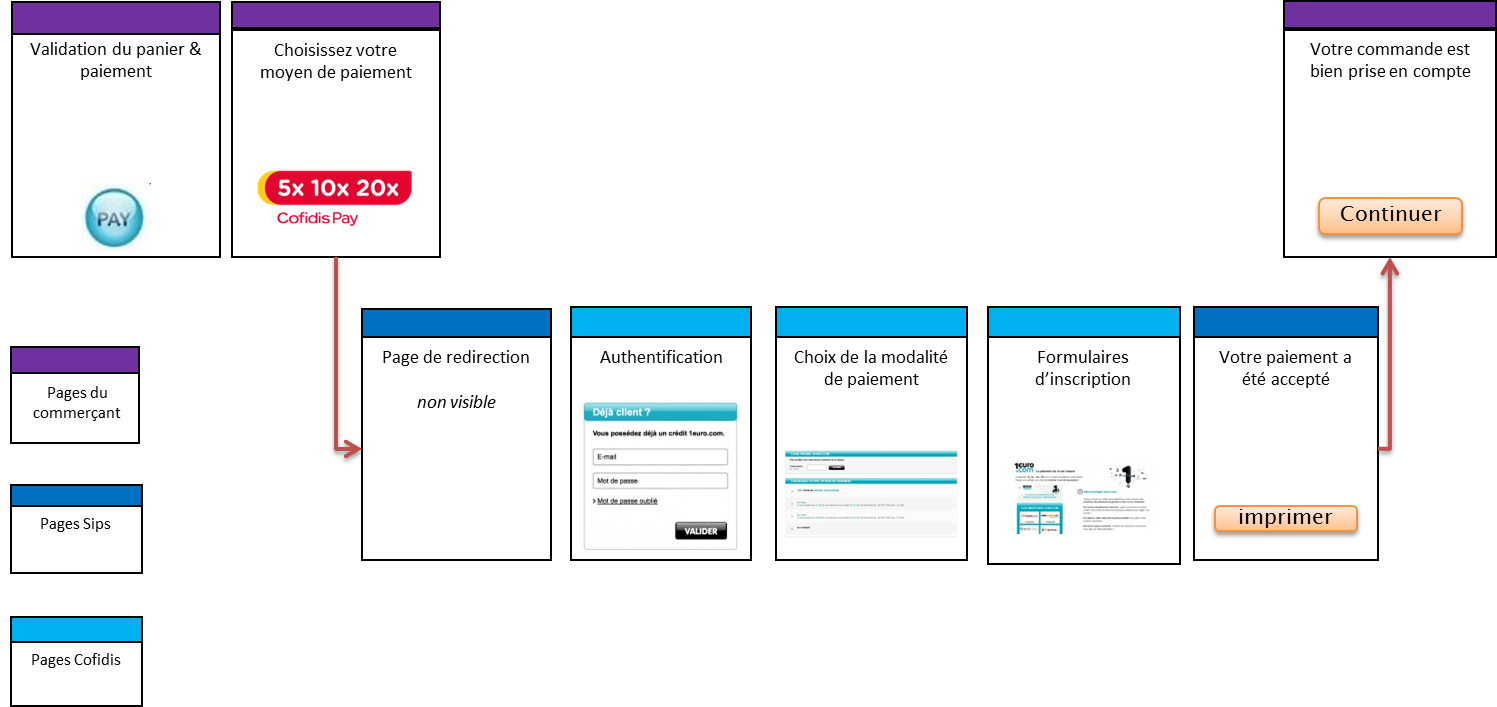

"Prospect" path

| Pages | Steps |

|---|---|

| Merchant | Cart validation |

| Merchant or Worldline Sips | Mean of payment selection (here on the merchant website). |

| Worldline Sips | The customer is automatically redirected to the Worldline Sips platform to initiate the transaction. The Worldline Sips platform can display the the "mean of payment choice" page to the customer. |

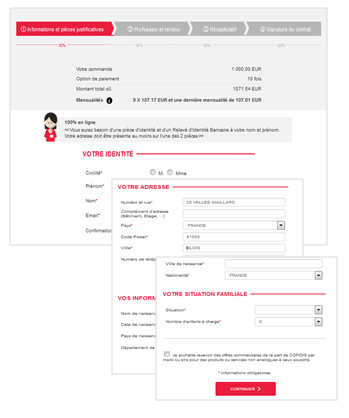

| Cofidis | The customer chooses the prospect path. |

| Cofidis | Mean of payment choice (cash, 5 instalments, 10 instalments, etc). |

| Cofidis | The customer populates his personal data (3 pages). |

| Cofidis | The customer populates his bank details. |

| Cofidis | Contract presentation for validation. |

| Worldline Sips | Ticket presentation |

| Merchant | The customer is redirected to the merchant website. |

Payment pages

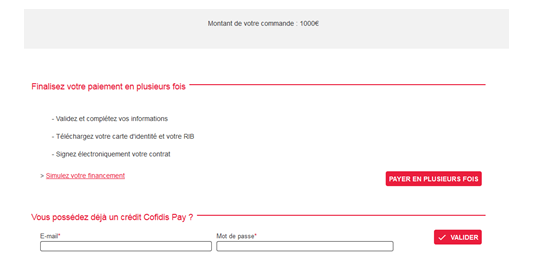

The customer selects the CofidisPay-5X10X20X means of payment.

They are then redirected to the login page:

Once connected, the payment option selection page is displayed:

The payment ticket is displayed, then the customer returns to your website:

Signing your CofidisPay-5X10X20X acceptance contract

In order to offer the CofidisPay-5X10X20X means of payment on your website, you have to sign an acceptance contract with Cofidis. Thereafter, you transmit us the contract number for recording in our information system.

Making a CofidisPay-5X10X20X payment

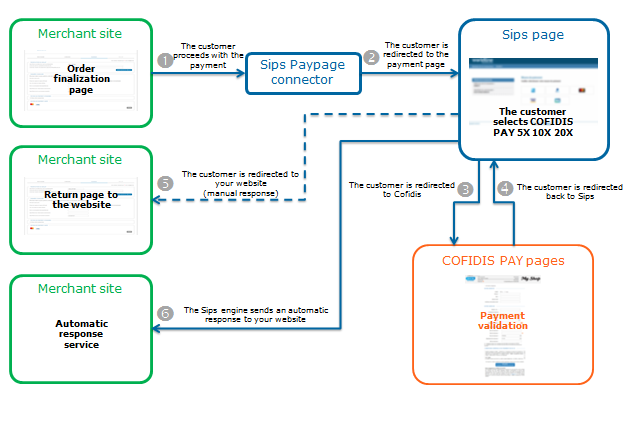

You can offer the CofidisPay-5X10X20X mean of payment through the Sips Paypage which directly acts as the payment interface with customers via their web browser.

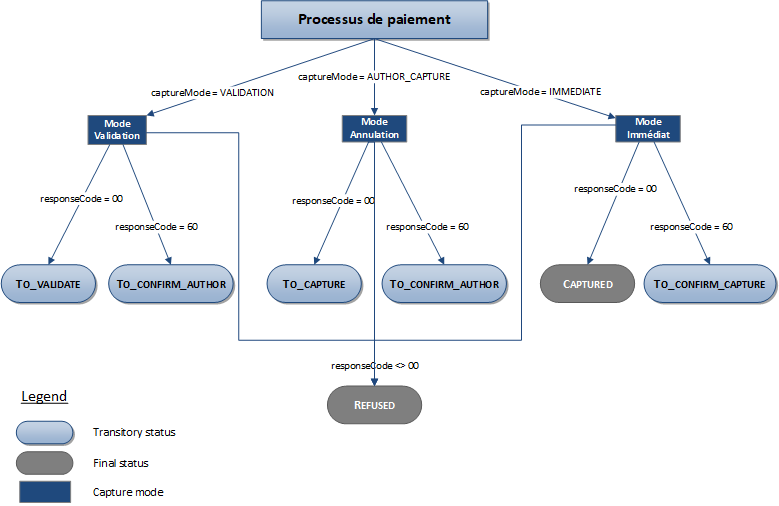

The remittance modes available for a CofidisPay-5X10X20X transaction are:

- Cancellation mode: default mode allowing transaction remittance on a predefined date, called capture delay. When this capture delay is reached, the remittance is sent automatically. This delay is set via the captureDay field with its 0 default value (end-of-day payment).

- Validation mode: you must validate the transaction to trigger the remittance. A capture delay must also be defined. When this capture delay is reached or exceeded, you will not be able to validate the transaction, which will therefore expire automatically.

- Immediate mode: the authorisation and remittance are executed online simultaneously.

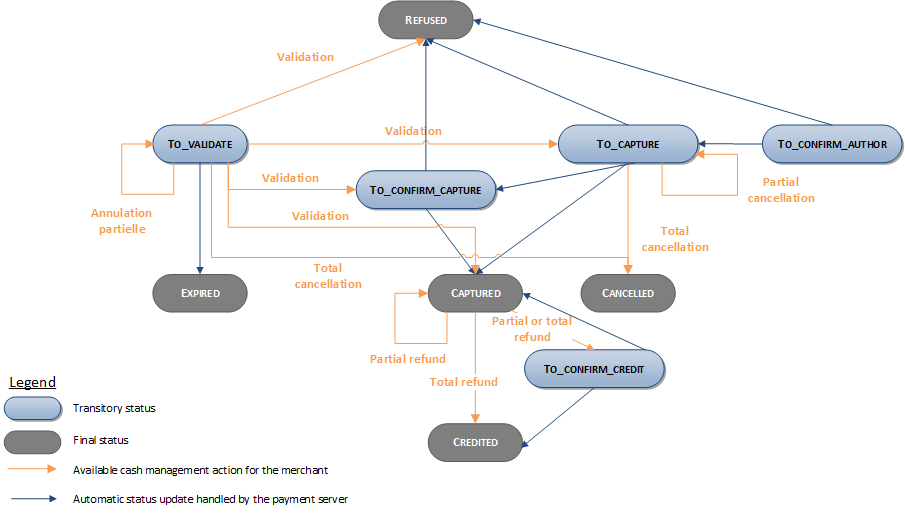

The diagram below explains the different transaction statuses according to the chosen capture mode:

Making a CofidisPay-5X10X20X payment with Sips Paypage

The payment process for Sips Paypage is described below:

Setting the payment request

This part lists all the data exchanged between the various actors (merchant, Worldline Sips, Cofidis) during a CofidisPay-5X10X20X payment request.

Some fields that you have populated allow to pre-fill the form hosted by Cofidis.

| Field name | Remarks/rules |

|---|---|

| paymentPattern | Tհe value sent in the request is ignored. The payment

type is forced to ONE_SHOT. |

| orderId | Mandatory (15 alphanumeric characters maximum) |

| amount | Formated in cents 9 digits maximum |

paymentMeanData.unEuroCom.preScoreValue |

Optional (N7): Your preliminary risk scoring on the

transaction. Setting a value in this field must be done

in accordance with Cofidis. |

customerIpAddress |

Optional. Customer IP address. |

customerContact |

Mandatory. Cf. the tables below for more

details. |

| customerId | Optional. (15 characters maximum) Customer identifier. |

| customerData | Optional. Cf. the tables below for more

details. |

| customerAddress | Optional. Cf. the tables below for more

details. |

| customerLanguage | Allows to choose the language used on Worldline Sips and Cofidis pages. |

| shoppingCartDetail | Optional. Cf. the tables below for more

details. |

| deliveryData | Optional. Cf. the tables below

for more details. |

| deliveryContact | Optional. Cf. the tables below

for more details. |

| customerAccountHistoric | Optional. Cf. the tables below

for more details. |

| travelData | Optional. Cf. the tables below

for more details. |

customerContact

| Field name | Remarks/rules |

|---|---|

| customerContact.title | Customer's title (MR, MRS or MISS) |

| customerContact.firstname | Customer's first name (32 characters maximum) |

| customerContact.lastname | Customer's name (32 characters maximum) |

| customerContact.phone | Landline number (10 numeric characters maximum) |

| customerContact.mobile | Mobile phone number (10 numeric characters maximum) |

| customerContact.email | E-mail address |

customerData

| Field name | Remarks/rules |

|---|---|

| customerData.birthDate | Birth date |

| customerData.birthZipCode | Birth province (32 characters maximum) |

| customerData.birthCity | Birthplace |

| customerData.birthCountry | Country of birth |

| customerData.nationalityCountry | Country of nationality |

| customerData.maidenName | Maiden name (32 characters maximum) |

customerAddress

| Field name | Remarks/rules |

|---|---|

customerAddress.streetNumber |

Street number (5 numeric characters maximum) |

| customerAddress.street | Street name (40 characters maximum) |

| customerAddress.streetAdditional1 | Addition to the address (32 characters maximum) |

| customerAddress.zipCode | Postal code (5 characters maximum) |

| customerAddress.city | City (32 characters maximum) |

| customerAddress.country | Country code |

| customerAddress.postBox | Post box for the address (8 characters maximum) |

| customerAddress.state | Country/region of the address |

shoppingCartDetail

| Field name | Remarks/rules |

|---|---|

| shoppingCartDetail.shoppingCartTotalQuantity | Total quantity of all products in the basket (2 numeric characters maximum) |

| shoppingCartDetail.discountAmount | 1 if a discount has been made, 0 else |

| shoppingCartDetail.shoppingCartItemList.itemX.productUnitAmount | Unit amount of the product |

| shoppingCartDetail.shoppingCartItemList.itemX.productDescription | Detailed description of the ordered product |

| shoppingCartDetail.shoppingCartItemList.itemX.productCategory | Category of the ordered product (20 characters maximum) |

| shoppingCartDetail.shoppingCartItemList.itemX.productCode | Ordered product code (15 characters maximum) |

| shoppingCartDetail.shoppingCartItemList.itemX.productQuantity | Product quantity in the cart (3 numeric characters maximum) |

| shoppingCartDetail.shoppingCartItemList.itemX.productName | Ordered product name (20 characters maximum) |

deliveryData

| Nom du champ | Remarques / règles |

|---|---|

| deliveryData.deliveryChargeAmount | Total charge of the order delivery (7 numeric characters maximum) |

| deliveryData.deliveryMethod | 1 – Withdrawal at the merchant 2 – Network of withdrawal points 3 - Withdrawal at a train station, an airport, a travel agency 4 – Carrier (eg. La poste, Colissimo, UPS, private carrier) 5 – Electronic ticket 6 – Locker, pick-up point without identity check 7 – autre |

| deliveryData.deliveryMode | S - Strandard E – Express I – Immediate O - Other |

| deliveryData.deliveryOperator | Delivery provider (50 characters maximum) |

deliveryAddress

| Nom du champ | Remarques / règles |

|---|---|

deliveryAddress.streetNumber |

Number of the street of the address (5 numeric characters maximum) |

| deliveryAddress.street | Name of the street of the address (40 characters maximum) |

| deliveryAddress.streetAdditional1 | Addition to the address (32 characters maximum) |

| deliveryAddress.zipCode | Postal code for the address (5 characters maximum) |

| deliveryAddress.city | City (32 characters maximum) |

| deliveryAddress.country | Coutry code |

| deliveryAddress.postBox | Post box for the address (8 characters maximum) |

| deliveryAddress.state | Country/region of the address |

deliveryContact

| Nom du champ | Remarques / règles |

|---|---|

| deliveryContact.mobile | Mobile phone number for the contact (15 characters maximum) |

travelData

| Nom du champ | Remarques / règles |

|---|---|

| travelData.stayDataList.stayDataX.stayDepartureDateTime | Departure date of stay |

| travelData.stayDataList.stayDataX.stayArrivalDateTime | Arrival date of stay |

| travelData.stayDataList.stayDataX.stayCategory | Nature of service for the stay |

| travelData.stayDataList.stayDataX.stayLocation | Country code |

customerAccountHistoric

| Nom du champ | Remarques / règles |

|---|---|

| customerAccountHistoric.creationDate | Customer registration date on merchant site |

| customerAccountHistoric.firstPurchaseDate | First customer purchase date |

| customerAccountHistoric.lastPurchaseDate | Last customer purchase date |

| customerAccountHistoric.numberOfPurchase180Days | Number of purchases made on the customer's account via the merchant site over the last six months (last 180 days) (2 numeric characters maximum) |

| customerAccountHistoric.numberOfTransactionYear | Number of accepted or abandoned transactions in the last year on the merchant's customer account. (2 numeric characters maximum) |

Analysing the response

The following table summarises the different response cases to be processed:

| Status | Response fields | Action to take |

|---|---|---|

| Payment accepted | acquirerResponseCode = 00

paymentMeanBrand =

1EUROCOMpaymentMeanType =

ONLINE_CREDITpaymentMeanData.unEuroCom.settlementMode

= code of the means of payment selected by the

customer.responseCode =

00 |

You can deliver the order. |

| Acquirer refusal | acquirerResponseCode = (cf.

the Data Dictionary).responseCode =

05 |

The authorisation is refused for a reason unrelated to

fraud. If you have not opted for the "new payment attempt"

option (please read the Functionality

set-up Guide for more details), you can suggest that your

customer pay with another means of payment by generating a new

request. |

| Refusal due to the number of attempts reached | responseCode = 75 |

The customer has made several attempts that have all failed. |

| Refusal due to a technical issue | acquirerResponseCode = 90-98

responseCode = 90,

99 |

Temporary technical issue when processing the transaction. Suggest that your customer redo a payment later. |

For the complete response codes (responseCode) and acquirer response

codes (acquirerResponseCode), please refer

to the Data dictionary.

Making a CofidisPay-5X10X20X payment with Sips Office

The CofidisPay-5X10X20X means of payment acceptance is not available through the Sips Office solution.

Managing your CofidisPay-5X10X20X transactions

Available cash operations

The following operations are available on CofidisPay-5X10X20X transactions:

| Cash management | ||

|---|---|---|

| Cancellation | V | |

| Validation | V | |

| Refund | V | |

| Duplication | X | |

| Credit | X | |

The diagram below explains which cash management operation is available when a transaction is in a given status:

Viewing your CofidisPay-5X10X20X transactions

Reports

The reports provided by Worldline Sips allow you to have a comprehensive and consolidated view of your transactions, cash operations, accounts and chargebacks. You can use this information to improve your information system.

The availability of Cofidis Pay 5X 10X 20X transactions for each type of report is summarised in the table below:

| Reports availability | |

|---|---|

| Transactions report | V |

| Operations report | V |

| Reconciliations report | X |

| Chargebacks report | X |

Sips Office Extranet

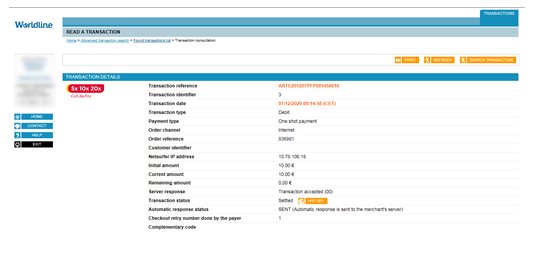

You can view your CofidisPay-5X10X20X transactions and perform various cash management operations with Sips Office Extranet.

Here are the details of an CofidisPay-5X10X20X transaction: