Introduction

Worldline Sips is a secure multi-channel e-commerce payment solution that complies with the PCI DSS standard. It allows you to accept and manage payment transactions by taking into account business rules related to your activity (payment upon shipping, deferred payment, recurring payment, payment in instalments, etc.).

The purpose of this document is to explain the Presto means of payment integration integration into Worldline Sips.

Who does this document target?

This document is intended to help you implement the Presto means of payment integration on your e-commerce site.

It includes:

- functional information for you

- implementation instructions for your technical team

To get an overview of the Worldline Sips solution, we advise you to consult the following documents:

- Functional presentation

- Functionality set-up guide

Understanding Presto payments with Worldline Sips

General principles

Cetelem, a brand of BNP Paribas Personal Finance, is a French financial institution specialising in financing individuals consumer credit activities.

The Presto means of payment, offered by BNP Paribas Personal Finance (BNPP PF), allows to make online purchases on credit.

During a Presto payment, the customer is redirected to the BNPP PF credit file opening application. Having completed the entry, they are informed online of the credit request application result.

Acceptance rules

Available functionalities

| Payment channels | ||

|---|---|---|

| Internet | V | Default payment channel |

| MOTO | X | |

| Fax | X | |

| IVS | X | |

| Means of payment | ||

|---|---|---|

| Immediate payment | V | Default method |

| End-of-day payment | X | |

| Deferred payment | X | |

| Payment upon shipping | X | |

| Payment in instalments | X | |

| Subscription payment | X | |

| Batch payment | X | |

| OneClick payment | X | |

| Currency management | ||

|---|---|---|

| Multicurrency acceptance | X | EUR only |

| Currency settlement | X | EUR only |

Payment pages

The customer selects the Presto means of payment.

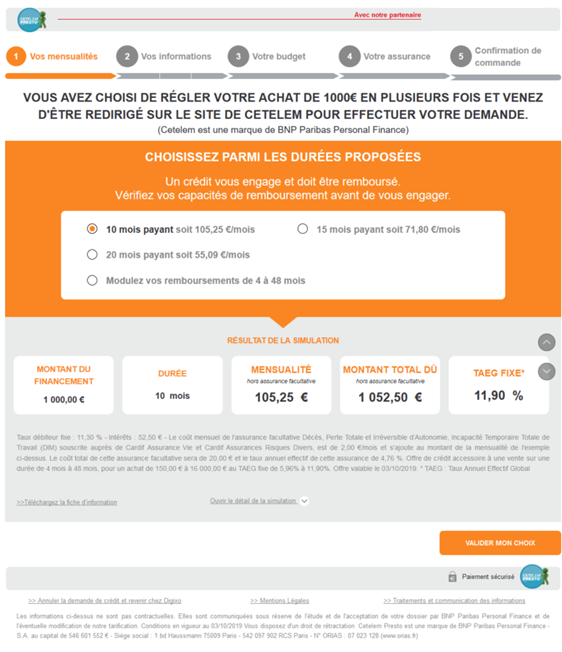

Once the means of payment has been selected, the payment option selection page is displayed as well as the refund simulation:

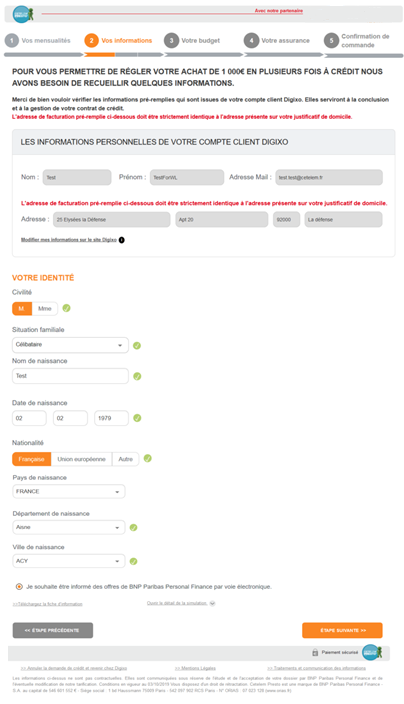

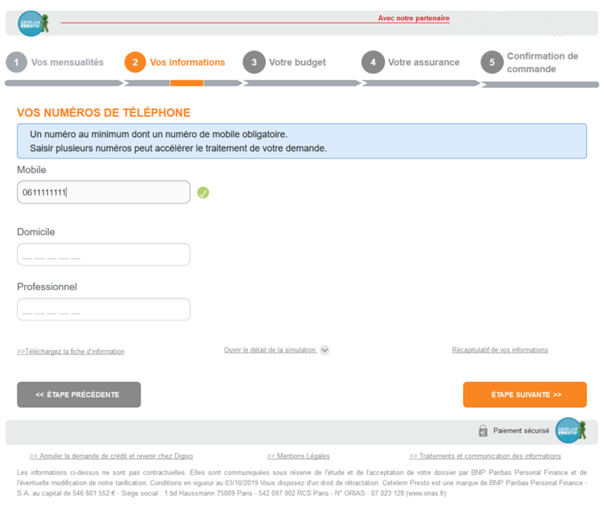

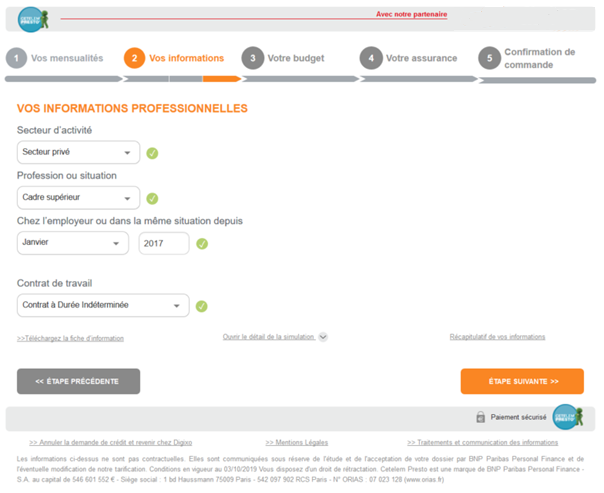

The customer must then enter the required information:

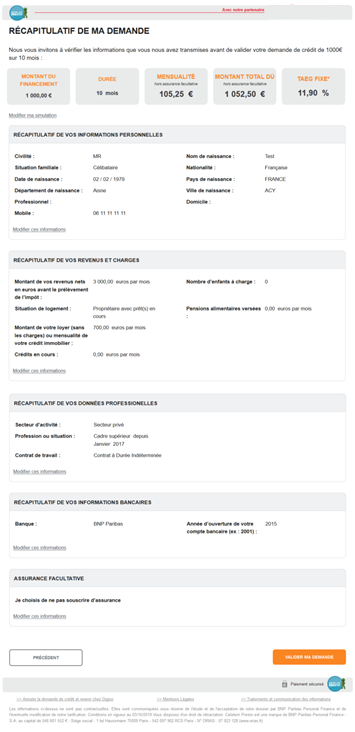

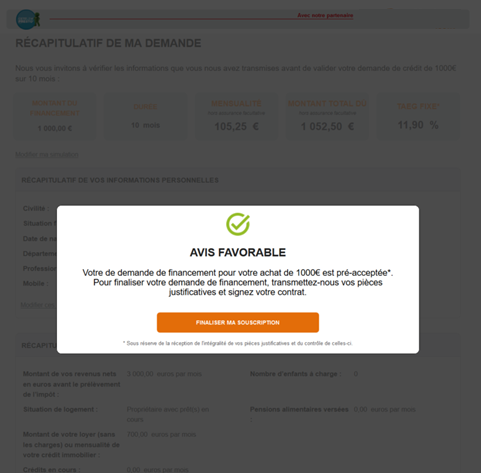

After providing the required information, the order confirmation page is displayed:

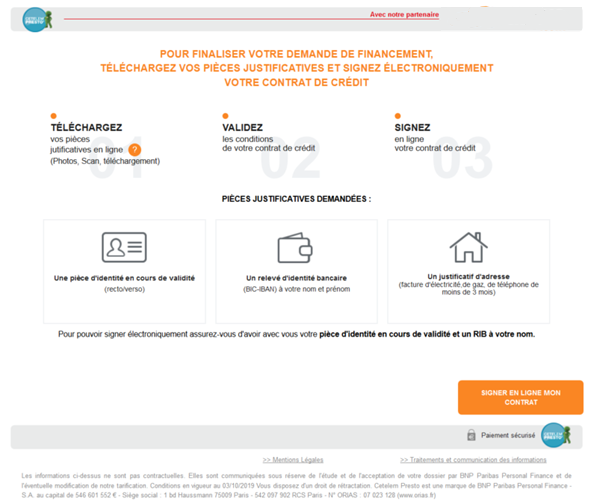

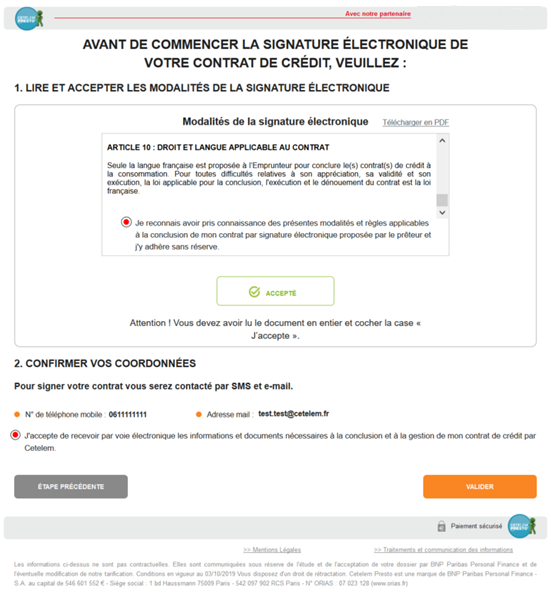

The customer must then sign electronically their contract:

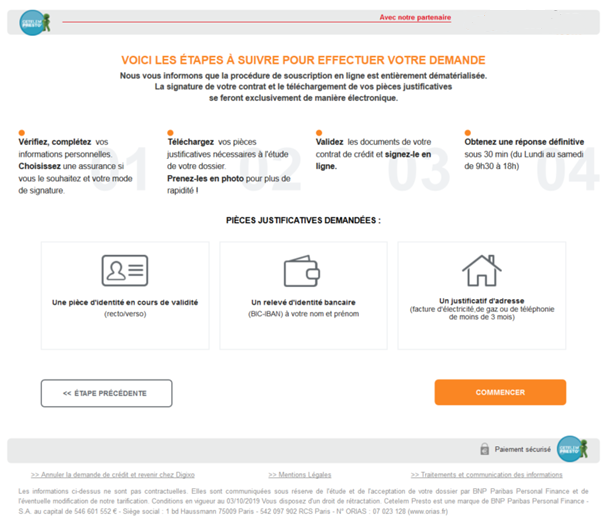

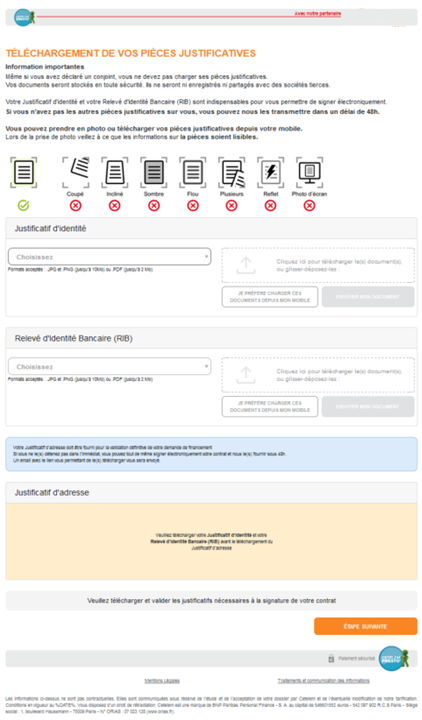

The customer must then upload the necessary documents:

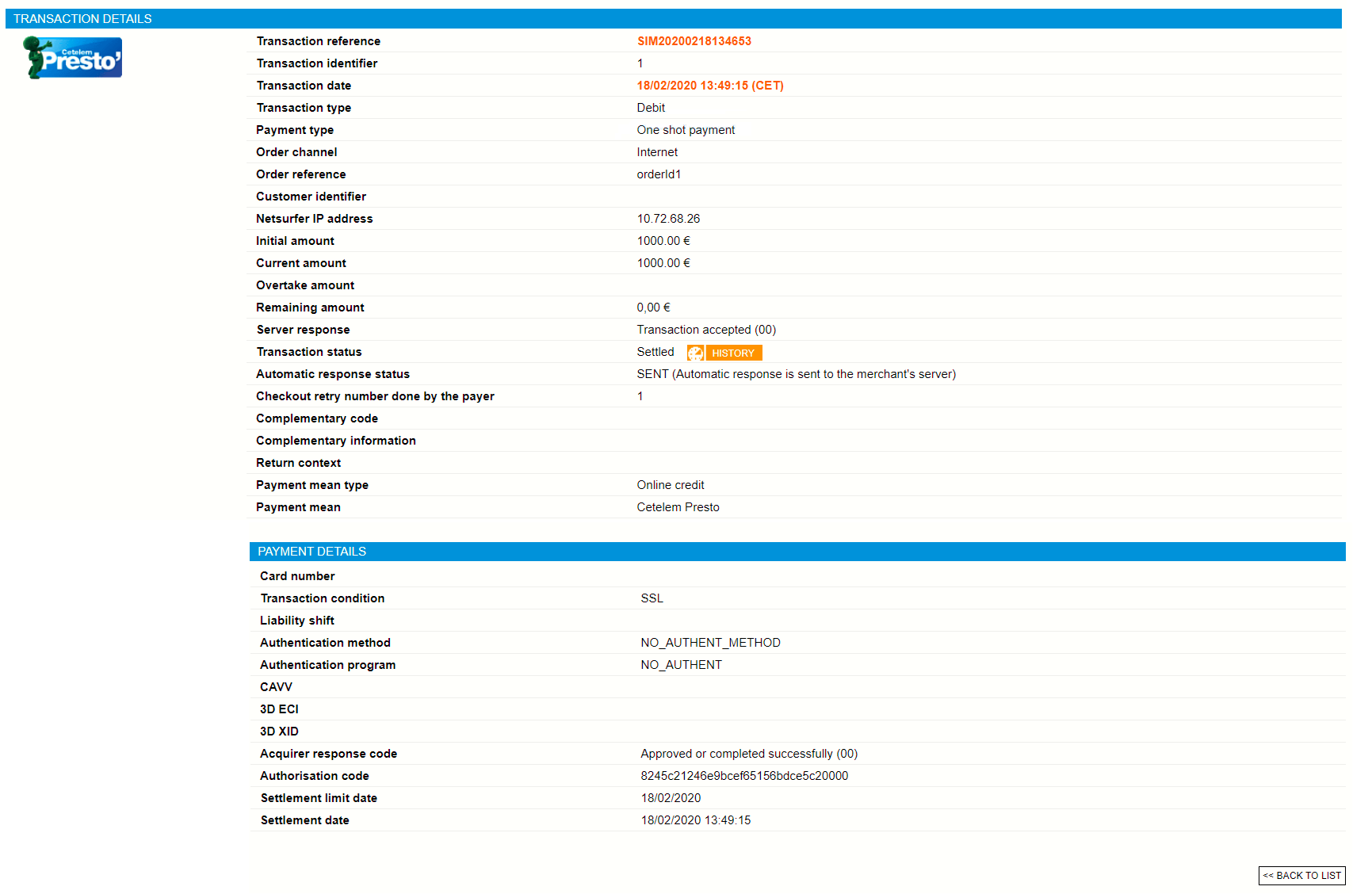

Transactions checkings

In the case of a Presto transaction, the credit can be automatically funded at the end of the payment, which is associated with the following final transaction status:

- CAPTURED

The customer credit request might also require a study before being approved. If a credit request is under validation by PBNPPF, the associated transaction status is:

- TO_CONFIRM_CAPTURE

A daily request from Worldline Sips to Celetem is performed to update these transactions to a final status:

- CAPTURED if the credit request is approved by BNPPF.

- CAPTURE_REFUSED if the credit request is refused by BNPPF, or if no update have been noted for 90 days.

Signing your Presto acceptance contract

In order to offer the Presto means of payment on your website, you have to sign an acceptance contract with BNP Paribas Personal Finance. Thereafter, you send us the contract number for us to store this number in our information system.

Making a Presto payment

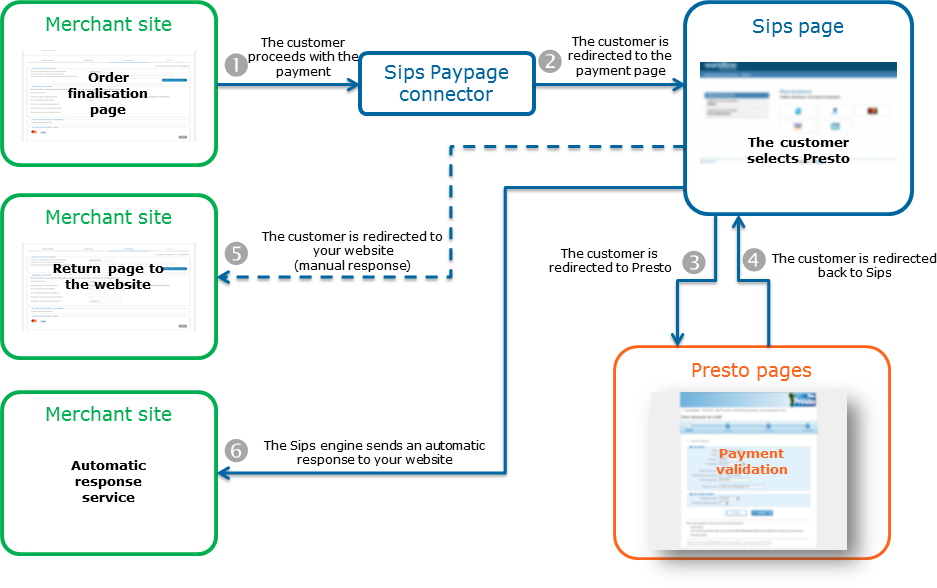

You can offer the Presto means of payment through Sips Paypage which directly acts as the payment interface with customers via their web browser.

For Presto payments, it is not allowed to defer the remittance, you cannot adjust the date of funds transfers.

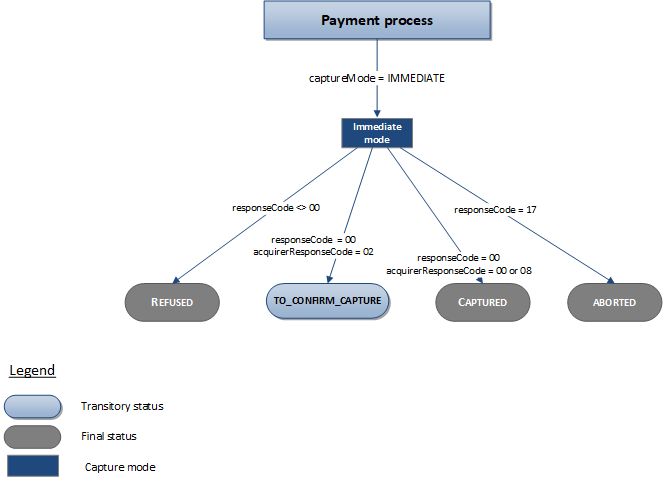

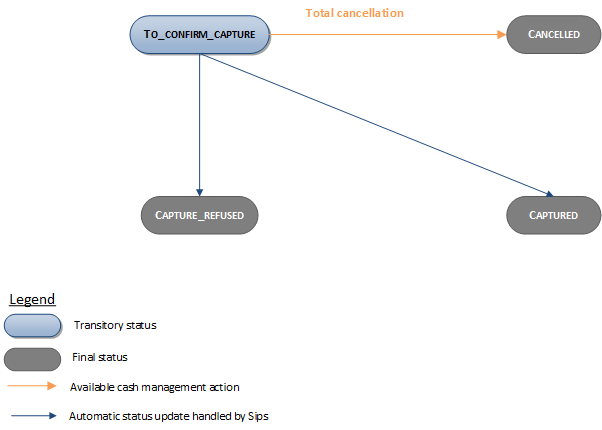

The diagram below explains the various transaction statuses according to the chosen capture mode:

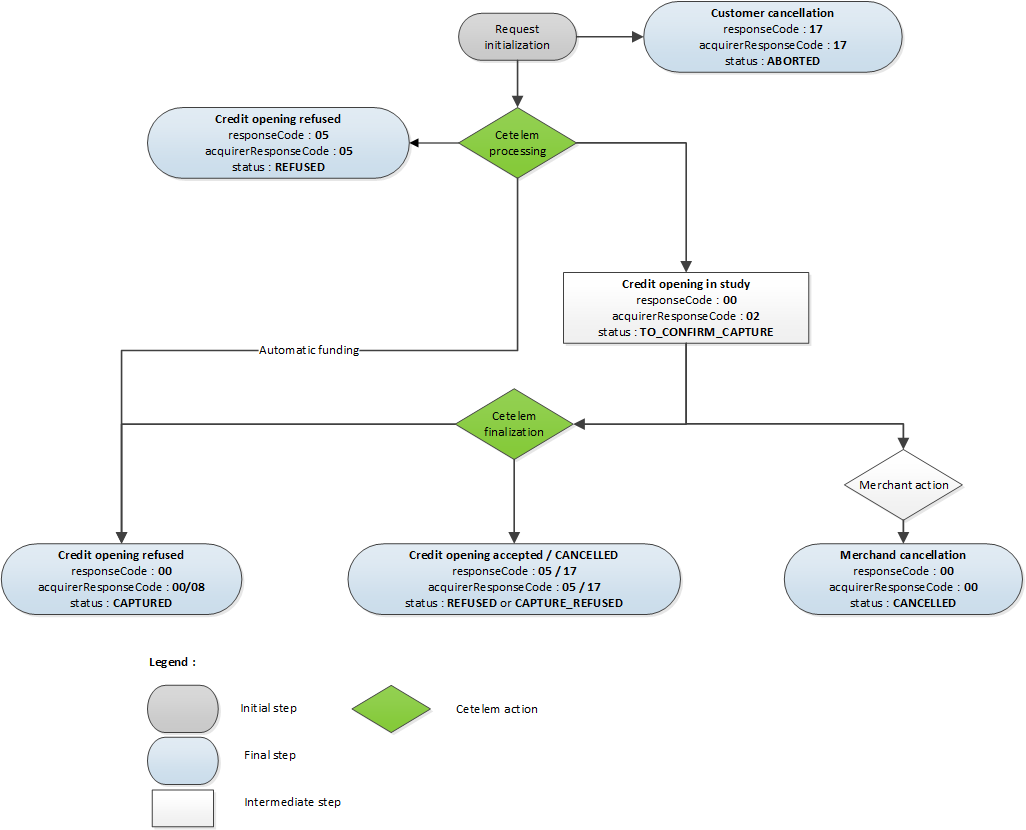

The diagram below describes the different statuses of a transaction, depending on the progress on Cetelem side.

Following a first processing on Cetelem side, a transaction can have 3 different statuses according to 3 reasons:

- Transaction refused by Cetelem (Final status REFUSED)

- Transaction under study at Cetelem (Intermediate status TO_CONFIRM_CAPTURE)

- Transaction accepted by Cetelem (Final status CAPTURED)

Transactions in a TO_CONFIRM_CAPTURE status are then processed by Cetelem before granting a final decision. This decision can take several days. Following this decision, the transaction may have two different statuses:

- Transaction refused by Cetelem (Final status CAPTURE_REFUSED)

- Transaction accepted by Cetelem (Final status CAPTURED)

During the time required for Cetelem to process the transaction, you have the option to request cancellation. In this case, the transaction will have the following status:

- Transaction cancelled by merchant (Final status CANCELLED)

Making a Presto payment with Sips Paypage

The payment process for Sips Paypage is described below:

Setting the payment request

The following fields have a particular behaviour:

| Field name | Remarks/rules |

|---|---|

| captureMode | Tհe value sent in the request is ignored. The capture

mode is forced to IMMEDIATE. |

| captureDay | Tհe value sent in the request is ignored. The capture

delay is forced to 0. |

| paymentPattern | Tհe value sent in the request is ignored. The payment

type is forced to ONE_SHOT. |

| orderId | Mandatory (13 alphanumeric characters

maximum) Customer purchase order identifier

|

| paymentMeanData.presto.paymentMeanCustomerId | Mandatory (21 alphanumeric characters

maximum) Customer reference |

| paymentMeanData.presto.financialProduct | Mandatory to populate with CLA |

| paymentMeanData.presto.prestoCardType | Optional |

shoppingCartDetail.mainProduct |

Mandatory |

customerContact |

Mandatory cf. the table below |

customerData |

Optional cf. the table below |

customerAddress |

Mandatory cf. the table below |

customerContact

| Field name | Remarks/rules |

|---|---|

| customerContact.title | Optional |

| customerContact.firstname | Mandatory (30 characters maximum) |

| customerContact.lastname | Mandatory (30 characters maximum) |

| customerContact.phone | Optional |

| customerContact.mobile | Optional |

| customerContact.email | Mandatory (49 characters maximum) |

customerData

| Field name | Remarks/rules |

|---|---|

| customerData.birthDate | Optional |

customerAddress

| Field name | Remarks/rules |

|---|---|

| customerAddress.addressAdditional1 | Mandatory (32 characters maximum) |

| customerAddress.addressAdditional2 | Optional |

| customerAddress.zipCode | Mandatory |

| customerAddress.city | Mandatory (30 characters maximum) |

Analysing the response

The following table summarises the different response cases to be processed:

| Status | Response fields | Action to take |

|---|---|---|

| Payment accepted | acquirerResponseCode = 00 or

08 authorisationId = (cf. the

Data Dictionary).paymentMeanBrand =

PRESTOpaymentMeanType =

ONLINE_CREDITresponseCode =

00 |

You can deliver the order. |

| Transaction under study | acquirerResponseCode = 02

authorisationId = (cf. the

Data Dictionary).paymentMeanBrand =

PRESTOpaymentMeanType =

ONLINE_CREDITresponseCode =

00 |

The customer credit request is under study

at Cetelem. You can wait for the final decision before

delivering the order or not. The result of the study is

checked daily, as explained above. |

| Acquirer refusal | acquirerResponseCode = (cf.

the Data Dictionary).responseCode =

05 |

The authorisation is refused for a reason unrelated to

fraud. If you have not opted for the "new payment attempt"

option (please read the Functionality

set-up Guide for more details), you can suggest that your

customer pay with another means of payment by generating a new

request. |

| Refusal due to the number of attempts reached | responseCode = 75 |

The customer has made several attempts that have all failed. |

| Refusal due to a technical issue | acquirerResponseCode = 90-98

responseCode = 90,

99 |

Temporary technical issue when processing the transaction. Suggest that your customer redo a payment later. |

For the complete response codes (responseCode) and acquirer response

codes (acquirerResponseCode), please refer

to the Data dictionary.

Making a Presto payment with Sips Office

The Presto means of payment acceptance is not available through the Sips Office solution.

Frequent error cases

Web merchant errors

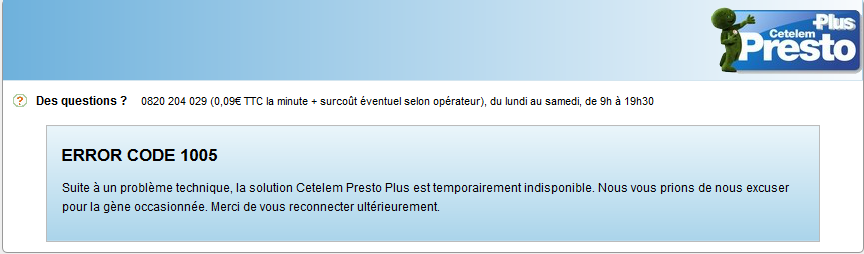

If the error is related to the data entered on the merchant side (financial product, etc.), the four-digit error code starts with 1XXX (1001 for example).

Check that the code of the financed property is properly set. This value is defined with Cetelem when the approval is opened.

Also check that your PrestoPlus payment request complies with the instructions described in this document.

Frequent errors:

- orderId not populated,

- paymentMeanData.presto.paymentMeanCustomerId not

populated.

Error cause Error code Description Merchant error 1003 Empty orderId field 1004 Empty paymentMeanData.presto.paymentMeanCustomerId field 1005 Equipment code length different from 3 characters 1006 Financial product code length different from 3 characters

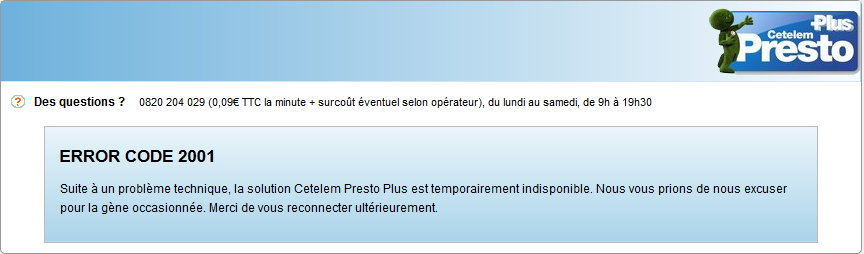

Worldline errors

If the error is related to the Worldline application, the four-digit error code begins with 2XXX (2001 for example).

Cetelem errors

If the error is related to the Cetelem application, the four-digit error code begins with 3XXX (3001 for example).

Equipment code management rules

The equipment code allows to associate a credit request with the property type. You have to determine the correspondence between the items in your catalogue and the BNP PF reference system (cf. the appendix).

List of equipment codes:

| Code | Field | Code | Field |

| 320 | Household – other | 616 | Computing |

| 322 | Refrigerator/Freezer | 619 | TV-HIFI group purchases |

| 323 | Dishwasher | 620 | Photo equipment |

| 324 | Washing machine | 621 | Telephony |

| 325 | Household group | 622 | Home cinema |

| 326 | Refrigerator | 623 | LCD screen / Plasma screen |

| 327 | Freezer | 624 | Camcorder |

| 328 | Stove/hob | 625 | Computer |

| 329 | Dryer | 626 | Printer/Scanner |

| 330 | Furniture – other | 631 | Holiday travels |

| 331 | Lounge | 640 | Clothing |

| 332 | Dining room | 650 | Books |

| 333 | Bedroom | 660 | Leisure – other |

| 334 | Sofa | 663 | DIY – gardening |

| 335 | Furniture group | 730 | Jewellery |

| 336 | Armchair | 737 | Shutter |

| 337 | Library/Wardrobe | 738 | Lawnmower |

| 338 | Bedding | 739 | Cultivator |

| 339 | Bedroom | 740 | Chainsaw |

| 340 | Soft furnishing | 741 | Brush cutter |

| 341 | Office furniture | 742 | Quad |

| 342 | Bathroom furniture | 743 | Garden furniture |

| 343 | Kitchen furniture | 744 | Barbecue |

| 610 | Video/Audio/Computer – other | 855 | Piano |

| 611 | VCR/Video/DVD | 857 | Organ |

| 613 | HIFI equipment | 858 | Music – other |

| 615 | TV set |

Managing your Presto transactions

Available cash operations

The following operations are available on Presto transactions:

| Cash management | ||

|---|---|---|

| Cancellation | V | Cancellation request sent to BNPP on the credit request linked to the transaction. |

| Validation | X | |

| Refund | X | |

| Duplication | X | |

| Credit | X | |

The diagram below allows you to know which cash management operation is available when a transaction is in a given state:

Viewing your Presto transactions

Reports

The reports provided by Worldline Sips allow you to have a comprehensive and consolidated view of your transactions, cash operations, accounts and chargebacks. You can use this information to improve your information system.

The availability of Presto transactions for each type of report is summarised in the table below:

| Reports availability | |

|---|---|

| Transactions report | V |

| Operations report | V |

| Reconciliations report | X |

| Chargebacks report | X |

Sips Office Extranet

You can view your Presto transactions and perform various cash management operations with Sips Office Extranet.